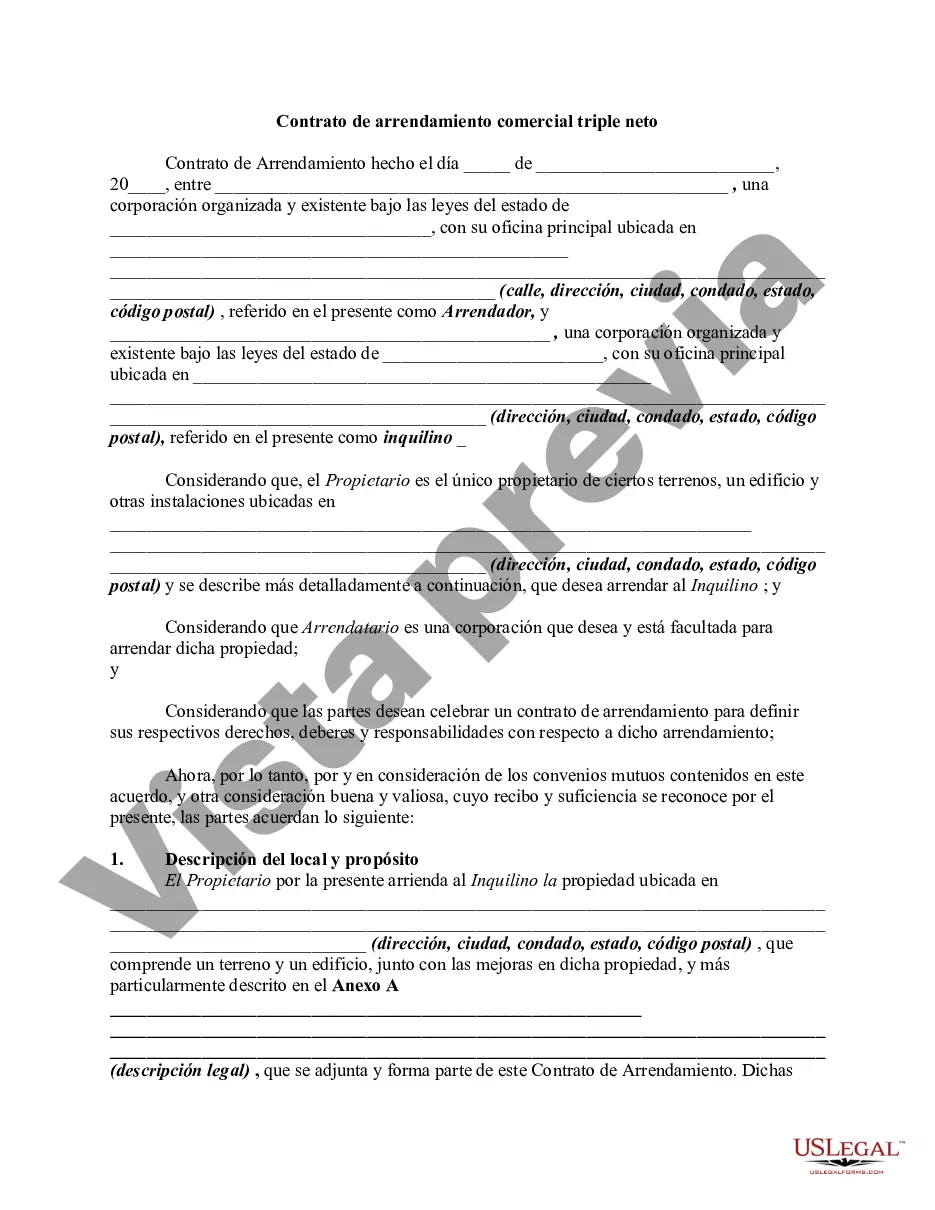

Maricopa, Arizona Triple Net Commercial Lease Agreement is a legal document that outlines the terms and conditions of leasing commercial real estate in Maricopa, Arizona. This agreement specifically covers the Triple Net (NNN) lease structure, which is commonly used in commercial leasing. What is a Triple Net Commercial Lease Agreement? A Triple Net Commercial Lease Agreement, also known as a NNN lease, is a type of lease commonly used in commercial real estate. In a Triple Net lease, the tenant is responsible for paying not only the base rent but also the property's operating expenses, such as real estate taxes, insurance, and maintenance costs. Overview of Maricopa, Arizona: Maricopa, Arizona is a rapidly growing city located in Pinal County, about 35 miles south of Phoenix. With a population of over 50,000, Maricopa offers a thriving economic environment, making it an attractive destination for businesses and commercial real estate investments. Types of Triple Net Commercial Lease Agreement in Maricopa, Arizona: 1. Maricopa Arizona Triple Net Commercial Lease Agreement for Retail Spaces: This type of agreement is specifically designed for leasing commercial properties intended for retail businesses. It may include provisions related to storefronts, parking, signage, and other retail-specific requirements. 2. Maricopa Arizona Triple Net Commercial Lease Agreement for Office Spaces: This agreement is tailored for leasing commercial properties that are primarily used as office spaces. It may address specific needs related to office layouts, utilities, common areas, and parking for employees and clients. 3. Maricopa Arizona Triple Net Commercial Lease Agreement for Industrial Spaces: This type of agreement is suitable for leasing commercial properties used for industrial or warehouse purposes. It may cover aspects such as loading docks, utilities, security measures, and zoning restrictions applicable to industrial activities. Benefits of a Maricopa Arizona Triple Net Commercial Lease Agreement: 1. Cost Control: NNN lease arrangements allow tenants to have control over operating expenses, empowering them to make decisions about utilities, insurance providers, and the overall maintenance of the property. 2. Stable Rental Payments: By stipulating that the tenant is responsible for the base rent plus property expenses, a Triple Net lease provides stability for both parties, ensuring the landlord receives consistent income while allowing tenants to plan their budget accordingly. 3. Flexibility in Space Customization: Commercial tenants often require flexibility in adapting the leased space to their specific needs. Triple Net leases typically grant this flexibility, allowing tenants to make alterations or improvements to suit their business requirements. 4. Tax Benefits: In some cases, tenants in a Triple Net lease may be eligible for tax deductions related to their payment of property expenses. Consulting with a tax professional is recommended to understand the specific tax benefits available in Maricopa, Arizona. In conclusion, Maricopa, Arizona Triple Net Commercial Lease Agreements are comprehensive legal documents that define the terms, responsibilities, and obligations of tenants and landlords in commercial real estate leasing. These agreements cater to various sectors, including retail, office, and industrial spaces, ensuring specific needs are addressed properly. With its robust economy and strategic location, Maricopa provides a promising environment for businesses seeking commercial real estate rentals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Maricopa Arizona Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Maricopa Triple Net Commercial Lease Agreement - Real Estate Rental suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. Aside from the Maricopa Triple Net Commercial Lease Agreement - Real Estate Rental, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Experts verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Maricopa Triple Net Commercial Lease Agreement - Real Estate Rental:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Maricopa Triple Net Commercial Lease Agreement - Real Estate Rental.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!