This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

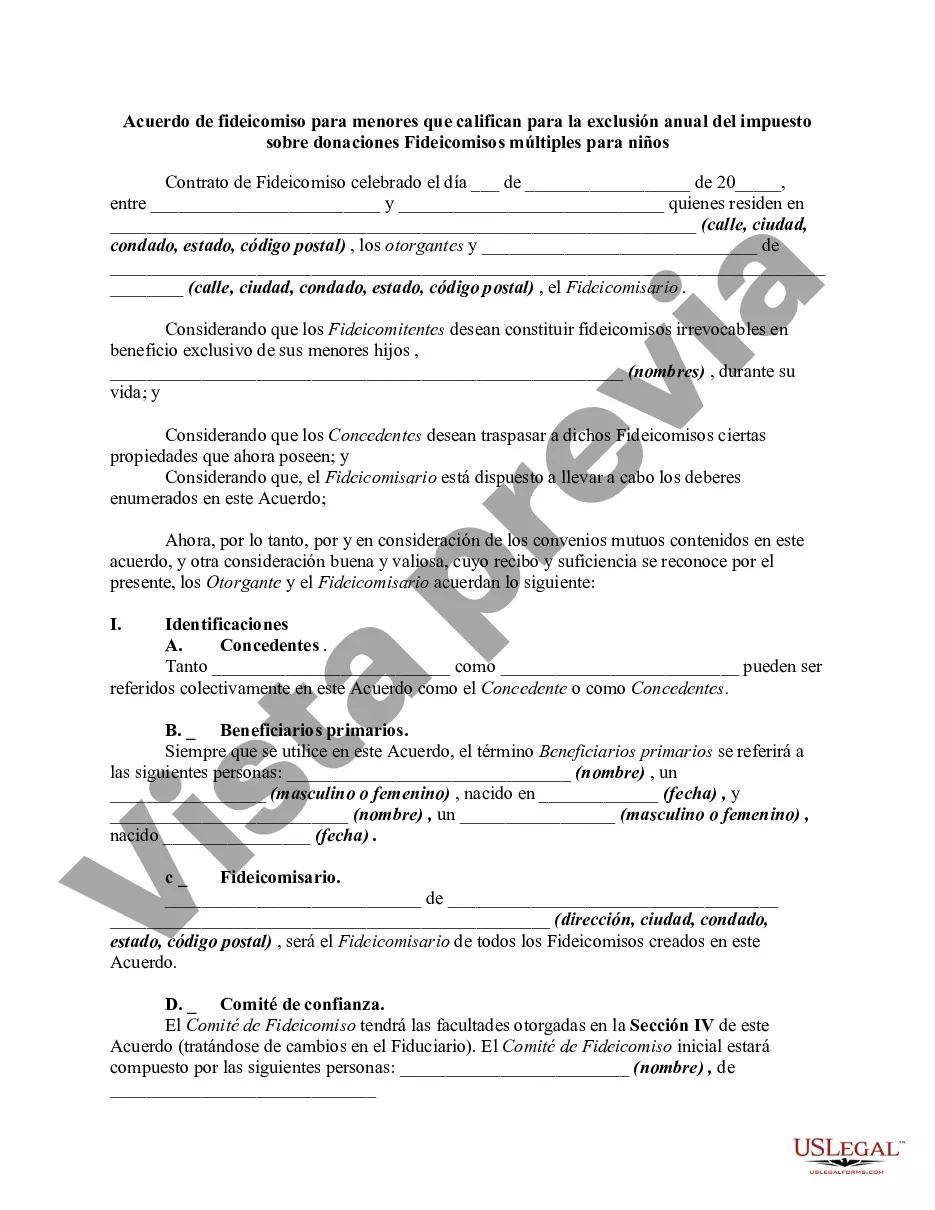

Suffolk New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children The Suffolk New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document designed specifically for residents of Suffolk County, New York, who wish to establish trusts for their minor children while taking advantage of the annual gift tax exclusion. This agreement provides the framework for creating multiple trusts to distribute assets to beneficiaries under specific conditions. There are different types of Suffolk New York Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, including: 1. Revocable Trust Agreement: This type of trust agreement allows the granter to revoke or modify the trust during their lifetime, giving them flexibility in managing the assets. It becomes irrevocable upon the granter's death. 2. Irrevocable Trust Agreement: With this agreement, the granter permanently relinquishes control over the trust assets, providing potential estate tax advantages. It cannot be modified or revoked without the consent of the beneficiaries. 3. Testamentary Trust Agreement: This trust is established under the granter's last will and testament and becomes effective upon their death. It allows the granter to specify how the assets should be managed and distributed for the benefit of their children, ensuring they qualify for the annual gift tax exclusion. 4. Special Needs Trust Agreement: This type of trust is designed for individuals with disabilities, allowing them to maintain eligibility for essential government benefits while receiving additional income or assets from the trust. 5. Education Trust Agreement: Created to support a child's education, this trust ensures that funds are specifically designated for educational expenses, providing them with the necessary resources for academic success. The Suffolk New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a comprehensive legal framework to protect and manage assets for the benefit of minor children. It allows parents to exercise control over how their assets are distributed while minimizing tax burdens and ensuring compliance with applicable laws and regulations. By establishing one or more trusts under this agreement, parents in Suffolk County, New York, can provide financial security and support for their children's future, whether it's for education, special needs, or general financial well-being.Suffolk New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children The Suffolk New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document designed specifically for residents of Suffolk County, New York, who wish to establish trusts for their minor children while taking advantage of the annual gift tax exclusion. This agreement provides the framework for creating multiple trusts to distribute assets to beneficiaries under specific conditions. There are different types of Suffolk New York Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, including: 1. Revocable Trust Agreement: This type of trust agreement allows the granter to revoke or modify the trust during their lifetime, giving them flexibility in managing the assets. It becomes irrevocable upon the granter's death. 2. Irrevocable Trust Agreement: With this agreement, the granter permanently relinquishes control over the trust assets, providing potential estate tax advantages. It cannot be modified or revoked without the consent of the beneficiaries. 3. Testamentary Trust Agreement: This trust is established under the granter's last will and testament and becomes effective upon their death. It allows the granter to specify how the assets should be managed and distributed for the benefit of their children, ensuring they qualify for the annual gift tax exclusion. 4. Special Needs Trust Agreement: This type of trust is designed for individuals with disabilities, allowing them to maintain eligibility for essential government benefits while receiving additional income or assets from the trust. 5. Education Trust Agreement: Created to support a child's education, this trust ensures that funds are specifically designated for educational expenses, providing them with the necessary resources for academic success. The Suffolk New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a comprehensive legal framework to protect and manage assets for the benefit of minor children. It allows parents to exercise control over how their assets are distributed while minimizing tax burdens and ensuring compliance with applicable laws and regulations. By establishing one or more trusts under this agreement, parents in Suffolk County, New York, can provide financial security and support for their children's future, whether it's for education, special needs, or general financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.