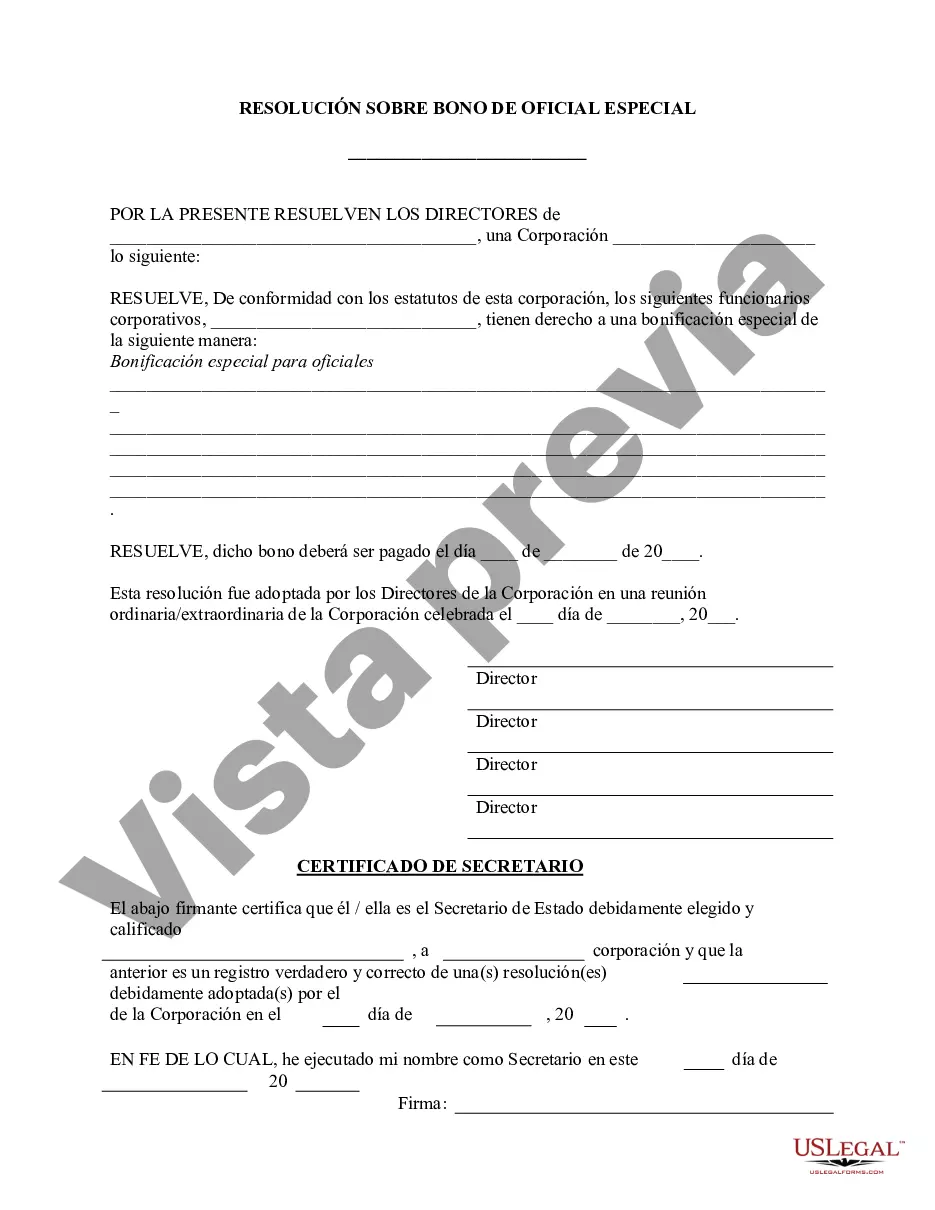

Description: The Harris Texas Specific Officers Bonus Resolution Form is a crucial document used by corporations in Harris County, Texas, to formalize the allocation of bonuses to specific officers within their organization. This form serves as a corporate resolution that outlines the details and terms related to the distribution of bonuses to designated officers. When it comes to Harris Texas Specific Officers Bonus Resolution Forms, there are potentially various types based on the specific nature and structure of each corporation. Some common variations include: 1. Executive Officers Bonus Resolution Form: This specific type of resolution form focuses on bonuses allocated to executive officers within the organization. It lays out the compensation structure and criteria for determining bonuses for high-level executives such as CEOs, CFOs, and COOs. 2. Board of Directors Bonus Resolution Form: This resolution form centers around bonuses awarded to members of the board of directors. It typically outlines the methodology for evaluating the board members' performance and sets forth the parameters for awarding bonuses accordingly. 3. Department-specific Officers Bonus Resolution Form: In larger organizations, different departments may have their own specific officers responsible for overseeing operations. This resolution form would cater to the allocation of bonuses to officers within each department based on their individual performance and contribution. Regardless of the specific type, the Harris Texas Specific Officers Bonus Resolution Form typically includes sections such as: — Identification: This section contains details about the company, including its legal name, address, and other relevant information. — Officer Information: Here, the resolution form prompts the inclusion of details about the specific officer(s) who will be eligible for bonuses, including their names, titles, and other designations. — Performance Evaluation: This section outlines the criteria and performance metrics that will be used to determine the officers' eligibility for bonuses. It may include factors such as financial targets, key performance indicators, or individual objective achievements. — Bonus Calculation: This part explains how the bonus amount will be calculated based on the officers' performance. It may specify whether the calculation is a fixed percentage of salary, a variable amount based on performance metrics, or any other predetermined formula. — Terms and Conditions: This section lays out any additional terms and conditions governing the bonus allocation, such as the timing of payments, withholding tax obligations, and clawback provisions in case of any performance discrepancies. — Signatures: The form concludes with spaces for the relevant authorities' signatures, such as company officers or board members, affirming their approval and agreement to the resolution. In conclusion, the Harris Texas Specific Officers Bonus Resolution Form is a critical document utilized by corporations in Harris County, Texas, to provide a clear framework for awarding bonuses to specific officers within the organization. With different variations available, these forms ensure transparency and consistency in bonus allocation processes, depending on factors like executive roles, board memberships, or department-specific responsibilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Bonificación de Directivos Específicos - Formulario de Resoluciones - Resoluciones Corporativas - Specific Officers Bonus - Resolution Form - Corporate Resolutions

Description

How to fill out Harris Texas Bonificación De Directivos Específicos - Formulario De Resoluciones - Resoluciones Corporativas?

If you need to find a reliable legal form supplier to get the Harris Specific Officers Bonus - Resolution Form - Corporate Resolutions, consider US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to find and complete different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Harris Specific Officers Bonus - Resolution Form - Corporate Resolutions, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Harris Specific Officers Bonus - Resolution Form - Corporate Resolutions template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less expensive and more affordable. Create your first company, arrange your advance care planning, draft a real estate agreement, or execute the Harris Specific Officers Bonus - Resolution Form - Corporate Resolutions - all from the comfort of your home.

Join US Legal Forms now!