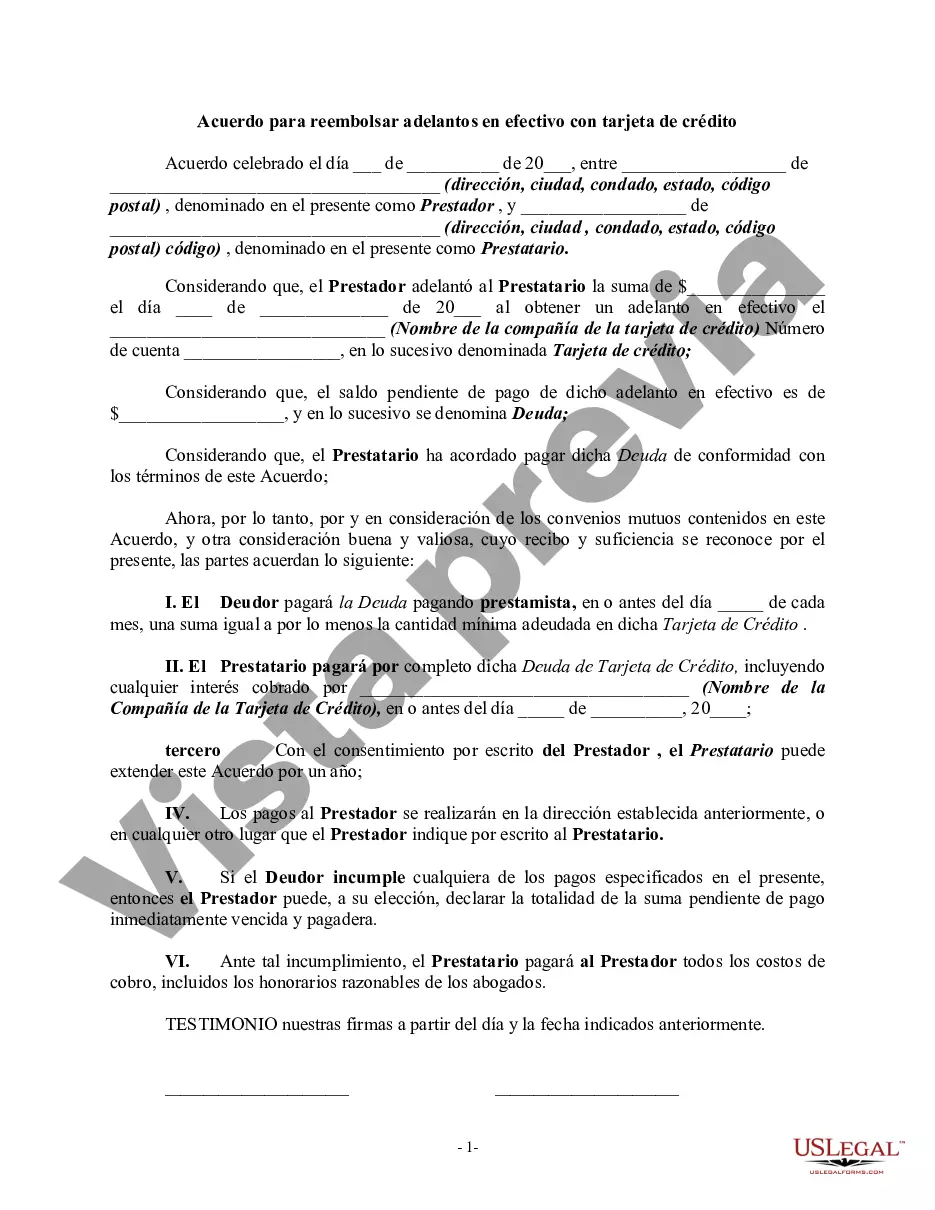

Wake North Carolina Agreement to Repay Cash Advance on Credit Card is a legal document that outlines the terms and conditions for repaying a cash advance taken on a credit card in the state of North Carolina. This agreement is entered into by the credit card holder and the financial institution that issued the credit card. Keywords: Wake North Carolina, Agreement to Repay, Cash Advance, Credit Card In Wake North Carolina, individuals have the option to take cash advances on their credit cards when they need immediate access to funds. This type of transaction is different from regular credit card purchases as it involves borrowing cash instead of making a traditional purchase. The Agreement to Repay Cash Advance on a Credit Card is the contract that both parties agree to when engaging in this kind of transaction. The Wake North Carolina Agreement to Repay Cash Advance on Credit Card serves several purposes. First, it outlines the terms and conditions of the cash advance, including the amount borrowed, the interest rate applied, and any additional fees or charges. The agreement also specifies the repayment schedule, which includes the minimum monthly payments required and the due dates. There may be different types of Wake North Carolina Agreement to Repay Cash Advance on Credit Card based on the specific policies of the credit card issuer. Some common types include: 1. Standard Agreement to Repay Cash Advance: This is the most common type of agreement, where the borrower agrees to repay the cash advance amount along with applicable fees and interest according to the terms and conditions set by the credit card issuer. 2. Promotional Agreement to Repay Cash Advance: In some cases, credit card issuers may offer promotional cash advances with lower interest rates or waived fees for a limited time. These agreements outline the terms of the promotional offer and any conditions that must be met for eligibility. 3. Agreement to Repay Cash Advance with Balance Transfer Option: Some credit cards allow borrowers to transfer their cash advance balance to another credit card with more favorable terms. These agreements include details on the balance transfer process and any associated fees or interest rates. It is important for individuals in Wake North Carolina to carefully read and understand the Agreement to Repay Cash Advance on Credit Card before accepting a cash advance. This ensures that they are aware of their repayment obligations and can make timely payments to avoid any negative consequences, such as increased interest rates or damage to their credit score. In conclusion, the Wake North Carolina Agreement to Repay Cash Advance on Credit Card is a legally binding document that governs the terms and conditions for repaying cash advances taken on credit cards. Different types of agreements may exist based on the credit card issuer's policies, including standard agreements, promotional agreements, and agreements with balance transfer options. Understanding the specifics of the agreement is crucial for borrowers to fulfill their repayment obligations responsibly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Wake North Carolina Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

Creating paperwork, like Wake Agreement to Repay Cash Advance on Credit Card, to manage your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for different cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Wake Agreement to Repay Cash Advance on Credit Card template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before getting Wake Agreement to Repay Cash Advance on Credit Card:

- Make sure that your document is compliant with your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Wake Agreement to Repay Cash Advance on Credit Card isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to begin utilizing our service and get the document.

- Everything looks good on your side? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!