This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

A San Jose California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document specifically designed to establish multiple trusts for children that meet the requirements for annual gift tax exclusion. In order to provide a detailed description, it is important to understand the key elements and benefits of such a trust agreement. First and foremost, this trust agreement allows parents or guardians to create multiple trusts for their children, ensuring efficient management and distribution of assets. By establishing separate trusts for each child, it becomes easier to customize the distribution of funds based on individual needs and circumstances. This flexibility is especially valuable when dealing with minors who may have varying financial requirements. A key advantage of this trust agreement is that it enables the application of the annual gift tax exclusion. Under current tax laws, individuals can make annual gifts up to a certain amount, without incurring any gift tax. By creating separate trusts for each child, parents can take advantage of the gift tax exclusion multiple times, potentially minimizing their tax liability while preserving their wealth for future generations. It is important to note that there may be different types of San Jose California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, depending on specific requirements and preferences. For instance, some parents may opt for a discretionary trust, where the trustee has the discretion to determine when and how funds are distributed to the child. Others may choose a spendthrift trust, which provides additional protection from the child's creditors and ensures the assets are properly managed. Furthermore, this trust agreement may include provisions for the appointment of a trustee, who assumes the responsibility of managing and investing the trust assets on behalf of the children. The trust agreement may dictate the trustee's powers and obligations, ensuring that the children's best interests are safeguarded and their financial needs are met. In conclusion, a San Jose California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children allows parents or guardians to establish separate trusts for each child, taking advantage of the annual gift tax exclusion. By doing so, they can customize the distribution of assets and potentially minimize their tax liability. Different types of trust agreements may exist, providing options for discretionary or spendthrift trusts, depending on individual preferences and requirements. Overall, this trust agreement provides a robust framework for the effective management and preservation of wealth for future generations.A San Jose California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document specifically designed to establish multiple trusts for children that meet the requirements for annual gift tax exclusion. In order to provide a detailed description, it is important to understand the key elements and benefits of such a trust agreement. First and foremost, this trust agreement allows parents or guardians to create multiple trusts for their children, ensuring efficient management and distribution of assets. By establishing separate trusts for each child, it becomes easier to customize the distribution of funds based on individual needs and circumstances. This flexibility is especially valuable when dealing with minors who may have varying financial requirements. A key advantage of this trust agreement is that it enables the application of the annual gift tax exclusion. Under current tax laws, individuals can make annual gifts up to a certain amount, without incurring any gift tax. By creating separate trusts for each child, parents can take advantage of the gift tax exclusion multiple times, potentially minimizing their tax liability while preserving their wealth for future generations. It is important to note that there may be different types of San Jose California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, depending on specific requirements and preferences. For instance, some parents may opt for a discretionary trust, where the trustee has the discretion to determine when and how funds are distributed to the child. Others may choose a spendthrift trust, which provides additional protection from the child's creditors and ensures the assets are properly managed. Furthermore, this trust agreement may include provisions for the appointment of a trustee, who assumes the responsibility of managing and investing the trust assets on behalf of the children. The trust agreement may dictate the trustee's powers and obligations, ensuring that the children's best interests are safeguarded and their financial needs are met. In conclusion, a San Jose California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children allows parents or guardians to establish separate trusts for each child, taking advantage of the annual gift tax exclusion. By doing so, they can customize the distribution of assets and potentially minimize their tax liability. Different types of trust agreements may exist, providing options for discretionary or spendthrift trusts, depending on individual preferences and requirements. Overall, this trust agreement provides a robust framework for the effective management and preservation of wealth for future generations.

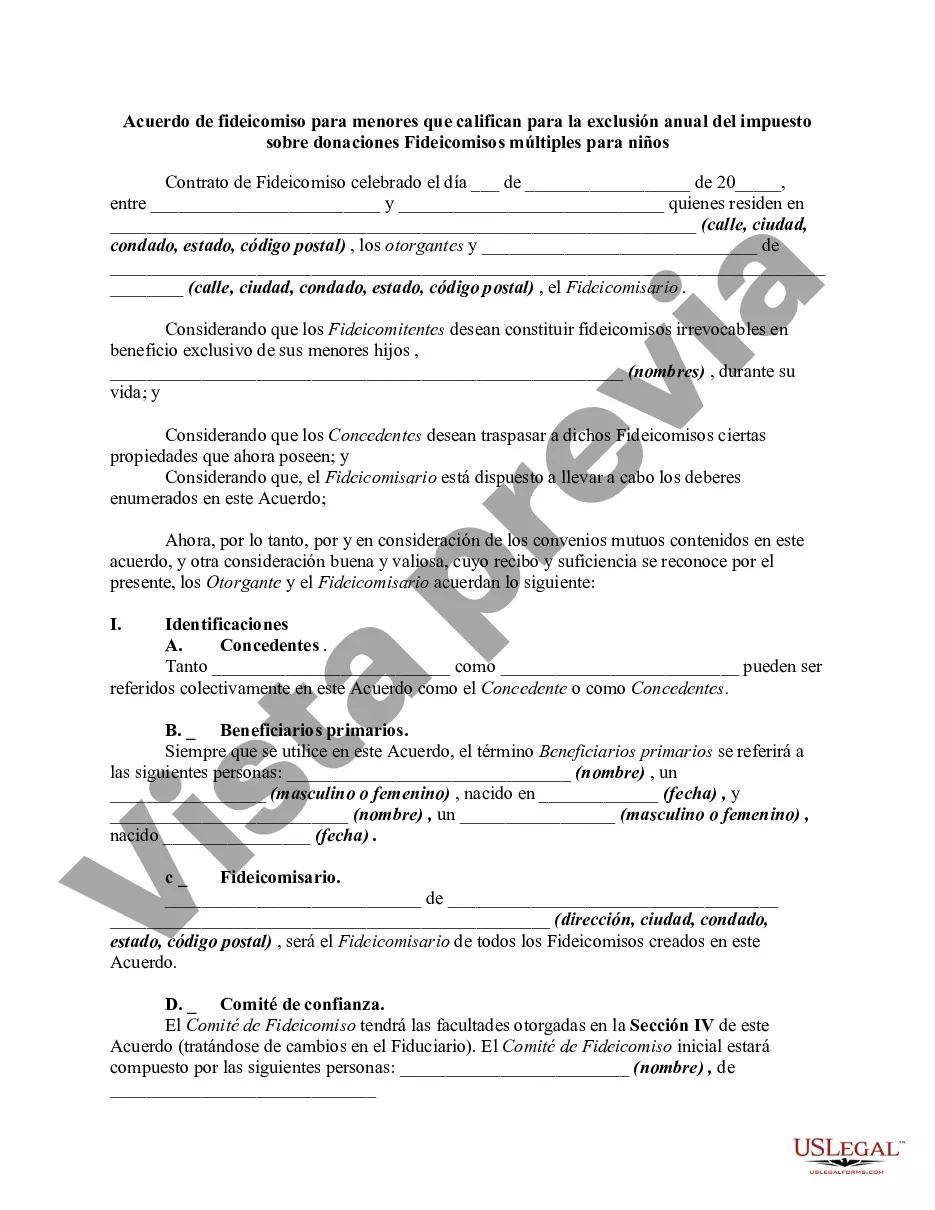

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.