Nassau, New York Rental Lease Agreement for Business is a legal document that outlines the terms and conditions of renting a commercial property in Nassau County, New York. This agreement is carefully designed to protect the rights and interests of both the landlord and the tenant engaging in a commercial rental transaction. The Nassau, New York Rental Lease Agreement for Business covers various aspects related to the rental of a commercial property, including the duration of the lease, rental rates, security deposits, maintenance responsibilities, and any additional charges or fees. It also contains provisions for renewing the lease or terminating it before the agreed-upon end date. There are different types of Nassau, New York Rental Lease Agreements for Business, which can be further classified based on various factors. These may include: 1. Short-Term Lease Agreement: This type of agreement is typically used for businesses that require a rental space for a limited period, such as pop-up shops, seasonal businesses, or temporary offices. 2. Standard Long-Term Lease Agreement: This is the most common type of lease agreement for businesses, usually ranging from 1 to 5 years. It provides stability for the tenant and allows for long-term planning and business growth. 3. Triple Net Lease Agreement: In this type of agreement, the tenant is responsible for not only the rent but also the property's maintenance expenses, insurance, and property taxes. It shifts more financial responsibilities to the tenant. 4. Modified Gross Lease Agreement: This type of lease agreement combines elements of gross and net leases. It typically involves the tenant paying a base rent while the landlord covers some operating expenses. However, specific expenses, such as utilities or maintenance costs, may be negotiated separately. 5. Percentage Lease Agreement: This type of agreement is commonly used for retail businesses. The tenant pays a base rent along with a percentage of their sales. It is often seen as a win-win situation as the landlord shares in the tenant's success. Regardless of the specific type, the Nassau, New York Rental Lease Agreement for Business should accurately reflect the intentions and expectations of both parties involved. It is essential for both the landlord and the tenant to thoroughly review and understand the terms and conditions before signing the lease agreement to avoid any potential conflicts or misunderstandings in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Contrato de arrendamiento de alquiler para negocios - Rental Lease Agreement for Business

Description

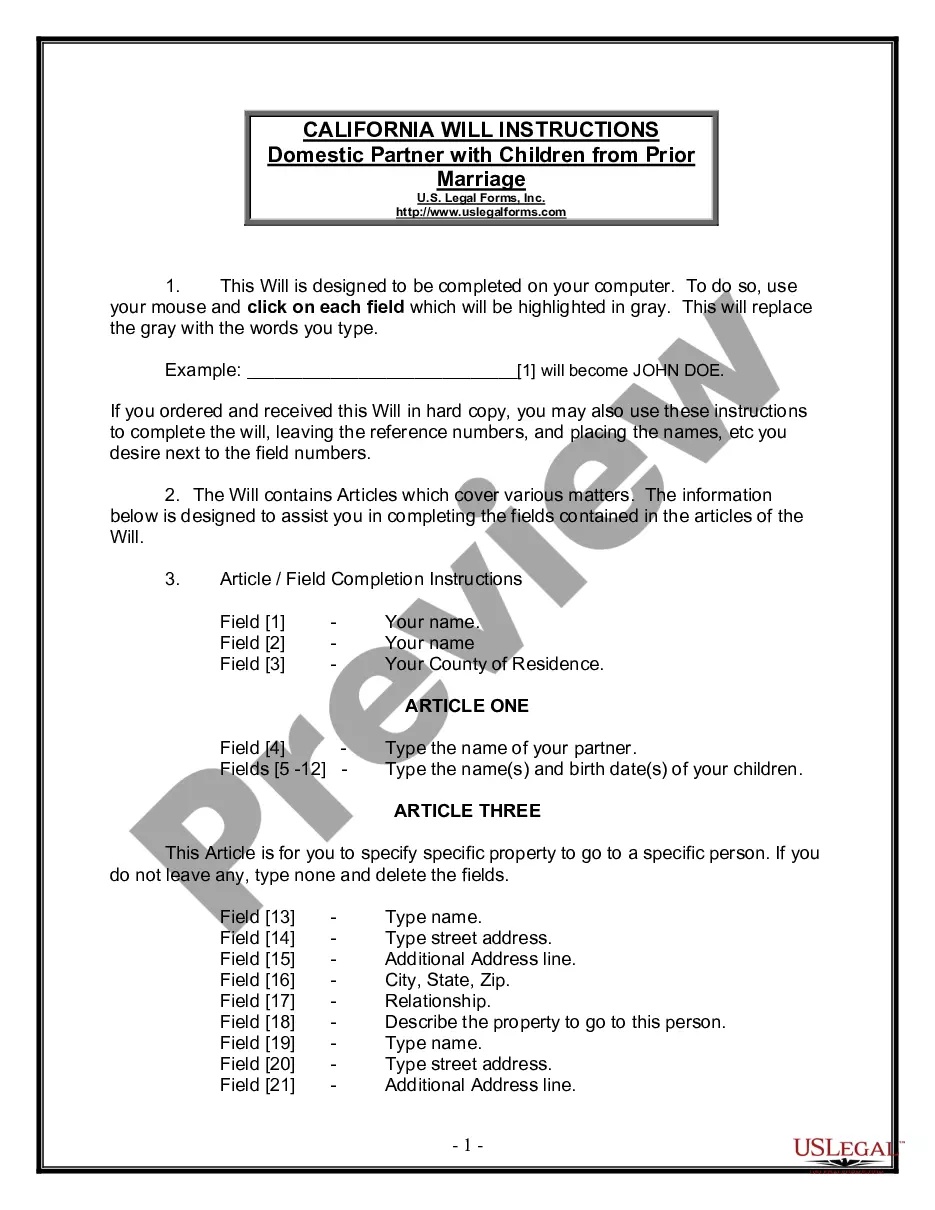

How to fill out Nassau New York Contrato De Arrendamiento De Alquiler Para Negocios?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business objective utilized in your region, including the Nassau Rental Lease Agreement for Business.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Nassau Rental Lease Agreement for Business will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Nassau Rental Lease Agreement for Business:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Nassau Rental Lease Agreement for Business on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!