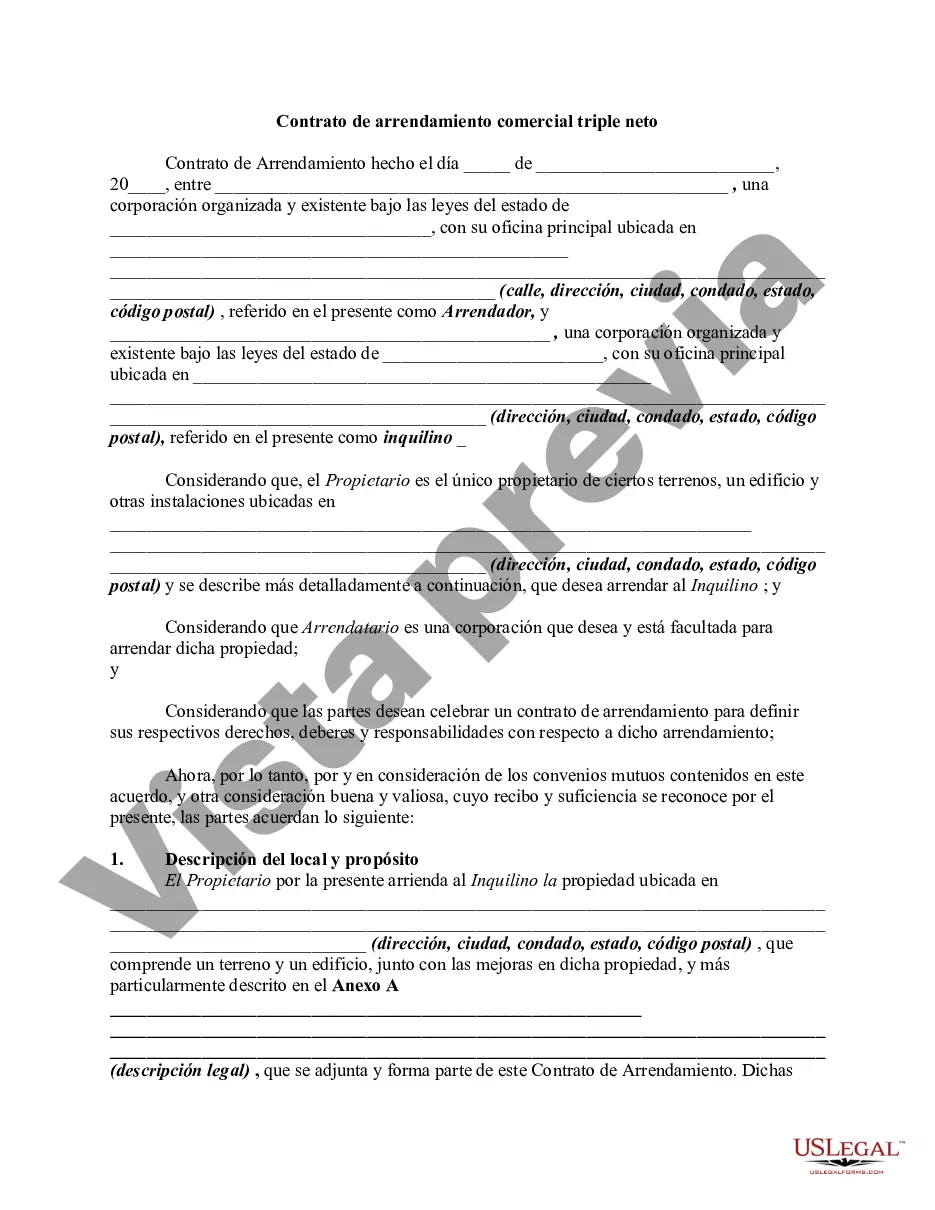

Los Angeles California Triple Net Commercial Lease Agreement — Real Estate Rental is a legally binding contract that outlines the terms and conditions between a landlord and a tenant for the rental of commercial property in Los Angeles, California. This type of lease agreement is specifically designed for commercial properties and includes a "triple net" provision, which means that the tenant is responsible for paying not only the rent but also all operating expenses, property taxes, and insurance associated with the property. In a Los Angeles California Triple Net Commercial Lease Agreement — Real Estate Rental, the landlord agrees to lease the commercial property to the tenant for a specific period, usually ranging from one to five years. The agreement outlines key details such as the rental amount, payment terms, the property's permitted use, maintenance responsibilities, and any additional terms and conditions agreed upon by both parties. This type of lease agreement is commonly used for various commercial properties in Los Angeles, California, such as retail stores, office spaces, industrial buildings, and warehouses. Different types of Triple Net (NNN) leases in Los Angeles may include: 1. Single Tenant Triple Net Lease: In this type of agreement, the tenant occupies the entire commercial property and is solely responsible for all property-related expenses, including property taxes, insurance, and maintenance. 2. Multi-Tenant Triple Net Lease: This lease agreement involves multiple tenants leasing individual spaces within a commercial property. Each tenant is responsible for their pro rata share of operating expenses, property taxes, and insurance. 3. Ground Triple Net Lease: This type of lease is often used for land lease agreements where the tenant has the right to construct and operate a building on the leased land. The tenant is responsible for all property-related expenses, including those associated with both the land and the building. Los Angeles California Triple Net Commercial Lease Agreement — Real Estate Rental is an essential document for landlords and tenants to protect their rights and establish clear expectations. It is crucial for both parties to seek legal counsel and thoroughly review the lease before signing to ensure a mutually beneficial and legally compliant agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Los Angeles California Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

Are you looking to quickly create a legally-binding Los Angeles Triple Net Commercial Lease Agreement - Real Estate Rental or maybe any other document to handle your own or business affairs? You can select one of the two options: hire a professional to draft a valid document for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant document templates, including Los Angeles Triple Net Commercial Lease Agreement - Real Estate Rental and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Los Angeles Triple Net Commercial Lease Agreement - Real Estate Rental is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Los Angeles Triple Net Commercial Lease Agreement - Real Estate Rental template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!