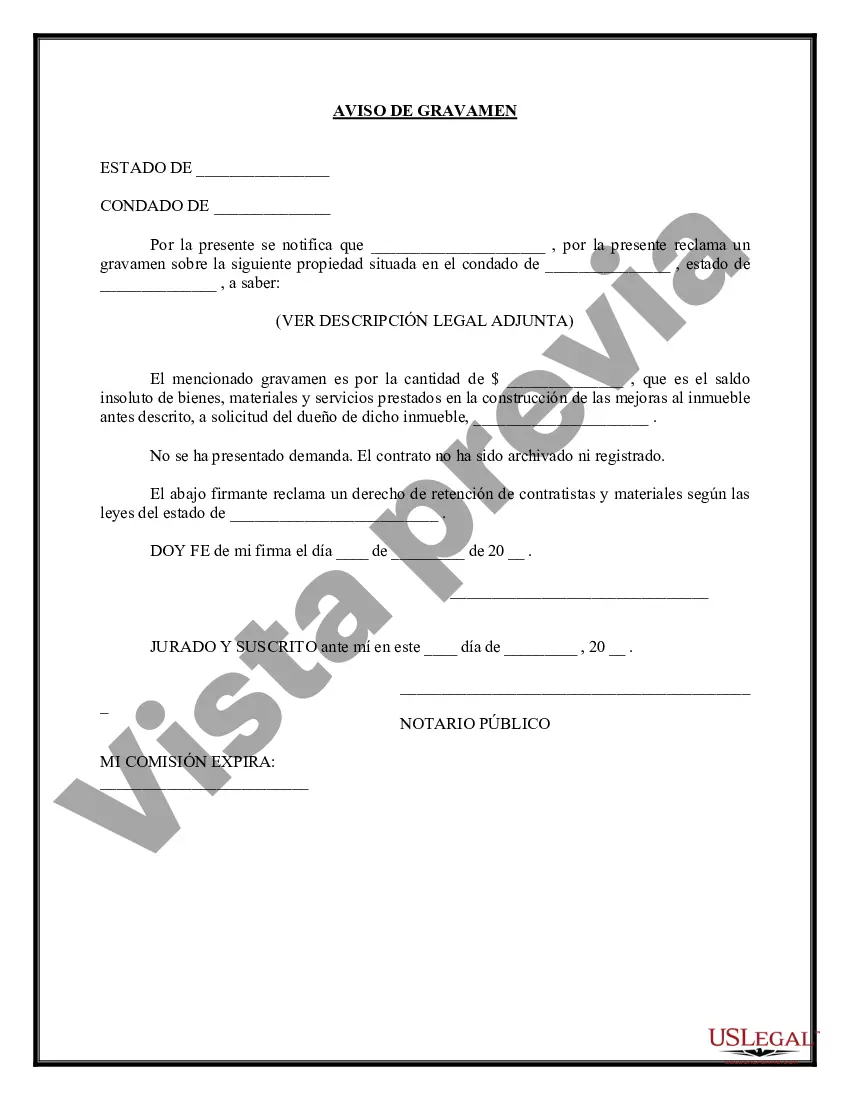

Franklin Ohio Lien Notice is a legal document that is used to notify property owners and interested parties about a lien that has been filed against a property located in Franklin, Ohio. It is an important tool in the real estate industry as it helps establish a claim on a property for unpaid debts or obligations. A Franklin Ohio Lien Notice contains detailed information regarding the lien, including the name of the lien holder, the amount owed, the property in question, and the reason for the lien. It serves as a formal notification to the property owner that they have a legal obligation to settle the debt or clear the lien on their property. There are different types of Franklin Ohio Lien Notices, depending on the nature of the debt or obligation. Some common types include: 1. Mechanics Liens: These are typically filed by contractors, subcontractors, or suppliers who have not been paid for labor, materials, or services provided towards the improvement of the property. 2. Tax Liens: These are filed by government agencies, such as the Internal Revenue Service (IRS) or the Ohio Department of Taxation, when property owners fail to pay their taxes on time. 3. Judgment Liens: These are filed by creditors who have obtained a court judgment against a property owner for unpaid debts. The lien attaches to the property, acting as security for the debt. 4. HOA Liens: Homeowner Associations (Has) can file liens against a property for unpaid monthly dues or violation fines. 5. Mortgage Liens: When a property owner fails to make mortgage payments, the lender may file a lien against the property to secure their interest. It is crucial for property owners and interested parties to be aware of any filed Franklin Ohio Lien Notices as it can have severe implications. Failure to address a lien can lead to foreclosure, loss of property, or damage to creditworthiness. In conclusion, a Franklin Ohio Lien Notice is a legal document that notifies property owners and interested parties about a filed lien against a property in Franklin, Ohio. There are various types of liens, including mechanics liens, tax liens, judgment liens, HOA liens, and mortgage liens. It is essential to address any filed liens promptly to avoid potential legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Enlace de aviso - Lien Notice

Description

How to fill out Franklin Ohio Enlace De Aviso?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your county, including the Franklin Lien Notice.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Franklin Lien Notice will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Franklin Lien Notice:

- Make sure you have opened the right page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Franklin Lien Notice on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!