Miami-Dade Florida is a vibrant county located in the southeastern part of Florida. Known for its beautiful beaches, lively nightlife, and diverse culture, Miami-Dade is a popular tourist destination and home to millions of residents. When it comes to financial services, Miami-Dade offers various agreements for individuals seeking to repay cash advances on their credit cards. These agreements allow credit card holders to borrow funds against their credit limit and repay the borrowed amount over time, usually with interest. One commonly offered type is the Miami-Dade Florida Agreement to Repay Cash Advance on Credit Card with a fixed interest rate. This type of agreement ensures that the interest rate remains constant throughout the repayment period, providing borrowers with predictability and stability in their monthly payments. It allows individuals to manage their finances effectively while meeting their immediate cash needs. Another type of agreement is the Miami-Dade Florida Agreement to Repay Cash Advance on Credit Card with a variable interest rate. This agreement's interest rate fluctuates based on market conditions or other predetermined factors, which can result in changes to the monthly payment amounts. This type of agreement provides the potential for lower interest rates during times of economic stability but may also lead to higher interest rates during uncertain market conditions. To obtain a Miami-Dade Florida Agreement to Repay Cash Advance on a Credit Card, individuals typically need to meet certain criteria set by the credit card issuer. These criteria may include a good credit score, steady income, and a history of responsible credit card usage. It's essential for potential borrowers to carefully read and understand the terms and conditions outlined in these agreements before signing them. In summary, Miami-Dade Florida offers individuals different types of agreements to repay cash advances on their credit cards, including fixed and variable interest rate agreements. These agreements provide individuals with the flexibility and financial assistance they need to manage their immediate cash needs effectively. It is crucial for borrowers to thoroughly review the terms and conditions of these agreements and ensure they meet the necessary criteria before entering into any agreement.

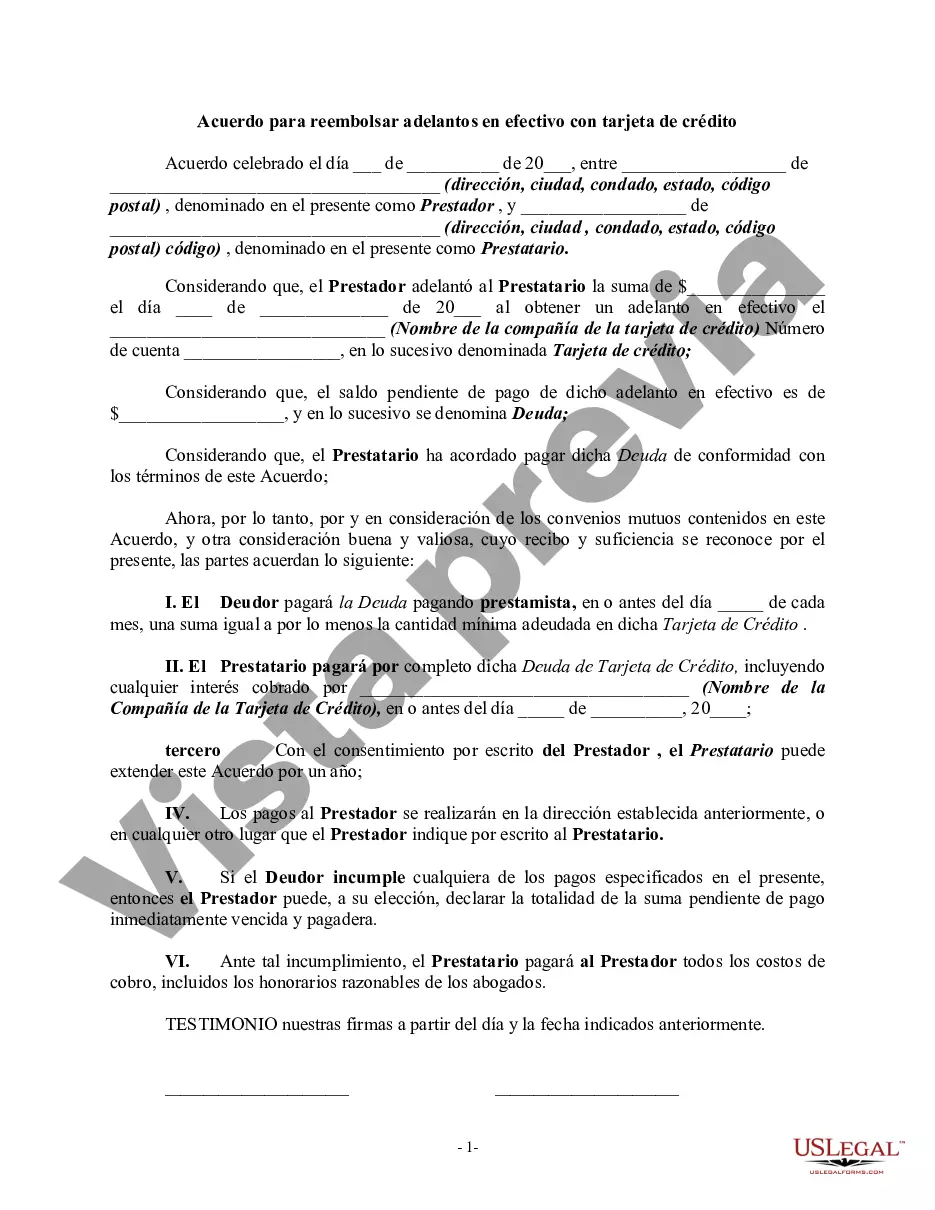

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-00776BG

Format:

Word

Instant download

Description

Este formulario es un acuerdo para liquidar un adelanto en efectivo realizado con una tarjeta de crédito. El anticipo se obtuvo de la tarjeta de crédito del acreedor en beneficio del deudor.

Miami-Dade Florida is a vibrant county located in the southeastern part of Florida. Known for its beautiful beaches, lively nightlife, and diverse culture, Miami-Dade is a popular tourist destination and home to millions of residents. When it comes to financial services, Miami-Dade offers various agreements for individuals seeking to repay cash advances on their credit cards. These agreements allow credit card holders to borrow funds against their credit limit and repay the borrowed amount over time, usually with interest. One commonly offered type is the Miami-Dade Florida Agreement to Repay Cash Advance on Credit Card with a fixed interest rate. This type of agreement ensures that the interest rate remains constant throughout the repayment period, providing borrowers with predictability and stability in their monthly payments. It allows individuals to manage their finances effectively while meeting their immediate cash needs. Another type of agreement is the Miami-Dade Florida Agreement to Repay Cash Advance on Credit Card with a variable interest rate. This agreement's interest rate fluctuates based on market conditions or other predetermined factors, which can result in changes to the monthly payment amounts. This type of agreement provides the potential for lower interest rates during times of economic stability but may also lead to higher interest rates during uncertain market conditions. To obtain a Miami-Dade Florida Agreement to Repay Cash Advance on a Credit Card, individuals typically need to meet certain criteria set by the credit card issuer. These criteria may include a good credit score, steady income, and a history of responsible credit card usage. It's essential for potential borrowers to carefully read and understand the terms and conditions outlined in these agreements before signing them. In summary, Miami-Dade Florida offers individuals different types of agreements to repay cash advances on their credit cards, including fixed and variable interest rate agreements. These agreements provide individuals with the flexibility and financial assistance they need to manage their immediate cash needs effectively. It is crucial for borrowers to thoroughly review the terms and conditions of these agreements and ensure they meet the necessary criteria before entering into any agreement.

Free preview