This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

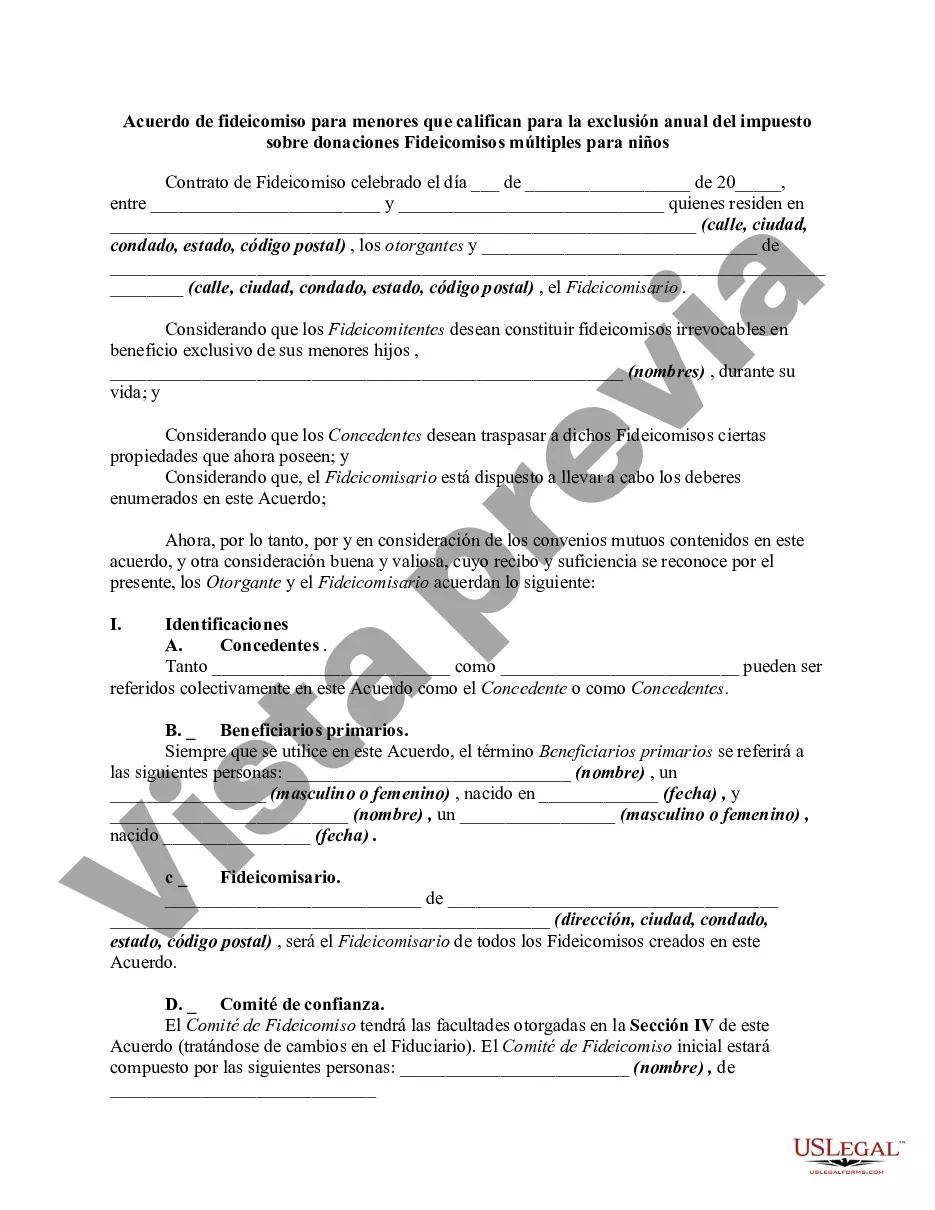

The Wake North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document created to establish separate trusts for multiple minors that qualify for the annual gift tax exclusion. This agreement allows parents or guardians to distribute assets to their children without incurring gift tax liabilities. In Wake North Carolina, there are various types of Trust Agreements specifically designed for minors qualifying for the annual gift tax exclusion. These include: 1. Wake North Carolina Uniform Transfer to Minors Act (TMA) Trust Agreement: This type of trust allows parents or guardians to transfer assets to their minor children without the need for a formal trust agreement. It is established under the provisions of the TMA, which provides a flexible framework for managing and disbursement of assets until the child reaches the age of majority. 2. Wake North Carolina Crummy Trust Agreement: This trust agreement utilizes a strategy called "Crummy powers" to qualify the contributions as annual exclusion gifts. The agreement allows parents or guardians to make gifts to a trust, which the children can access at a predetermined age or event. 3. Wake North Carolina 2503© Trust Agreement: This trust agreement is established under section 2503(c) of the Internal Revenue Code, which allows gifts made to the trust to qualify for the annual gift tax exclusion. The assets in the trust can be used for the health, education, and support of the children until they reach a specified age or event. 4. Wake North Carolina Minor's Trust Agreement: This is a general term referring to a trust agreement created for the benefit of a minor child. It can include various provisions, such as income distribution, principal distribution, and age restrictions, to suit the specific needs and goals of the parents or guardians. Creating a Wake North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides parents or guardians with the flexibility to manage and distribute assets to their children while taking advantage of the annual gift tax exclusion. These various types of trust agreements offer different structures and benefits to accommodate the unique circumstances of each family. It is essential to consult with a qualified attorney or financial advisor to determine the most suitable trust agreement for your situation.The Wake North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document created to establish separate trusts for multiple minors that qualify for the annual gift tax exclusion. This agreement allows parents or guardians to distribute assets to their children without incurring gift tax liabilities. In Wake North Carolina, there are various types of Trust Agreements specifically designed for minors qualifying for the annual gift tax exclusion. These include: 1. Wake North Carolina Uniform Transfer to Minors Act (TMA) Trust Agreement: This type of trust allows parents or guardians to transfer assets to their minor children without the need for a formal trust agreement. It is established under the provisions of the TMA, which provides a flexible framework for managing and disbursement of assets until the child reaches the age of majority. 2. Wake North Carolina Crummy Trust Agreement: This trust agreement utilizes a strategy called "Crummy powers" to qualify the contributions as annual exclusion gifts. The agreement allows parents or guardians to make gifts to a trust, which the children can access at a predetermined age or event. 3. Wake North Carolina 2503© Trust Agreement: This trust agreement is established under section 2503(c) of the Internal Revenue Code, which allows gifts made to the trust to qualify for the annual gift tax exclusion. The assets in the trust can be used for the health, education, and support of the children until they reach a specified age or event. 4. Wake North Carolina Minor's Trust Agreement: This is a general term referring to a trust agreement created for the benefit of a minor child. It can include various provisions, such as income distribution, principal distribution, and age restrictions, to suit the specific needs and goals of the parents or guardians. Creating a Wake North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides parents or guardians with the flexibility to manage and distribute assets to their children while taking advantage of the annual gift tax exclusion. These various types of trust agreements offer different structures and benefits to accommodate the unique circumstances of each family. It is essential to consult with a qualified attorney or financial advisor to determine the most suitable trust agreement for your situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.