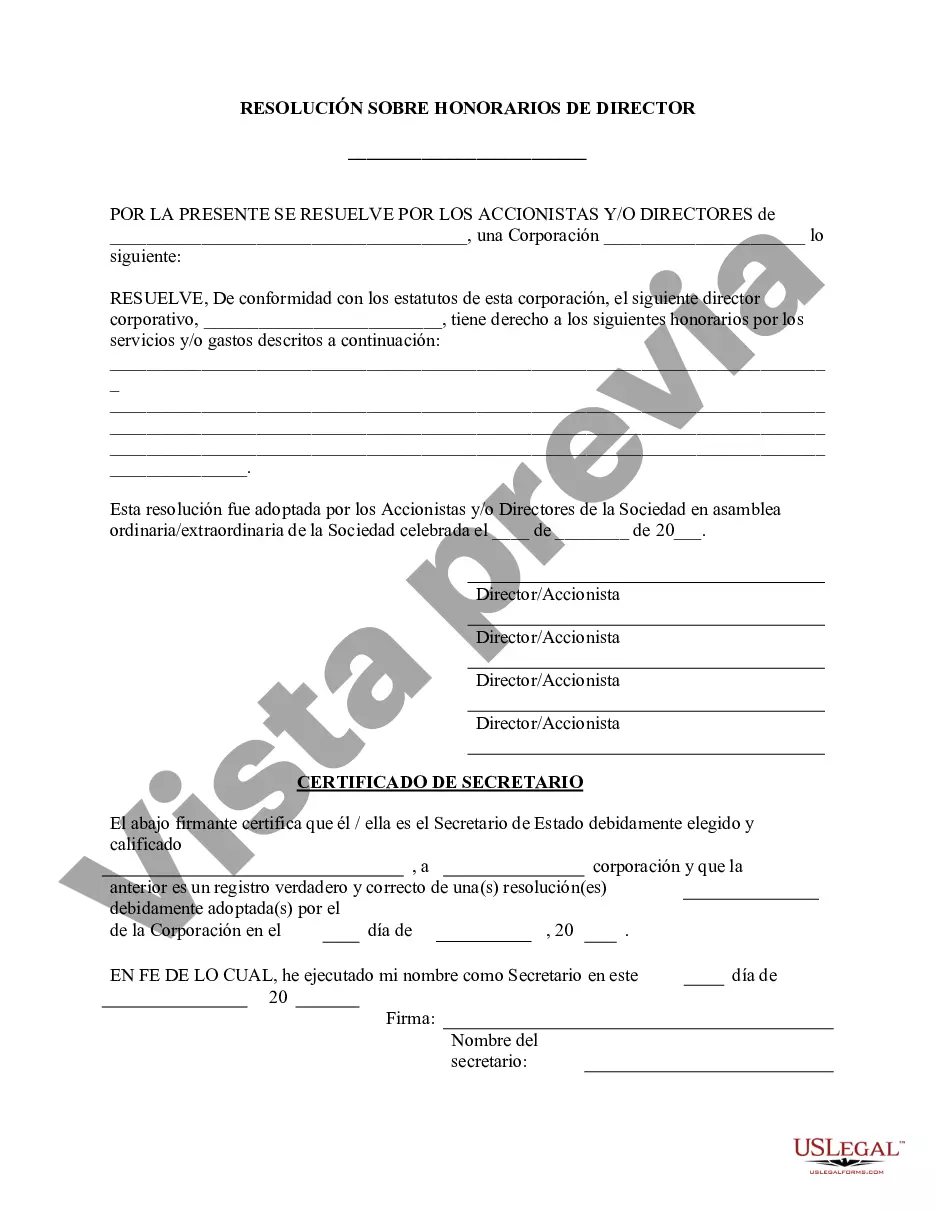

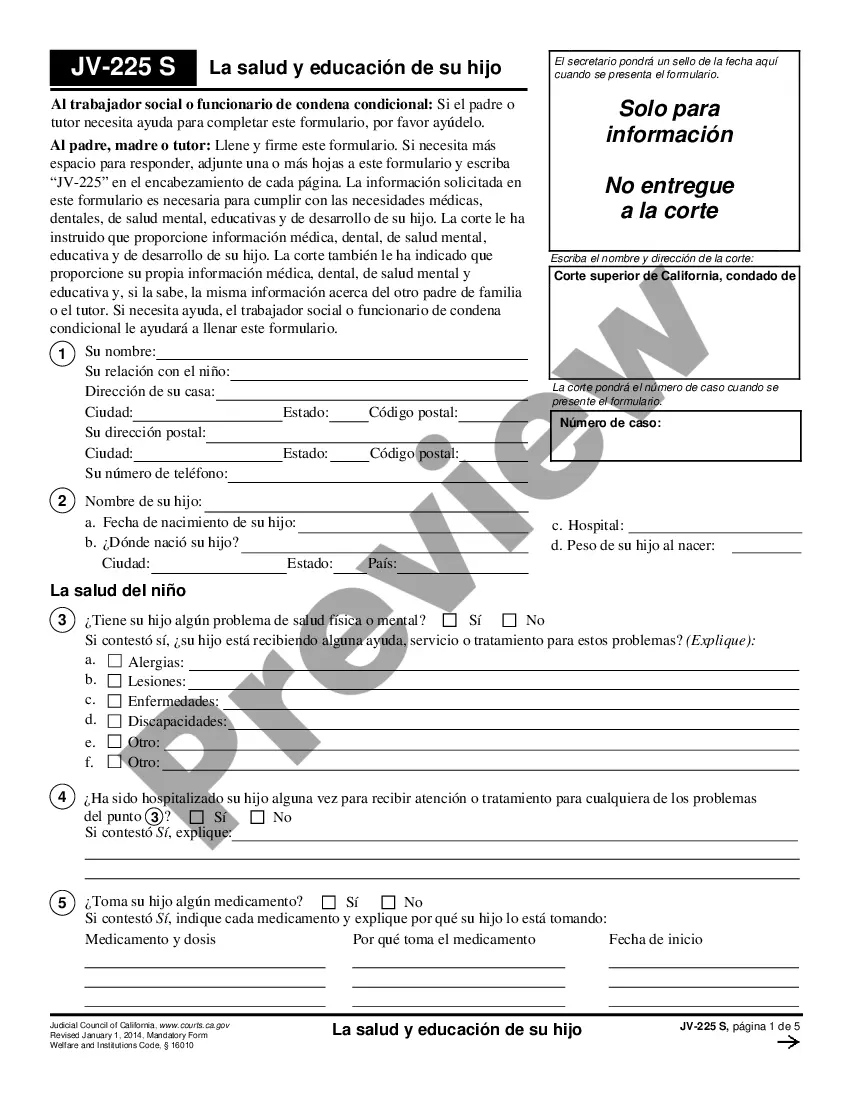

Riverside California Director's Fees — Resolution For— - Corporate Resolutions In Riverside, California, when a corporation decides to compensate its directors for their services, it must follow specific legal procedures. One of these procedures is the issuance of a Director's Fees — Resolution Form, also known as a Corporate Resolutions document. This form outlines the terms and conditions under which directors will be paid for their management and governance contributions. The Director's Fees — Resolution Form typically includes the relevant details such as the name of the corporation, the names of individual directors, and the specific fees or compensation structure to be offered. It serves as an official record of the proper authorization and agreement between the corporation and its directors, ensuring transparency and legal compliance. Different types of Riverside California Director's Fees — Resolution Forms may exist, depending on the corporation's unique needs and circumstances. These variations can include: 1. Standard Director's Fees — Resolution Form: This is the most common type of resolution form used by corporations in Riverside, California. It outlines a fixed monetary compensation that directors will receive for their services over a specific period, usually annually or quarterly. 2. Performance-Based Director's Fees — Resolution Form: This type of resolution form links the directors' compensation to specific performance metrics or corporate objectives. Directors are rewarded based on their contribution towards achieving predefined goals, such as revenue growth, market share expansion, or cost reduction. 3. Equity-Based Director's Fees — Resolution Form: In some cases, corporations may opt to provide their directors with ownership stakes or options to purchase company stock as part of their compensation package. This form outlines the terms and conditions for issuing equity to directors and specifies the percentage or number of shares they will be entitled to. 4. Retainer Director's Fees — Resolution Form: Some corporations prefer to offer their directors a fixed retainer fee, which compensates them for their availability and commitment to the role throughout the year. This form describes the retainer amount and the services that directors are expected to provide in return. Regardless of the specific type of Riverside California Director's Fees — Resolution Form used, it is essential for corporations to ensure that these documents are properly drafted, reviewed, and approved by relevant parties. Compliance with legal obligations and adherence to best practice guidelines for director compensation not only safeguards the corporation's interests but also fosters transparency and accountability in corporate governance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Honorarios de los directores - Formulario de resolución - Resoluciones corporativas - Director's Fees - Resolution Form - Corporate Resolutions

Description

How to fill out Riverside California Honorarios De Los Directores - Formulario De Resolución - Resoluciones Corporativas?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Riverside Director's Fees - Resolution Form - Corporate Resolutions.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Riverside Director's Fees - Resolution Form - Corporate Resolutions will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Riverside Director's Fees - Resolution Form - Corporate Resolutions:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Riverside Director's Fees - Resolution Form - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!