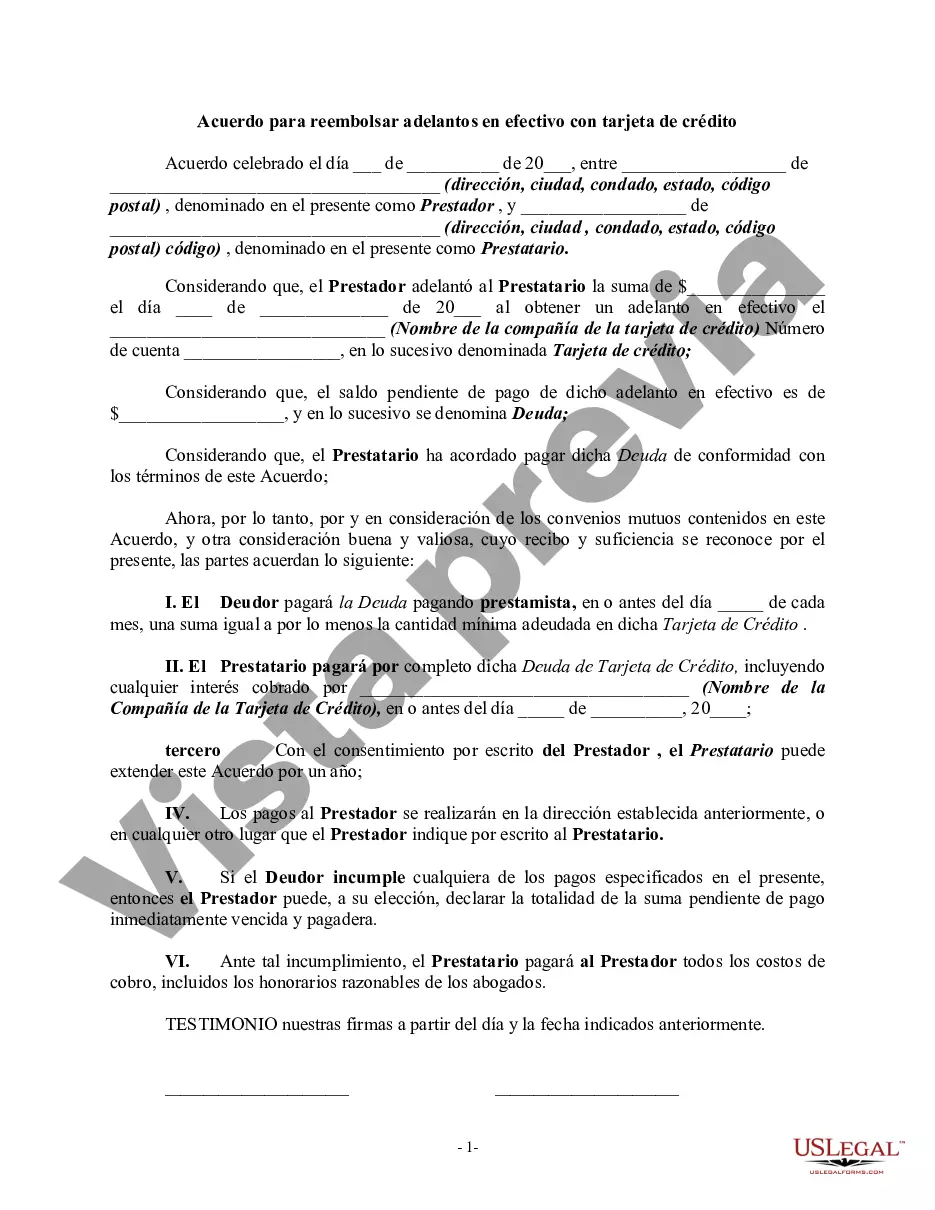

Orange California Agreement to Repay Cash Advance on Credit Card is a legal document that outlines the terms and conditions for obtaining a cash advance on a credit card in Orange, California. This agreement is crucial as it establishes the responsibilities and obligations of both the credit card issuer and the cardholder. The Orange California Agreement to Repay Cash Advance on Credit Card typically includes key information such as the cash advance limit, interest rates, repayment terms, and fees associated with obtaining cash from the credit card. The agreement is designed to protect the interests of both parties involved and ensures transparency in the financial transaction. There are different types of Orange California Agreements to Repay Cash Advance on Credit Card, including: 1. Standard Cash Advance Agreement: This type of agreement is the most common and provides credit cardholders access to a portion of their credit limit in the form of cash. The terms and conditions, such as interest rates and repayment terms, will be specified within this agreement. 2. Promotional Cash Advance Agreement: Some credit card issuers offer promotional cash advances to attract new customers or promote specific services. This agreement may contain special terms and conditions, such as lower interest rates for a limited period or waived fees. 3. Balance Transfer Cash Advance Agreement: Some credit cards allow cardholders to transfer balances from other credit cards to their account, effectively obtaining a cash advance. This type of agreement will outline the terms and conditions specific to balance transfers, including any associated fees or promotional offers. Regardless of the specific type of Orange California Agreement to Repay Cash Advance on Credit Card, it is vital for cardholders to thoroughly read and understand the terms and conditions before proceeding with a cash advance. This helps avoid any potential misunderstandings and ensures that both parties are in agreement regarding the loan terms. If uncertain about any aspect of the agreement, seeking professional advice or clarifications from the credit card issuer is recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Orange California Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from scratch, including Orange Agreement to Repay Cash Advance on Credit Card, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how you can find and download Orange Agreement to Repay Cash Advance on Credit Card.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Check the related document templates or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment method, and buy Orange Agreement to Repay Cash Advance on Credit Card.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Orange Agreement to Repay Cash Advance on Credit Card, log in to your account, and download it. Of course, our website can’t take the place of a legal professional entirely. If you have to cope with an extremely difficult situation, we recommend getting a lawyer to review your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of users. Become one of them today and get your state-specific paperwork with ease!