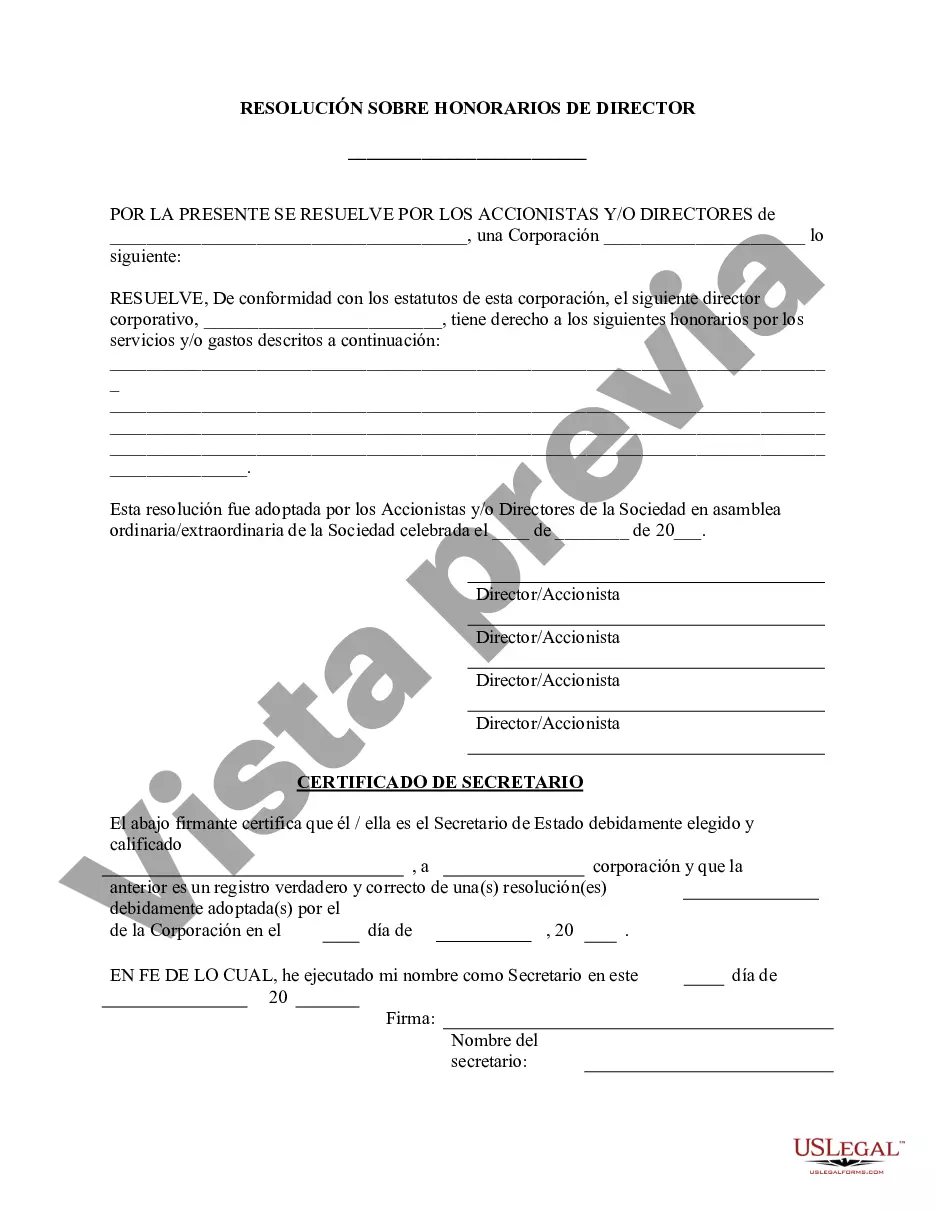

Harris Texas Director's Fees — Resolution Form is a vital document used in corporate governance to establish the compensation arrangement for directors in the Harris County area of Texas. This form is part of a corporate resolution, which is a formal action taken by a corporation's board of directors or shareholders. It ensures transparency and compliance with legal requirements while determining director compensation. In Harris Texas, Director's Fees — Resolution Form outlines the specific details regarding the fees paid to the directors serving on the board of a corporation. It includes relevant information such as the amount of compensation, payment frequency, and any additional benefits or perks provided to the directors. This form is essential for corporate governance as it helps companies formalize and record the decisions made regarding director compensation. It ensures that directors' fees are handled in a legally compliant manner, protecting both the corporation and the directors themselves. Different types and variations of Harris Texas Director's Fees — Resolution Form may include: 1. Basic Director's Fees — Resolution Form: This form outlines the standard compensation package offered to directors, including a fixed amount of remuneration for their service on the board. 2. Performance-Based Director's Fees — Resolution Form: This form is used when the director's compensation is directly tied to the company's performance or specific metrics. It specifies how the performance will be measured, the formula for calculating compensation, and any target goals that should be achieved. 3. Equity-based Director's Fees — Resolution Form: In some cases, directors may receive stock options or equity in the company as part of their compensation. This form highlights the grant of equity, including the number of shares, vesting period, and any restrictions or conditions associated with the equity allocation. 4. Committee-Specific Director's Fees — Resolution Form: In corporations that have various committees, this form differentiates the compensation rates and structures for directors serving on different committees. It ensures transparency and fairness in compensating directors based on their committee responsibilities. 5. Director Benefits and Perks — Resolution Form: Apart from fees, some directors may be eligible for additional benefits or perks such as pension plans, healthcare coverage, or travel allowances. This form provides details on these additional benefits and outlines the terms and conditions associated with them. In conclusion, the Harris Texas Director's Fees — Resolution Form is a crucial component of corporate governance that establishes the compensation arrangement for directors serving on the board of a corporation in Harris County, Texas. These forms come in various types, addressing different director compensation scenarios and ensuring compliance and transparency in director remuneration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Honorarios de los directores - Formulario de resolución - Resoluciones corporativas - Director's Fees - Resolution Form - Corporate Resolutions

Description

How to fill out Harris Texas Honorarios De Los Directores - Formulario De Resolución - Resoluciones Corporativas?

Do you need to quickly draft a legally-binding Harris Director's Fees - Resolution Form - Corporate Resolutions or probably any other form to manage your own or business affairs? You can select one of the two options: contact a professional to write a valid document for you or draft it completely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge catalog of more than 85,000 state-specific form templates, including Harris Director's Fees - Resolution Form - Corporate Resolutions and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Harris Director's Fees - Resolution Form - Corporate Resolutions is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were seeking by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Harris Director's Fees - Resolution Form - Corporate Resolutions template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the documents we provide are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!