A Wayne Michigan Triple Net (NNN) Commercial Lease Agreement is a legal contract between a landlord and a tenant for renting commercial real estate property in Wayne, Michigan. In this type of lease agreement, the tenant is responsible for the base rent, property taxes, insurance premiums, and maintenance expenses associated with the property, making it a popular choice for commercial property owners. The Wayne Michigan Triple Net (NNN) Commercial Lease Agreement provides both the landlord and tenant with clear guidelines and obligations during the lease term. It specifies the terms of the lease, including the duration, rent amount, payment frequency, and any additional fees or expenses. There are different types of Wayne Michigan Triple Net Commercial Lease Agreements available, such as: 1. Absolute Triple Net Lease: In this type of lease, the tenant assumes total responsibility for all costs associated with the property, including property taxes, insurance, maintenance, and repairs. 2. Modified Triple Net Lease: This lease agreement may require the tenant to pay for property taxes, insurance, and maintenance, but excludes significant structural repairs and replacements, which remain the landlord's responsibility. 3. Double Net Lease: Under this lease, the tenant is responsible for property taxes and insurance, while the landlord remains responsible for maintenance and structural repairs. 4. Single Net Lease: In a single net lease, the tenant is responsible for paying property taxes, while the landlord covers insurance and maintenance costs. A Wayne Michigan Triple Net Commercial Lease Agreement provides benefits to both landlords and tenants. For landlords, it ensures a steady stream of income with reduced responsibilities for property expenses. Tenants benefit from the freedom to customize and maintain their rented commercial space while having control over their financial obligations. Both landlords and tenants should carefully review and negotiate the terms of the Wayne Michigan Triple Net Commercial Lease Agreement to protect their interests and ensure a fair and mutually beneficial rental arrangement. It is advisable to consult with legal professionals or real estate agents familiar with local laws and regulations for guidance throughout the leasing process in Wayne, Michigan.

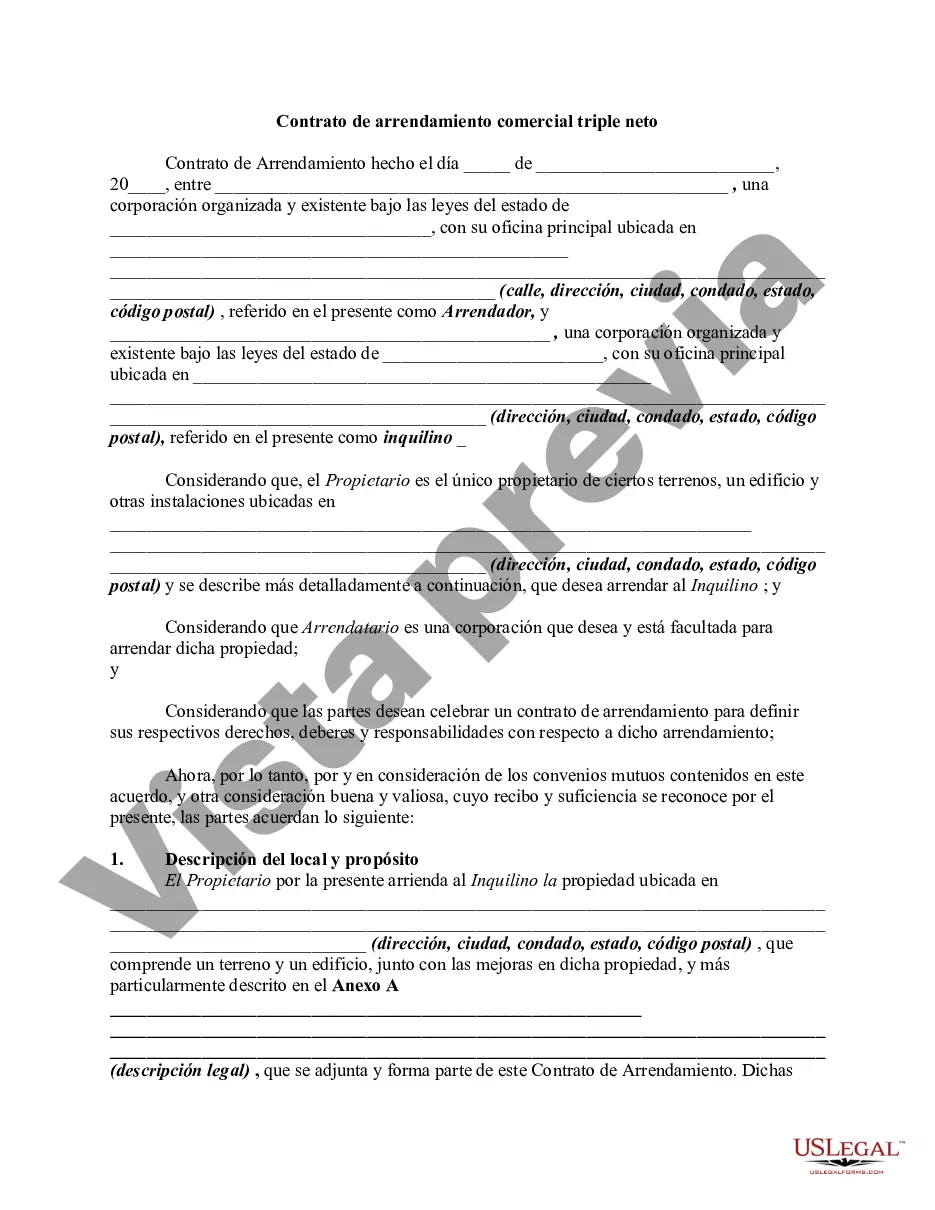

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Contrato de Arrendamiento Comercial Triple Neto - Alquiler de Bienes Raíces - Triple Net Commercial Lease Agreement - Real Estate Rental

Description

How to fill out Wayne Michigan Contrato De Arrendamiento Comercial Triple Neto - Alquiler De Bienes Raíces?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, finding a Wayne Triple Net Commercial Lease Agreement - Real Estate Rental suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Wayne Triple Net Commercial Lease Agreement - Real Estate Rental, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Wayne Triple Net Commercial Lease Agreement - Real Estate Rental:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Triple Net Commercial Lease Agreement - Real Estate Rental.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!