Hennepin Minnesota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts — Real Estate is a type of commercial lease agreement commonly used in Hennepin County, Minnesota. This lease arrangement is specifically tailored for retail businesses and includes an additional rent component based on a percentage of the tenant's gross receipts. Under this lease agreement, the tenant agrees to pay a base rent, usually a fixed amount per month, to the landlord. In addition to the base rent, the tenant is also obligated to pay an additional rent based on a percentage of their gross receipts. The specific percentage is usually negotiated between the tenant and the landlord and is outlined in the lease. The purpose of including additional rent based on gross receipts is to provide a fair and flexible arrangement for both the tenant and the landlord. This type of lease structure allows the landlord to benefit directly from the tenant's success, as the rent increases in proportion to the tenant's sales. On the other hand, the tenant's rent is proportionate to their business's performance, providing a more manageable cost structure, especially during periods of lower sales. There may be different variations or terms associated with the Hennepin Minnesota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts — Real Estate. These can include: 1. Percentage Rent Threshold: There may be a minimum sales threshold that the tenant must reach before the additional rent based on percentage kicks in. This threshold ensures that the tenant is not burdened with a high percentage rent when sales are low. 2. Percentage Rent Calculation: The lease agreement should specify how the percentage rent is calculated. It is typically based on the total gross sales achieved during a specified period, such as a month or a year. 3. Audit Rights: The lease may provide the landlord with the right to audit the tenant's books to verify the accuracy of the reported gross receipts. This ensures transparency and prevents potential disputes between the landlord and tenant. 4. Exclusions or Deductions: Some lease agreements may allow certain exclusions or deductions from the gross receipts before calculating the percentage rent. These exclusions can include sales tax, refunds, or returns, as agreed upon by both parties. 5. Reporting and Payment: The lease should outline the tenant's obligations regarding reporting the gross receipts and making the additional rent payments. This typically includes the frequency of reporting (e.g., monthly or annually) and the timelines for payment. In conclusion, the Hennepin Minnesota Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts — Real Estate is a specialized lease agreement that offers both the tenant and the landlord a flexible and fair arrangement. It allows the tenant's rent to be directly tied to their business's performance, while providing the landlord with the opportunity to benefit from the tenant's success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Arrendamiento de tienda minorista con alquiler adicional basado en el porcentaje de ingresos brutos - Bienes raíces - Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Hennepin Minnesota Arrendamiento De Tienda Minorista Con Alquiler Adicional Basado En El Porcentaje De Ingresos Brutos - Bienes Raíces?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Hennepin Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate meeting all regional requirements can be exhausting, and ordering it from a professional lawyer is often costly. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Apart from the Hennepin Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, here you can get any specific document to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the file in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Hennepin Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate:

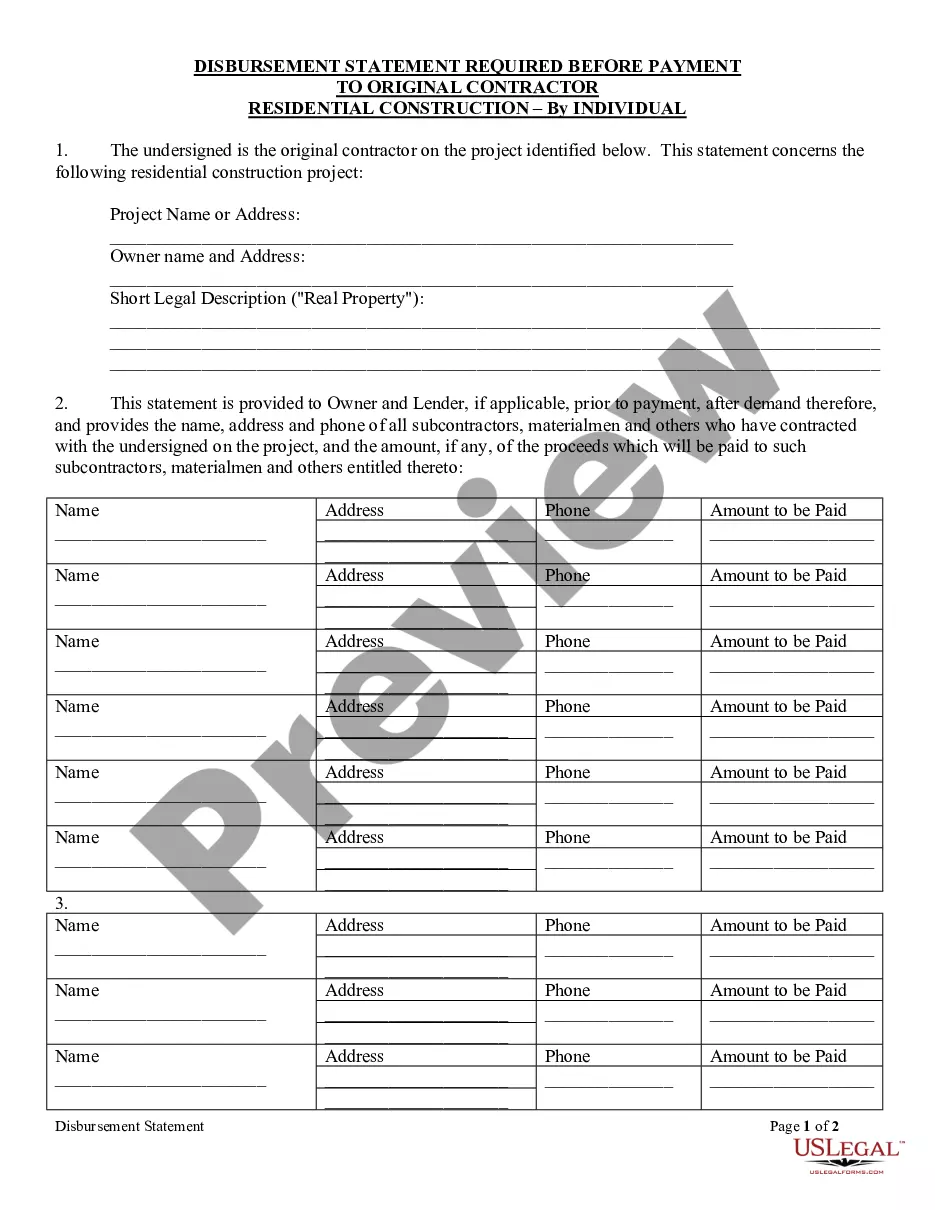

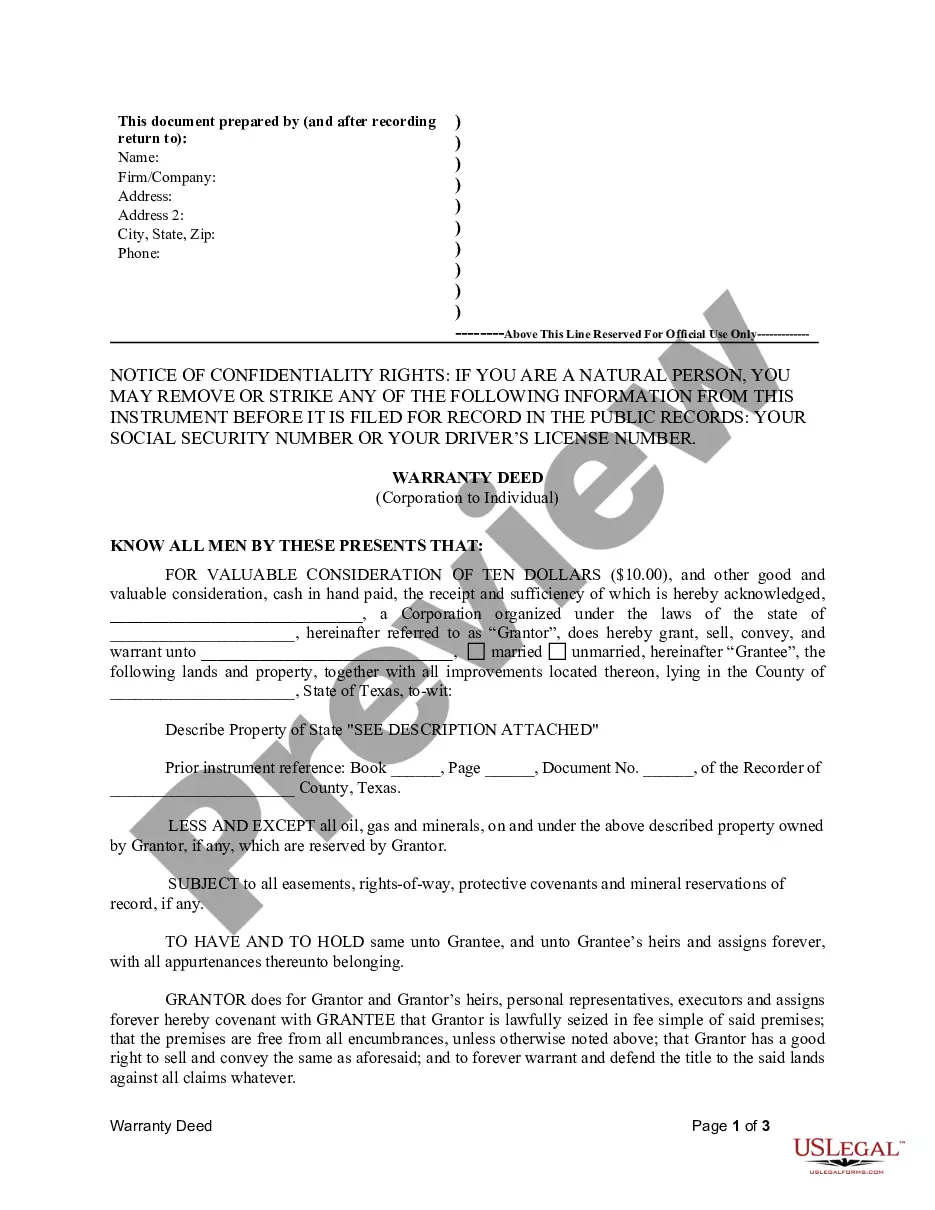

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Hennepin Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!