Mecklenburg North Carolina Financial Consulting Agreement is a legally binding contract entered into by a financial consulting firm and a client located in Mecklenburg County, North Carolina. This agreement outlines the terms and conditions under which the consulting services will be provided and the compensation to be paid for these services. The key components of a Mecklenburg North Carolina Financial Consulting Agreement include: 1. Parties involved: This section identifies the consulting firm and the client, including their legal names and contact details. 2. Scope of services: It describes in detail the nature, extent, and objectives of the financial consulting services to be provided. This can include services such as financial planning, investment advice, risk assessment, cash flow analysis, tax planning, and budgeting. 3. Duration of the agreement: Specifies the start and end date of the consulting services. It may also include provisions for termination or renewal of the agreement. 4. Compensation: Outlines the fees or payment structure for the consulting services. This can be based on an hourly rate, project-based, or a retainer fee. It may also include reimbursement for any necessary expenses incurred during the engagement. 5. Confidentiality: This section ensures the protection of sensitive and proprietary information shared between the consulting firm and the client. It establishes the obligations of both parties to maintain confidentiality during and after the agreement. 6. Ownership of work product: Determines the ownership rights of any reports, analyses, or documents created during the consulting engagement. It clarifies whether the client or the consulting firm holds the intellectual property rights. 7. Limitation of liability: Sets forth the extent of liability each party bears for any losses or damages incurred during the performance of the consulting services. Types of Mecklenburg North Carolina Financial Consulting Agreements: 1. General Financial Consulting Agreement: Covers a wide range of financial advisory services, including overall financial planning, investment management, and financial risk assessment. 2. Tax Consulting Agreement: Specifically focuses on tax planning, compliance, and advisory services. It may involve assisting clients in maximizing tax deductions, minimizing tax liabilities, and staying up to date with the ever-changing tax laws. 3. Retirement Planning Consulting Agreement: Provides specialized advice and guidance in planning for retirement, including pension funds, retirement savings accounts, and other investment options to ensure a financially secure retirement. 4. Estate Planning Consulting Agreement: Concentrates on helping clients manage their assets and plan for the orderly transfer of wealth to their intended beneficiaries. 5. Business Consulting Agreement: Aims to assist businesses in managing their financial operations effectively, providing services such as financial forecasting, budgeting, cash flow management, and financial restructuring. These agreements serve as the foundation for clear communication, expectations, and legal protections between the financial consulting firm and the client in Mecklenburg County, North Carolina. It is always advisable to seek legal advice to ensure compliance with local regulations and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Acuerdo de consultoría financiera - Financial Consulting Agreement

Description

How to fill out Mecklenburg North Carolina Acuerdo De Consultoría Financiera?

Preparing papers for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Mecklenburg Financial Consulting Agreement without professional help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Mecklenburg Financial Consulting Agreement by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Mecklenburg Financial Consulting Agreement:

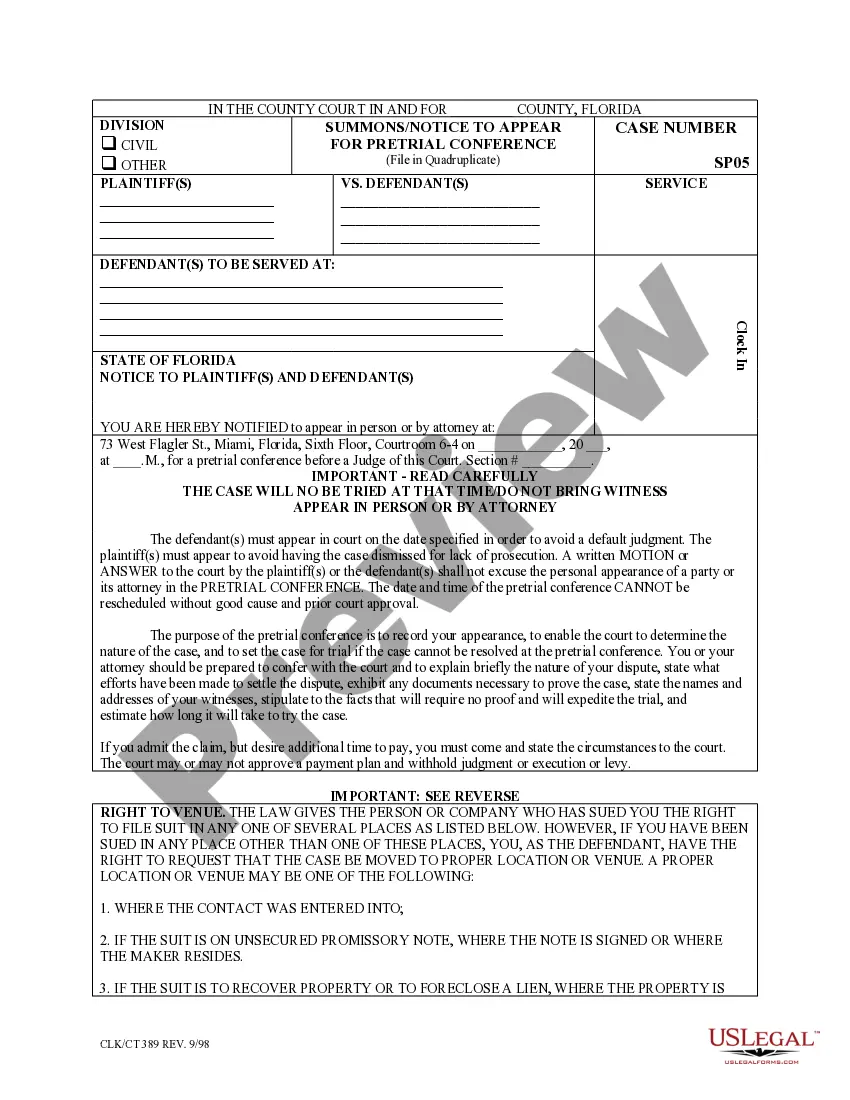

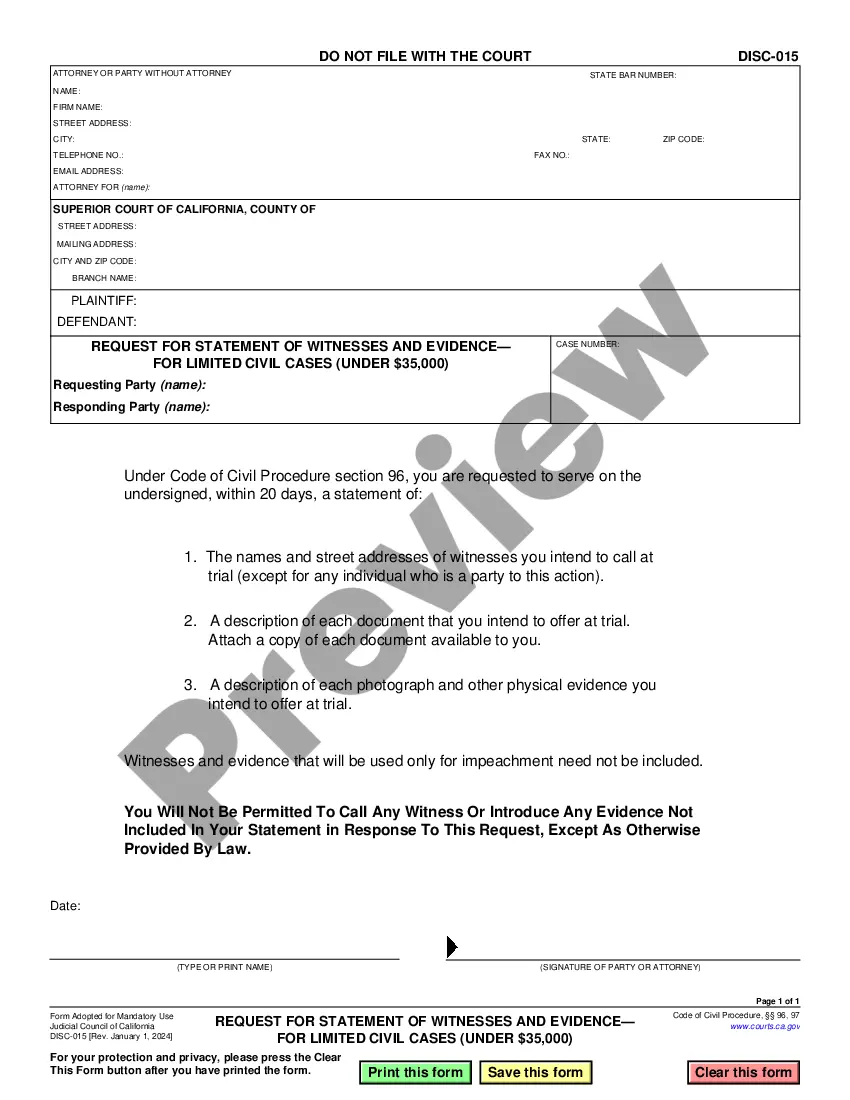

- Examine the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!