A triple net (NNN) commercial lease agreement is a commonly used rental contract in the Salt Lake City, Utah area for commercial real estate properties. This type of lease agreement is particularly beneficial for landlords as it transfers the responsibility of certain costs associated with the property to the tenant. Salt Lake City, the capital of Utah, offers a thriving commercial real estate market where various types of triple net lease agreements are available to facilitate rental transactions. Here are some of the different types of triple net commercial lease agreements prevalent in Salt Lake City, Utah: 1. Retail NNN Lease: A retail triple net lease agreement is commonly used for space within shopping centers, malls, or stand-alone retail properties in Salt Lake City. In this type of agreement, the tenant not only pays the base rent but also bears additional costs like property taxes, insurance premiums, and maintenance expenses. 2. Office NNN Lease: This type of triple net lease agreement is suitable for office spaces in Salt Lake City. Tenants leasing office spaces often have NNN lease agreements that require them to assume responsibility for utilities, property taxes, insurance, and maintenance costs. 3. Industrial NNN Lease: Industrial properties in Salt Lake City, such as warehouses or manufacturing units, typically use triple net lease agreements. Under an industrial NNN lease, tenants bear the costs for property taxes, insurance, maintenance, and repairs, in addition to paying the base rent. 4. Medical NNN Lease: Medical or healthcare-related facilities in Salt Lake City, including hospitals, clinics, or private practices, often utilize triple net lease agreements. These agreements ensure that tenants are responsible for the essential costs of running a medical facility, such as property taxes, insurance, maintenance, and utilities. 5. Ground NNN Lease: A ground lease is a unique type of triple net lease where the tenant rents only the land and constructs their own building on it. The tenant is responsible for property insurance, maintenance, and taxes associated with the land, while the landlord retains ownership of the land. Salt Lake City, Utah offers a range of triple net commercial lease agreements tailored to various types of commercial properties. These agreements benefit both landlords and tenants by clearly outlining the financial responsibilities of each party, enabling efficient and transparent real estate rental transactions.

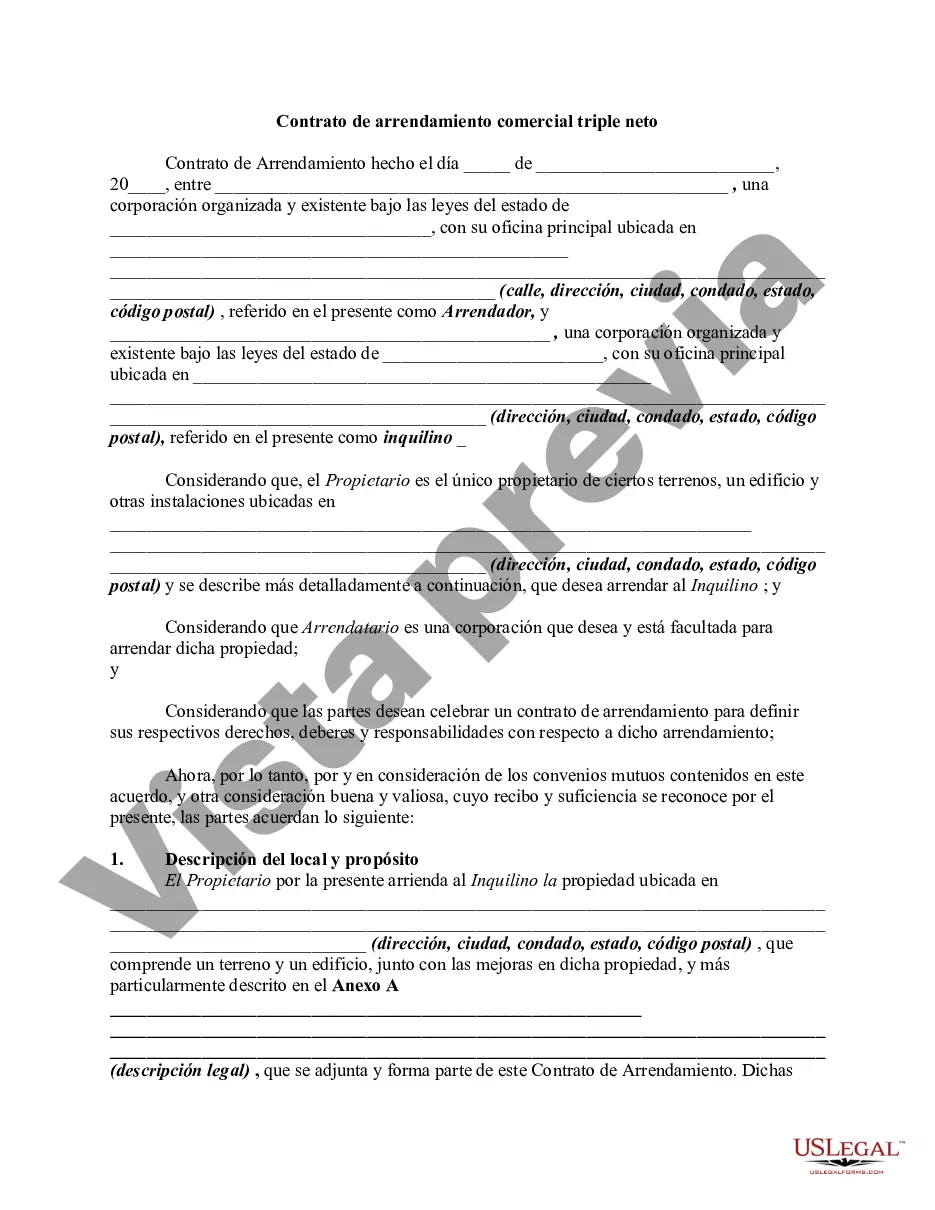

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Salt Lake Utah Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Salt Lake Triple Net Commercial Lease Agreement - Real Estate Rental, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed resources and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to find and download Salt Lake Triple Net Commercial Lease Agreement - Real Estate Rental.

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Check the related forms or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and buy Salt Lake Triple Net Commercial Lease Agreement - Real Estate Rental.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Salt Lake Triple Net Commercial Lease Agreement - Real Estate Rental, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional entirely. If you have to cope with an exceptionally complicated case, we recommend getting an attorney to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and purchase your state-specific paperwork with ease!