Cook Illinois Limited Partnership Agreement between Limited Liability Company and Limited Partner is a legal document that establishes the rights, obligations, and responsibilities of the limited liability company (LLC) and the limited partner involved in a partnership in the Cook County, Illinois area. This agreement outlines the essential terms and conditions that govern the partnership, ensuring clarity and mutual understanding between the parties involved. The Cook Illinois Limited Partnership Agreement is designed to protect the interests of both the LLC and the limited partner, fostering a harmonious and cooperative partnership. The agreement typically includes various sections addressing crucial aspects such as capital contributions, profit and loss sharing, management and decision-making authority, distributions, dissolution, and dispute resolution mechanisms. In Cook County, there may be different types of Limited Partnership Agreements that exist between a Limited Liability Company and a Limited Partner, catering to the unique requirements and circumstances of each partnership. Some of these variations include: 1. General Partnership Agreement: This is a basic form of partnership agreement where both the LLC and the limited partner share equal rights and responsibilities in the partnership's management, decision-making, and profits. 2. Limited Liability Partnership Agreement: In this type of agreement, the limited partner is shielded from personal liability for the partnership's debts and obligations beyond their initial investment. The LLC assumes greater management control and liability. 3. Limited Partnership Agreement with Silent/Passive Limited Partner: In this scenario, the limited partner provides capital but remains silent without participating actively in the partnership's management or decision-making. The LLC assumes full managerial responsibilities. 4. Limited Partnership Agreement with Capital-Only Limited Partner: In this case, the limited partner solely contributes capital to the partnership while leaving the day-to-day decision-making and management tasks to the LLC. They don't actively participate in the business operations. These are just a few examples of the different types of Cook Illinois Limited Partnership Agreements that can be established between a Limited Liability Company and a Limited Partner. It is essential for the parties involved to carefully draft and review the agreement, ensuring that it aligns with their specific needs, goals, and legal requirements. By utilizing a Cook Illinois Limited Partnership Agreement, partners can establish clear guidelines, responsibilities, and expectations, reducing the potential for misunderstandings or disputes that could arise during the course of the partnership. It provides a solid legal framework that supports efficient decision-making, profit distribution, and overall operational management, fostering a successful and mutually beneficial partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Acuerdo de sociedad limitada entre sociedad de responsabilidad limitada y socio comanditario - Limited Partnership Agreement Between Limited Liability Company and Limited Partner

Description

How to fill out Cook Illinois Acuerdo De Sociedad Limitada Entre Sociedad De Responsabilidad Limitada Y Socio Comanditario?

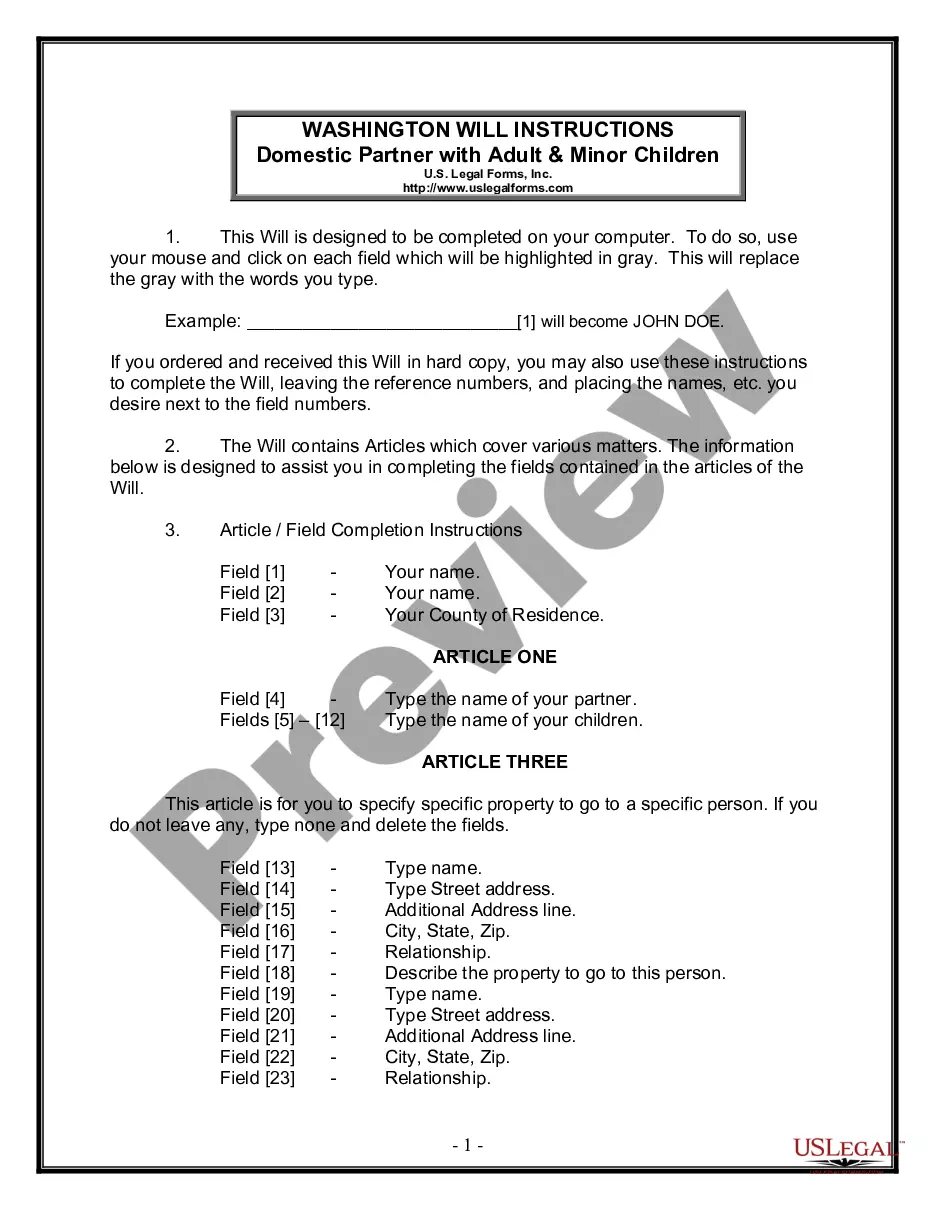

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Limited Partnership Agreement Between Limited Liability Company and Limited Partner, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the latest version of the Cook Limited Partnership Agreement Between Limited Liability Company and Limited Partner, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Limited Partnership Agreement Between Limited Liability Company and Limited Partner:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cook Limited Partnership Agreement Between Limited Liability Company and Limited Partner and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!