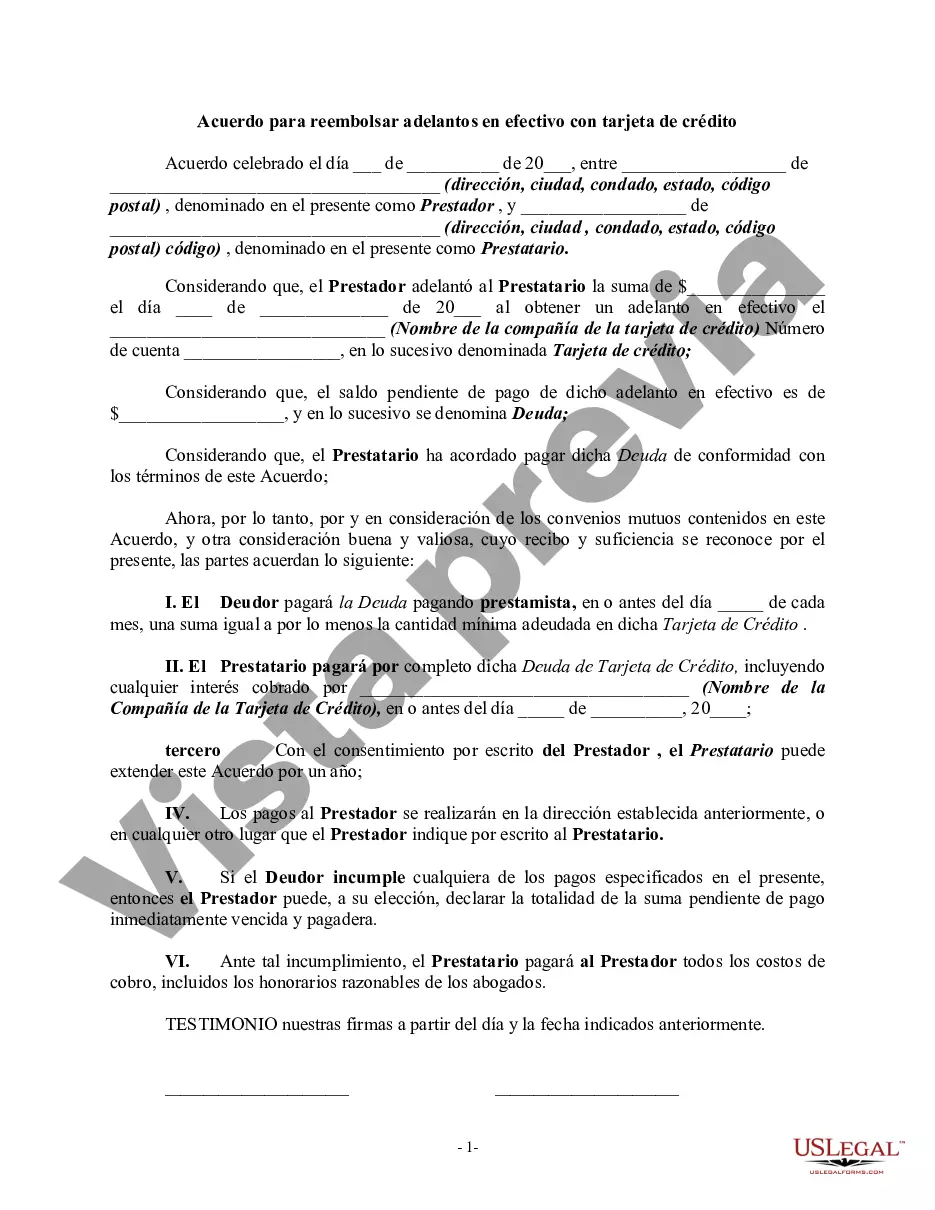

Santa Clara California Agreement to Repay Cash Advance on Credit Card is a legal document that outlines the terms and conditions agreed upon by a borrower and a lending institution when acquiring a cash advance on a credit card in Santa Clara, California. This agreement ensures that both parties are aware of their responsibilities and rights regarding the cash advance transaction. The Santa Clara California Agreement to Repay Cash Advance on Credit Card contains several important details. It specifies the amount of cash advance provided to the borrower, the interest rate, repayment terms, and any associated fees or penalties. This document may also outline the borrower's consent to the lending institution to deduct the owed amount from their credit card account. There are various types of Santa Clara California Agreement to Repay Cash Advance on Credit Card, depending on the lending institution and credit card provider. Some common types include: 1. Standard Agreement: This is the standard agreement provided by most credit card companies in Santa Clara, California. It covers the basic terms and conditions for repaying cash advances. 2. Promotional Cash Advance Agreement: Some credit card companies offer promotional cash advances with special interest rates or terms for a limited period. The agreement for such cash advances will detail the specific terms and conditions associated with these promotional offers. 3. Secured Cash Advance Agreement: In some cases, a borrower may provide collateral as security for a cash advance. This type of agreement will include details about the collateral, its valuation, and how it will be handled in case of default. 4. Revolving Cash Advance Agreement: This type of agreement allows borrowers to access cash advances multiple times, up to a predetermined credit limit. The terms and conditions for revolving cash advances may differ from standard agreements due to the ongoing nature of the transaction. Regardless of the specific type of Santa Clara California Agreement to Repay Cash Advance on Credit Card, it is crucial for borrowers to carefully review the terms and conditions before signing. Understanding the interest rates, repayment schedule, fees, and penalties associated with the agreement is essential to avoid any financial difficulties or misunderstandings in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Santa Clara California Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

If you need to get a trustworthy legal form supplier to find the Santa Clara Agreement to Repay Cash Advance on Credit Card, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to get and execute various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply select to search or browse Santa Clara Agreement to Repay Cash Advance on Credit Card, either by a keyword or by the state/county the form is created for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Santa Clara Agreement to Repay Cash Advance on Credit Card template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Santa Clara Agreement to Repay Cash Advance on Credit Card - all from the comfort of your home.

Join US Legal Forms now!