The Clark Nevada Agreement to Repay Cash Advance on Credit Card is a contractual agreement between a cardholder and their credit card issuer. This agreement outlines the terms and conditions for borrowing cash against the card's available credit limit. By understanding the specifics of this agreement, cardholders can make informed decisions about utilizing cash advances on their credit cards. When cardholders opt for a cash advance, they essentially borrow money from their credit card company. However, it's important to note that cash advances typically come with high fees and interest rates compared to regular card purchases. The Clark Nevada Agreement to Repay Cash Advance on Credit Card clearly states the terms and conditions associated with this borrowing option, ensuring that cardholders are aware of their financial obligations. The agreement includes several important details that cardholders should be aware of. It specifies the interest rate applicable to cash advances, the associated fees, and the due date by which the balance should be repaid. This due date is typically shorter than the billing cycle for regular card purchases. Cardholders must also understand any additional charges that may be incurred, such as ATM withdrawal fees or foreign transaction fees if they choose to use a cash advance while traveling abroad. Additionally, the Clark Nevada Agreement to Repay Cash Advance on Credit Card may include information about different types of cash advances available. For instance, there might be a distinction between ATM cash advances and over-the-counter cash advances obtained at banks or other financial institutions. Each type of cash advance may have different fees and limitations outlined in the agreement. Cardholders should carefully review the terms and conditions of the Clark Nevada Agreement to Repay Cash Advance on Credit Card to fully comprehend their responsibilities. It's crucial to note the consequences of not repaying the cash advance on time, such as accruing significant interest charges or damaging their credit score. Being knowledgeable about the specifics of the agreement empowers cardholders to make informed financial decisions and ensures that they are fully aware of the obligations associated with cash advances.

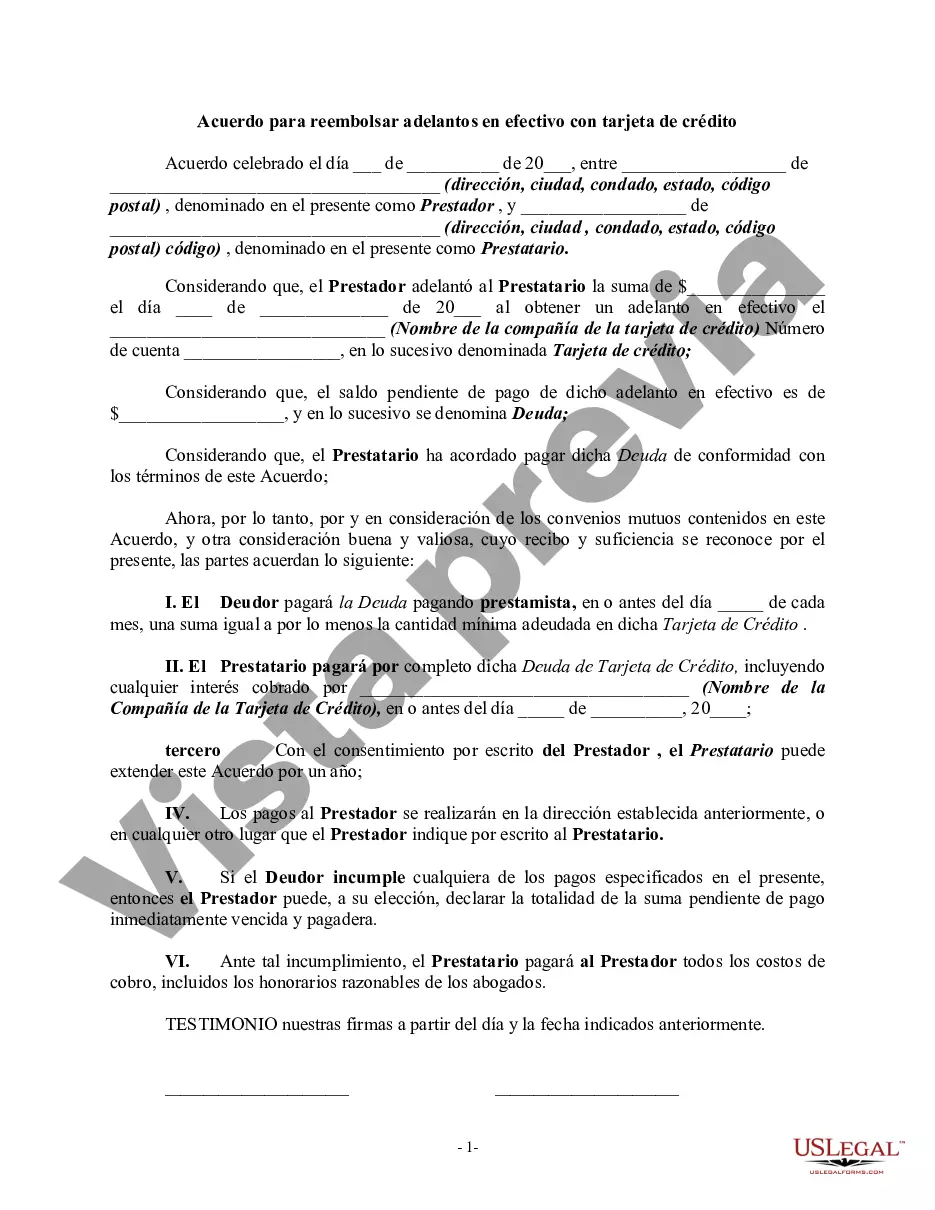

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Clark Nevada Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

If you need to get a reliable legal paperwork supplier to find the Clark Agreement to Repay Cash Advance on Credit Card, consider US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to locate and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

You can simply type to search or browse Clark Agreement to Repay Cash Advance on Credit Card, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Clark Agreement to Repay Cash Advance on Credit Card template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Clark Agreement to Repay Cash Advance on Credit Card - all from the comfort of your home.

Sign up for US Legal Forms now!