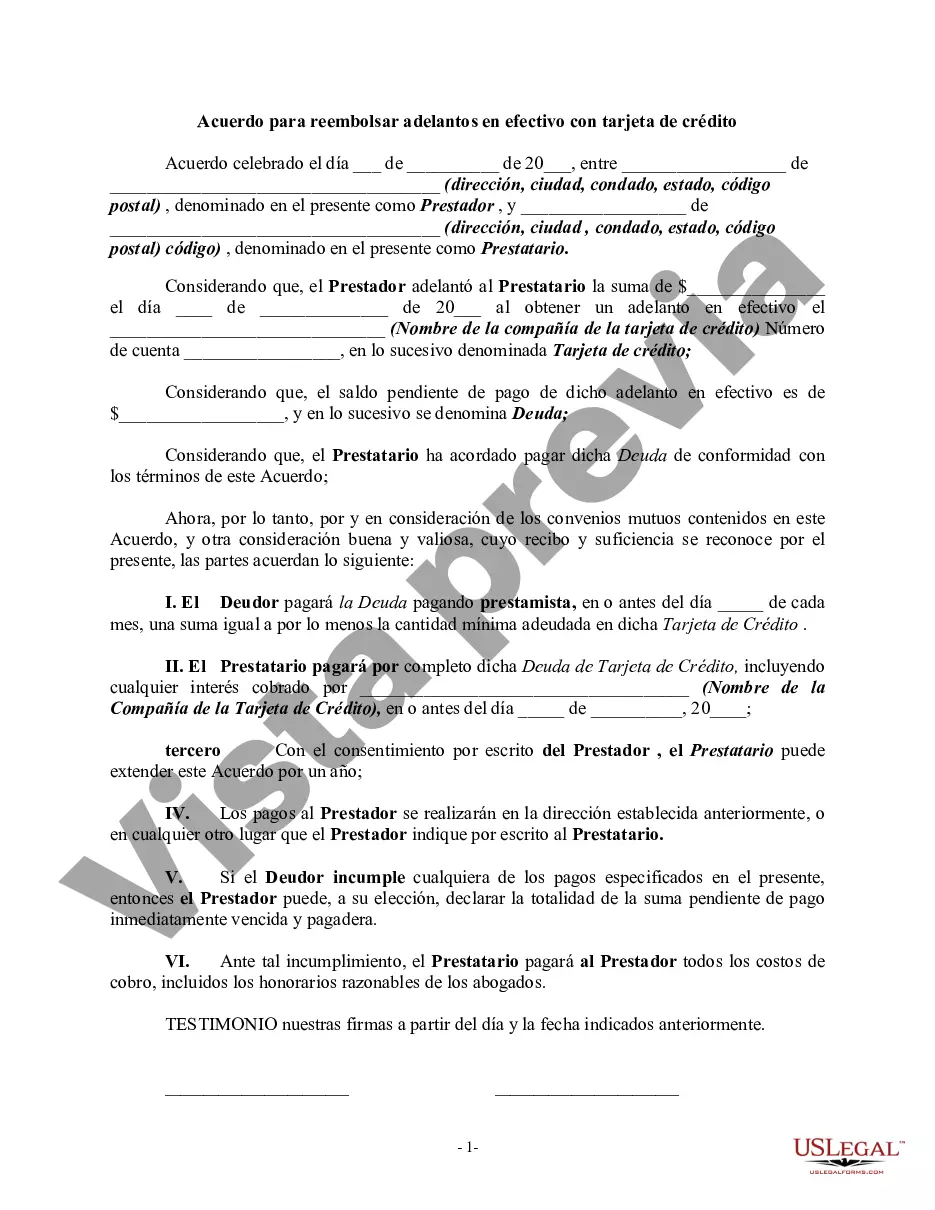

A San Antonio Texas Agreement to Repay Cash Advance on Credit Card is a legally binding contract between a card issuer and a cardholder, specifically outlining the terms under which the cardholder agrees to repay funds advanced through a cash advance on their credit card. This agreement ensures that both parties are aware of their rights and responsibilities, promoting transparency and accountability. The agreement typically includes a detailed breakdown of the repayment terms, interest rates, fees, and other relevant charges associated with the cash advance. It outlines the cardholder's obligation to repay the borrowed amount within a specified timeframe and provides information on how the minimum payment is calculated. Additionally, it may stipulate the consequences of late or missed payments, such as increased interest rates or penalties. While there may not be distinct types of San Antonio Texas Agreements to Repay Cash Advance on Credit Card, variations can exist based on individual credit card issuers' policies and terms. Some credit card companies may have slightly different agreements, but the core elements and objectives are generally similar across the industry. When obtaining a cash advance on a credit card, it is crucial for cardholders to carefully review the agreement to fully understand the terms and conditions. This allows them to make informed decisions about the financial implications and plan their repayment strategy accordingly. Keywords: San Antonio Texas, agreement to repay, cash advance, credit card, repayment terms, interest rates, fees, charges, minimum payment, late payment, missed payment, penalties, credit card issuers, policies, terms, cash advance agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out San Antonio Texas Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

If you need to find a reliable legal document provider to obtain the San Antonio Agreement to Repay Cash Advance on Credit Card, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support make it simple to locate and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to search or browse San Antonio Agreement to Repay Cash Advance on Credit Card, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the San Antonio Agreement to Repay Cash Advance on Credit Card template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the San Antonio Agreement to Repay Cash Advance on Credit Card - all from the convenience of your sofa.

Sign up for US Legal Forms now!