Travis Texas Triple Net Commercial Lease Agreement is a legally binding contract that outlines the terms and conditions for renting commercial real estate properties in Travis County, Texas. This lease agreement specifically follows the Triple Net (NNN) structure, which requires the tenant to bear additional expenses beyond the base rent, including property taxes, insurance, and maintenance costs. In this detailed description, we will delve into the key components and important considerations of a Travis Texas Triple Net Commercial Lease Agreement for real estate rentals. This comprehensive lease agreement protects the rights and obligations of both the landlord and tenant, ensuring a smooth and transparent business relationship throughout the lease term. The Travis Texas Triple Net Commercial Lease Agreement covers essential details such as: 1. Parties Involved: Clearly identifies the parties involved in the lease agreement, including the landlord (property owner) and tenant (business entity or individual). 2. Property Description: Provides a detailed description of the commercial property being leased, including the address, square footage, and specific leasable areas. 3. Lease Term: Specifies the duration of the lease, including the start and end dates. It may also include provisions for renewal or termination. 4. Rental Structure: Outlines the financial terms, including the base rent amount, payment schedule, and escalation clauses for potential rent increases over the lease term. 5. Triple Net (NNN) Expenses: Defines the tenant's responsibilities for additional costs associated with the property, such as property taxes, insurance premiums, and maintenance expenses. 6. Tenant Improvements: Determines whether the tenant is allowed to make modifications or improvements to the property, including any conditions or restrictions imposed. 7. Use of Property: Specifies the permitted and prohibited uses of the commercial space, ensuring that the tenant operates within legal and acceptable boundaries. 8. Maintenance and Repairs: Clearly outlines the party responsible for routine maintenance tasks, repairs, and the allocation of associated costs. 9. Insurance Requirements: Sets forth the insurance coverage obligations for both the landlord and tenant, such as general liability insurance and property insurance. 10. Default and Remedies: Details the consequences and actions that may be taken in case of a breach of the lease agreement by either party, including the right to terminate the lease. Different types of Travis Texas Triple Net Commercial Lease Agreements under Real Estate Rentals may include variations based on property type, such as: 1. Retail Triple Net Lease: Pertains to commercial properties used for retail purposes, such as standalone stores, shopping centers, or malls. 2. Office Triple Net Lease: Covers commercial properties primarily used for office space, including office buildings, business parks, or shared office facilities. 3. Industrial Triple Net Lease: Deals with large-scale commercial properties utilized for industrial purposes, such as warehouses, manufacturing facilities, or distribution centers. By thoroughly understanding the intricacies of the Travis Texas Triple Net Commercial Lease Agreement, both landlords and tenants can confidently engage in real estate rental transactions and ensure a fair and mutually beneficial lease arrangement in Travis County.

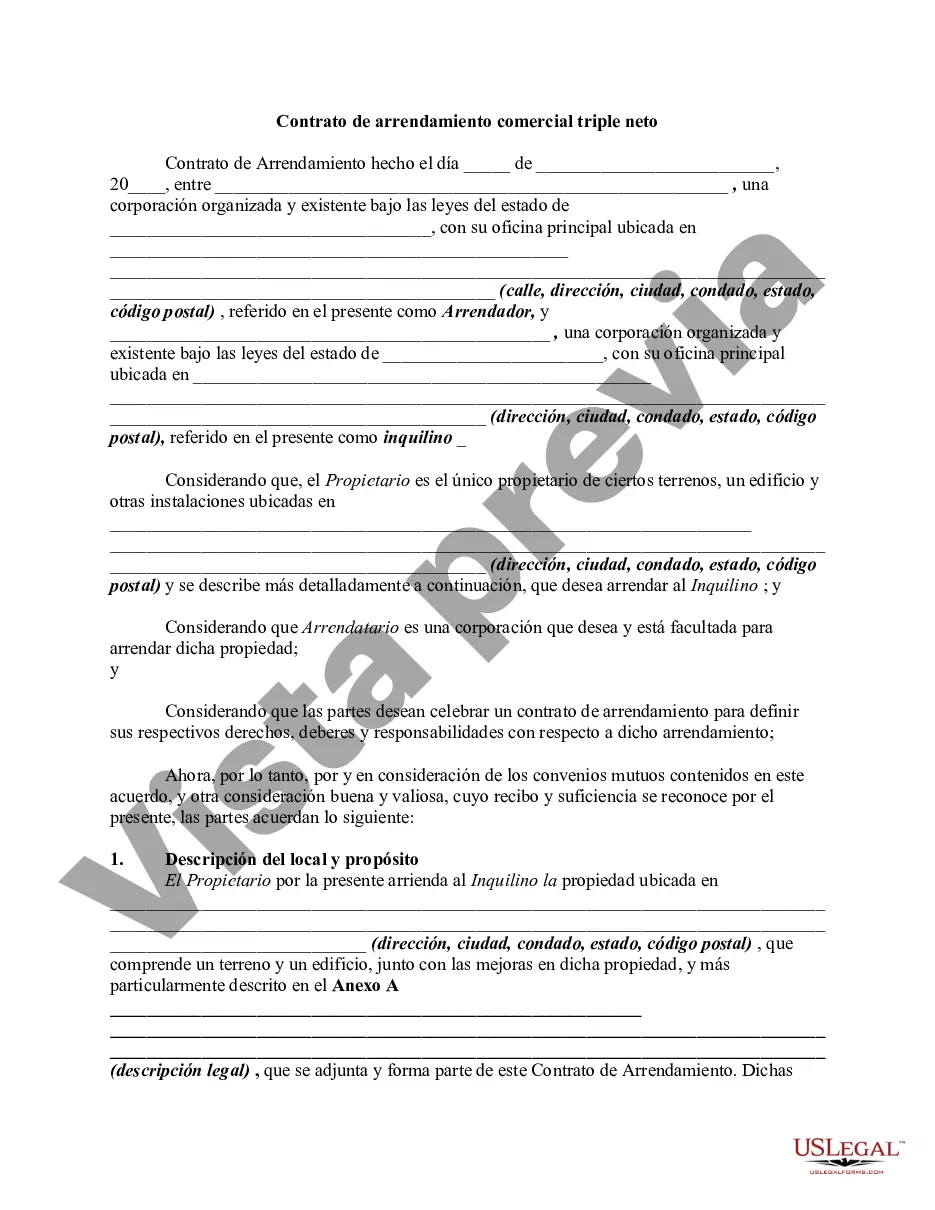

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Travis Texas Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Travis Triple Net Commercial Lease Agreement - Real Estate Rental, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Travis Triple Net Commercial Lease Agreement - Real Estate Rental from the My Forms tab.

For new users, it's necessary to make some more steps to get the Travis Triple Net Commercial Lease Agreement - Real Estate Rental:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!