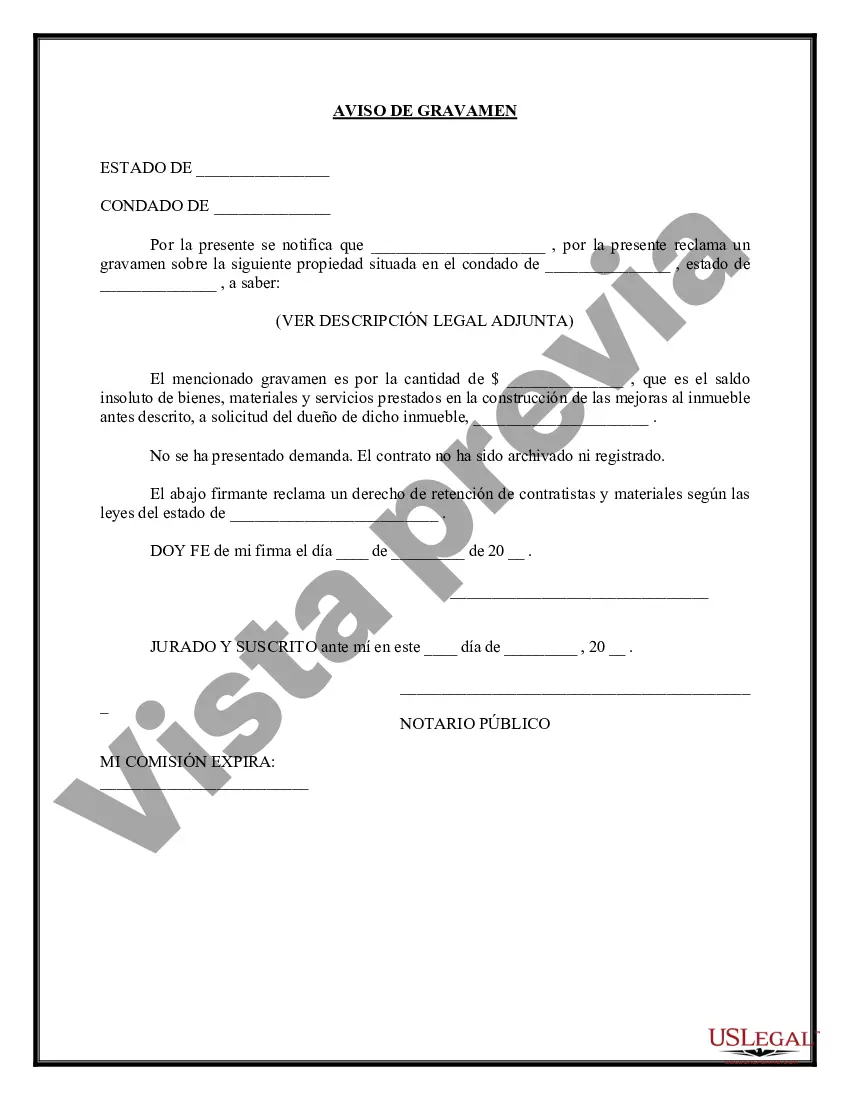

Queens New York Lien Notice is a legal document that notifies property owners in the borough of Queens, New York, about the existence of a lien on their property. A lien is a claim or legal right that a creditor holds over a property until a debt is repaid. This notice is an important tool used by creditors to enforce their rights and seek payment for debts owed. There are several types of Queens New York Lien Notice that may be issued depending on the specific circumstances: 1. Mechanics Lien Notice: This type of lien notice is filed by contractors, subcontractors, suppliers, or laborers who have provided materials or services for a construction project in Queens. It serves as an alert to property owners that there is an unresolved payment dispute related to the project, and that the claiming party has a legal right to place a lien on the property until the debt is settled. 2. Tax Lien Notice: If property owners fail to pay their property taxes in Queens, the local government may file a tax lien notice against the property. This notice informs the property owner that a lien has been placed, and the government has a legal claim on the property until the outstanding taxes, penalties, and interest are paid. 3. Judgment Lien Notice: In cases where a creditor has successfully obtained a judgment against a debtor through a lawsuit, a judgment lien notice may be filed in Queens. This document alerts property owners that the creditor has a legal right to place a lien on their property as a means of collecting the owed debt. 4. Homeowners Association (HOA) Lien Notice: Homeowners associations in Queens may issue a lien notice to homeowners who have failed to pay their dues, fines, or assessments. This notice informs the homeowner that the association has a legal claim on their property until the outstanding payments are made. It is essential for property owners in Queens, New York, to take lien notices seriously. Failure to address these notices may result in further legal actions, such as foreclosure or forced sale of the property to settle the debt. Therefore, it is crucial to consult with a qualified attorney or legal professional to fully understand the implications of a Queens New York Lien Notice and to navigate the required legal processes to resolve the underlying debt.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Enlace de aviso - Lien Notice

Description

How to fill out Queens New York Enlace De Aviso?

Whether you intend to start your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Queens Lien Notice is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to get the Queens Lien Notice. Adhere to the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Queens Lien Notice in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!