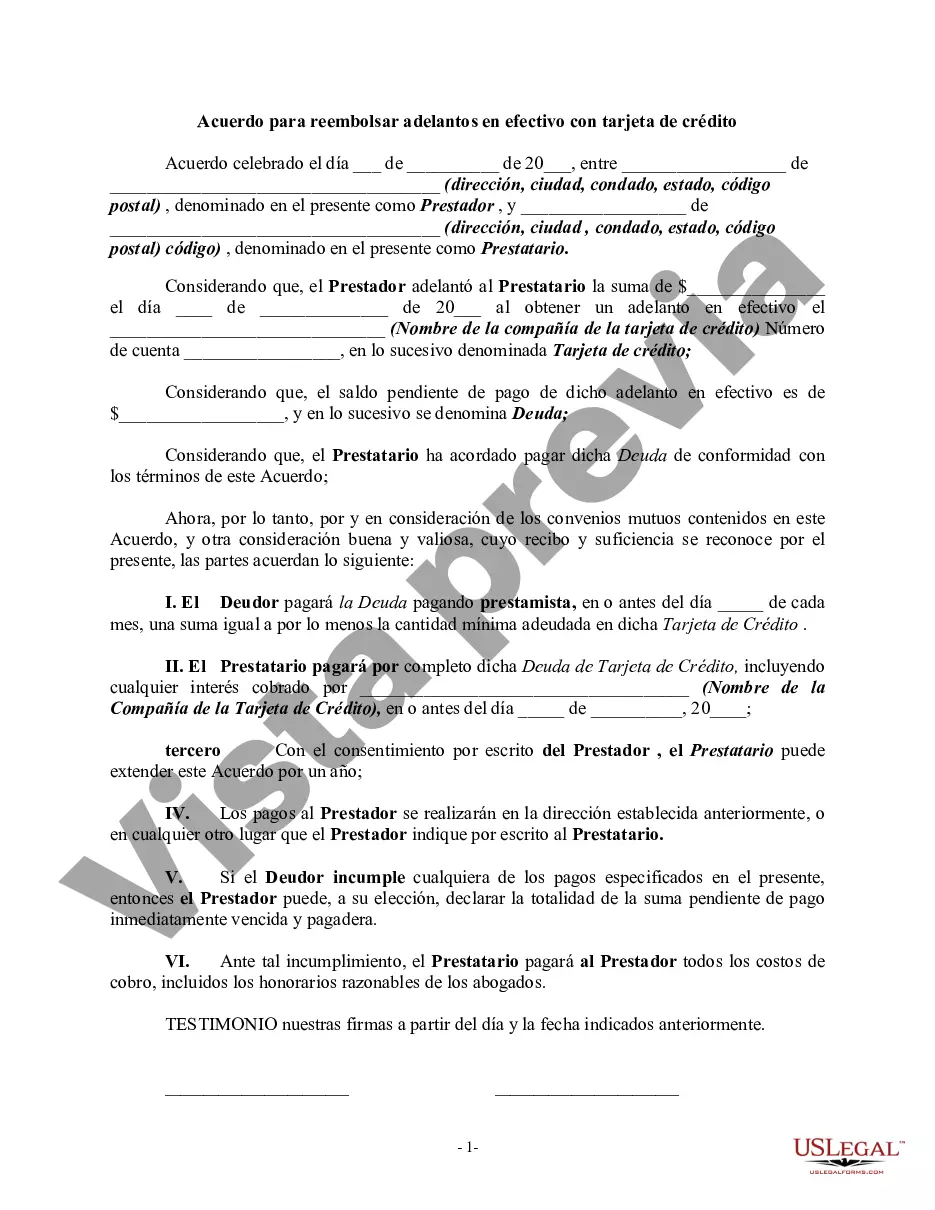

Maricopa, Arizona Agreement to Repay Cash Advance on Credit Card: Explained In Maricopa, Arizona, an Agreement to Repay Cash Advance on a Credit Card is a legal document that outlines the terms and conditions under which an individual borrows funds from their credit card provider and agrees to pay it back. This agreement serves as a contract that ensures both the borrower and the credit card company are aware of their responsibilities regarding the cash advance. The terms within the Maricopa, Arizona Agreement to Repay Cash Advance on Credit Card typically include the borrowed amount, interest rate, repayment period, and any associated fees or charges. It is crucial for borrowers to thoroughly understand all aspects of this agreement to avoid any potential disputes or financial consequences. There are several types of Maricopa, Arizona Agreements to Repay Cash Advance on Credit Card, each catering to different borrowing needs. Some commonly observed types include: 1. Standard Cash Advance Agreement: This type of agreement typically involves borrowing a lump sum directly from the credit card, to be repaid over a defined period with interest and sometimes additional transaction fees. 2. Balance Transfer Agreement: In this case, the credit card holder transfers the outstanding balance from one credit card to another, usually with a lower interest rate or promotional offer. This agreement focuses on repaying the outstanding balance and may involve specific terms and conditions. 3. Convenience Check Agreement: Some credit card companies provide convenience checks that allow customers to write checks from their credit card account. This agreement outlines the terms for repayment of funds advanced through these checks, including interest rates, repayment schedule, and potential fees. 4. Personal Line of Credit Agreement: Certain credit cards offer a personal line of credit that allows borrowers to draw funds as needed. This agreement defines the terms and conditions for repayment of these borrowed funds, such as interest rates, minimum monthly payments, and any associated fees. By understanding the specific Maricopa, Arizona Agreement to Repay Cash Advance on Credit Card that applies to their situation, borrowers can ensure they are meeting their financial obligations and avoid any potential penalties or negative impacts on their credit history. It is essential for individuals to carefully review and comprehend the terms of their agreement before signing, seeking clarification if needed, to ensure a transparent and mutually beneficial credit transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Maricopa Arizona Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

Creating forms, like Maricopa Agreement to Repay Cash Advance on Credit Card, to manage your legal matters is a tough and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms created for different cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Maricopa Agreement to Repay Cash Advance on Credit Card template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before getting Maricopa Agreement to Repay Cash Advance on Credit Card:

- Make sure that your form is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Maricopa Agreement to Repay Cash Advance on Credit Card isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our service and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is all set. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!