A Suffolk New York Triple Net Commercial Lease Agreement is a legally binding contract between a landlord and a tenant for a commercial real estate rental property. In this type of lease agreement, the tenant is responsible for paying not only the base rent but also the net expenses associated with the property such as property taxes, insurance, and maintenance costs. The Triple Net (NNN) structure in a Suffolk New York Triple Net Commercial Lease Agreement shifts a significant portion of financial responsibility from the landlord to the tenant. This arrangement is commonly observed in commercial real estate leases and is particularly attractive to investors and property owners. NNN leases provide a stable and predictable income stream for landlords while ensuring that tenants have control over the property's operating expenses. Within the realm of Suffolk New York Triple Net Commercial Lease Agreements, there are various types depending on the specific terms outlined in the agreement. These variations can include: 1. Single-Tenant Triple Net Lease: This type of lease agreement involves a single tenant renting the entire commercial property and being solely responsible for all expenses related to the property's maintenance, taxes, and insurance. 2. Multi-Tenant Triple Net Lease: In this scenario, multiple tenants rent separate units within the same commercial property, and each tenant is responsible for paying their share of the property expenses, typically determined by their proportionate square footage or space occupied. 3. Absolute Triple Net Lease: An absolute triple net lease places the highest level of responsibility on the tenant, making them solely accountable for both the variable expenses (maintenance, insurance, and taxes) and the fixed expenses (such as rent). 4. Ground Lease: A ground lease is a type of Suffolk New York Triple Net Commercial Lease Agreement where the tenant only leases the land and constructs their own building on it. The tenant is usually responsible for the costs associated with both the land and the building, including maintenance, property taxes, insurance, and any required improvements. 5. Modified Triple Net Lease: This type of lease agreement falls in between a standard triple net lease and a modified gross lease. While the tenant typically pays for property taxes, insurance, and utilities in a modified triple net lease, the landlord would shoulder some maintenance or operational expenses. In summary, Suffolk New York Triple Net Commercial Lease Agreements are a common practice in commercial real estate, offering a beneficial arrangement for both landlords and tenants. These agreements vary based on the number of tenants involved, the level of financial responsibility, and the specific terms outlined in the contract.

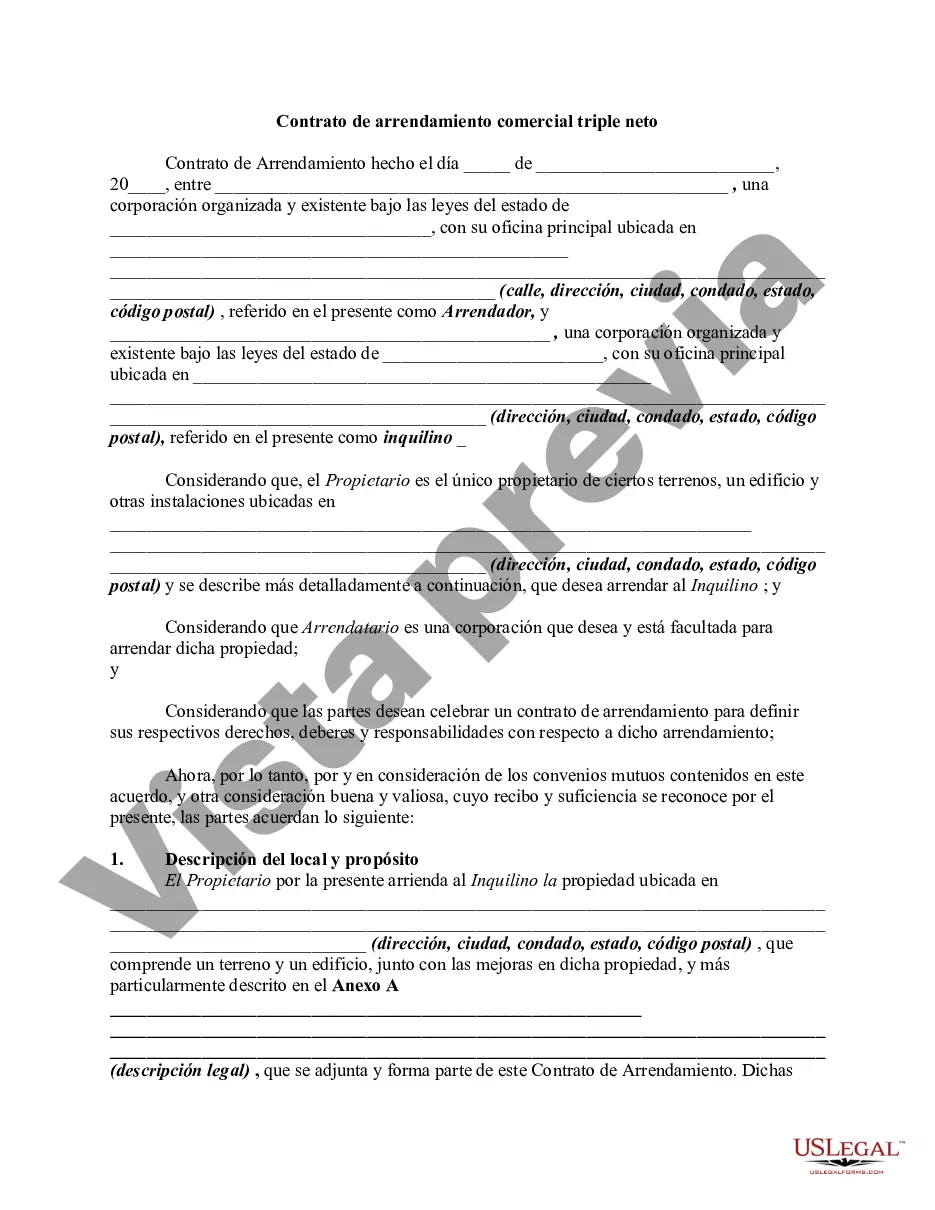

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Suffolk New York Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Suffolk Triple Net Commercial Lease Agreement - Real Estate Rental, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Suffolk Triple Net Commercial Lease Agreement - Real Estate Rental from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Suffolk Triple Net Commercial Lease Agreement - Real Estate Rental:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!