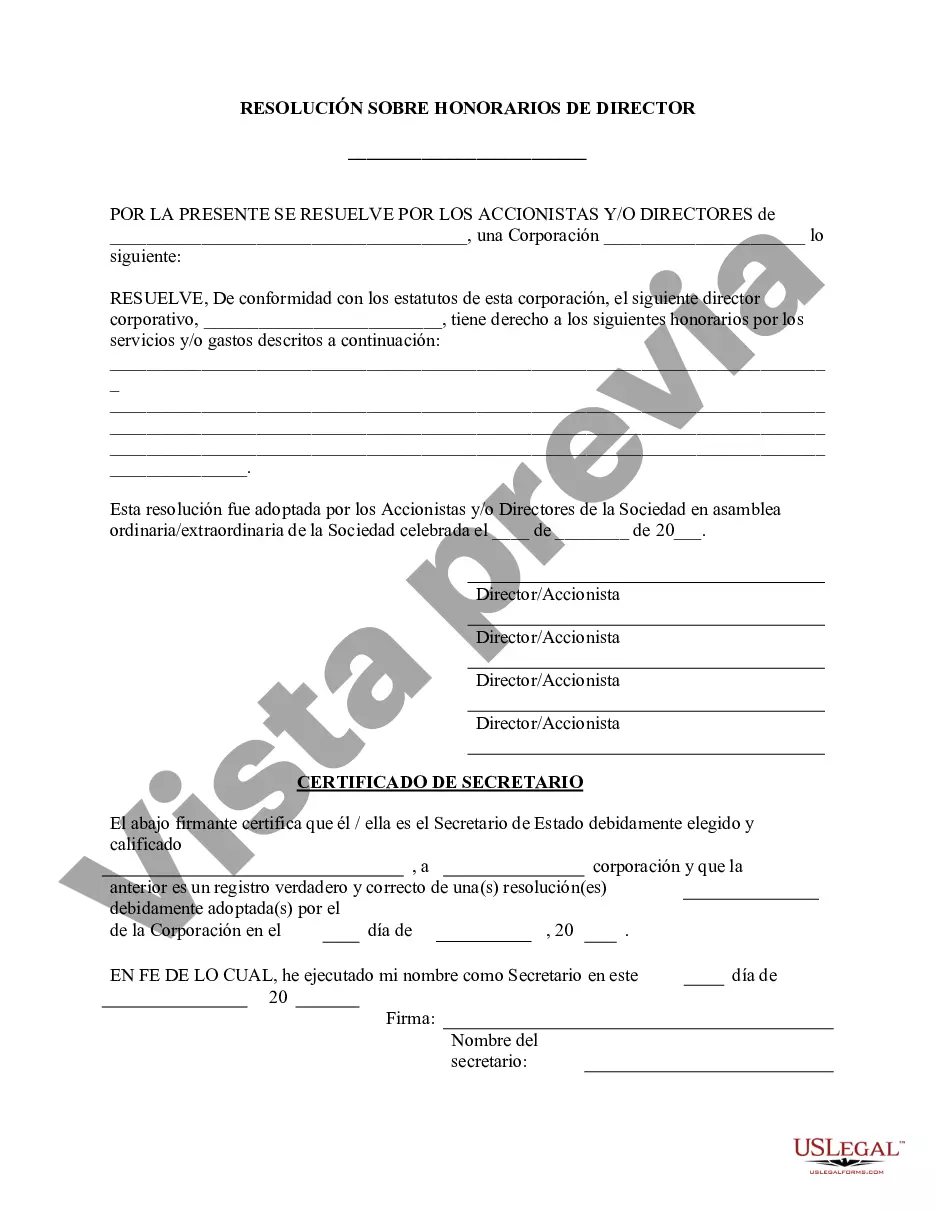

Cook Illinois Corporation is a well-established transportation company based in Illinois, USA. As part of its corporate governance, the company has established a Director's Fees Resolution Form to outline the compensation of its directors. This form is important in determining the fees and remuneration provided to the members of the company's board of directors. The Cook Illinois Director's Fees Resolution Form is a corporate resolution that offers a comprehensive breakdown of the compensation structure for the directors. This form ensures transparency and clarity in the process of determining directors' fees, aligning with the best corporate governance practices. Key elements covered in the Cook Illinois Director's Fees Resolution Form may include: 1. Identification: The form starts by stating the name of the corporation, "Cook Illinois," and clearly indicates that it pertains to director's fees resolution. 2. Fee Structure: The resolution form highlights the base director's fee, which typically covers the standard duties and responsibilities that directors fulfill. It can offer a specific monetary amount, or it may present a range of fees based on the individual director's experience, qualifications, and responsibilities. 3. Committee Compensation: If Cook Illinois has committees within its board structure, such as an audit committee, compensation committee, or governance committee, the form may provide details regarding additional fees or stipends for those who serve on these committees. This compensation acknowledges the extra time and effort devoted to committee work. 4. Board Chair Compensation: In cases where Cook Illinois has a separate board chair role, the form may address director's fees specific to this position. This may include additional compensation to reflect the added responsibilities and leadership role of the board chair. 5. Meeting Fees: The resolution form may outline fees paid for attending board meetings, including both in-person and virtual sessions. It may specify the amount per meeting or indicate a standardized monthly or annual fee for directors' attendance. 6. Expenses Reimbursement: The form may include a provision for reimbursement of reasonable expenses incurred by directors in the performance of their duties. This may cover expenses related to travel, accommodation, meals, and other necessary business expenditures. It is worth noting that variations may exist concerning the specific details and components of the Cook Illinois Director's Fees Resolution Form, as each company tailors their forms to reflect their unique circumstances and governance structure. In summary, the Cook Illinois Director's Fees Resolution Form serves as a crucial document for the company's corporate governance framework. It provides a clear and structured approach to compensating directors and ensures transparency in the process. By addressing various components of director's fees, such as base fees, committee compensation, board chair compensation, meeting fees, and expense reimbursement, Cook Illinois promotes ethical and effective board leadership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Honorarios de los directores - Formulario de resolución - Resoluciones corporativas - Director's Fees - Resolution Form - Corporate Resolutions

Description

How to fill out Cook Illinois Honorarios De Los Directores - Formulario De Resolución - Resoluciones Corporativas?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Cook Director's Fees - Resolution Form - Corporate Resolutions, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any tasks associated with document completion simple.

Here's how you can purchase and download Cook Director's Fees - Resolution Form - Corporate Resolutions.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Cook Director's Fees - Resolution Form - Corporate Resolutions.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Cook Director's Fees - Resolution Form - Corporate Resolutions, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an extremely complicated case, we recommend using the services of a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!