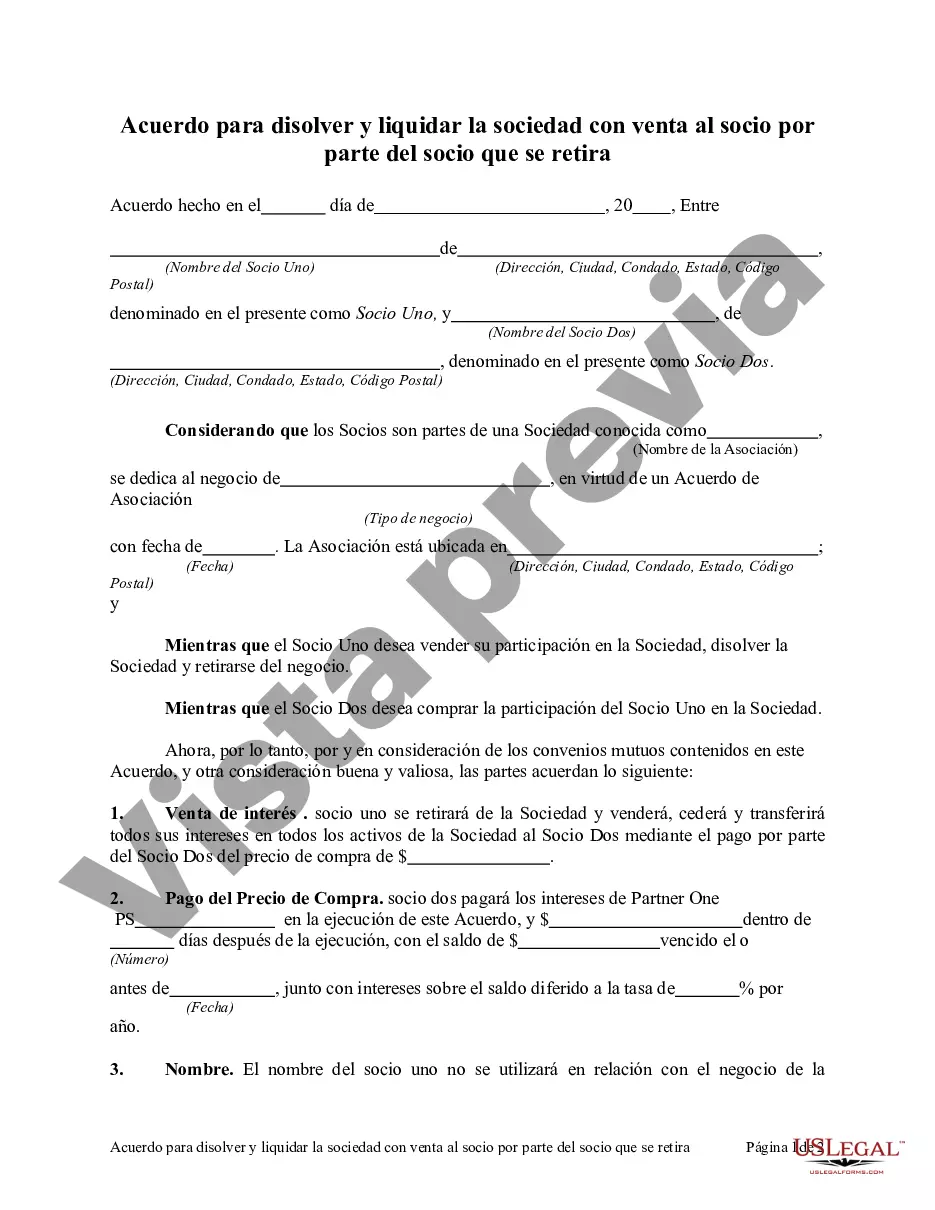

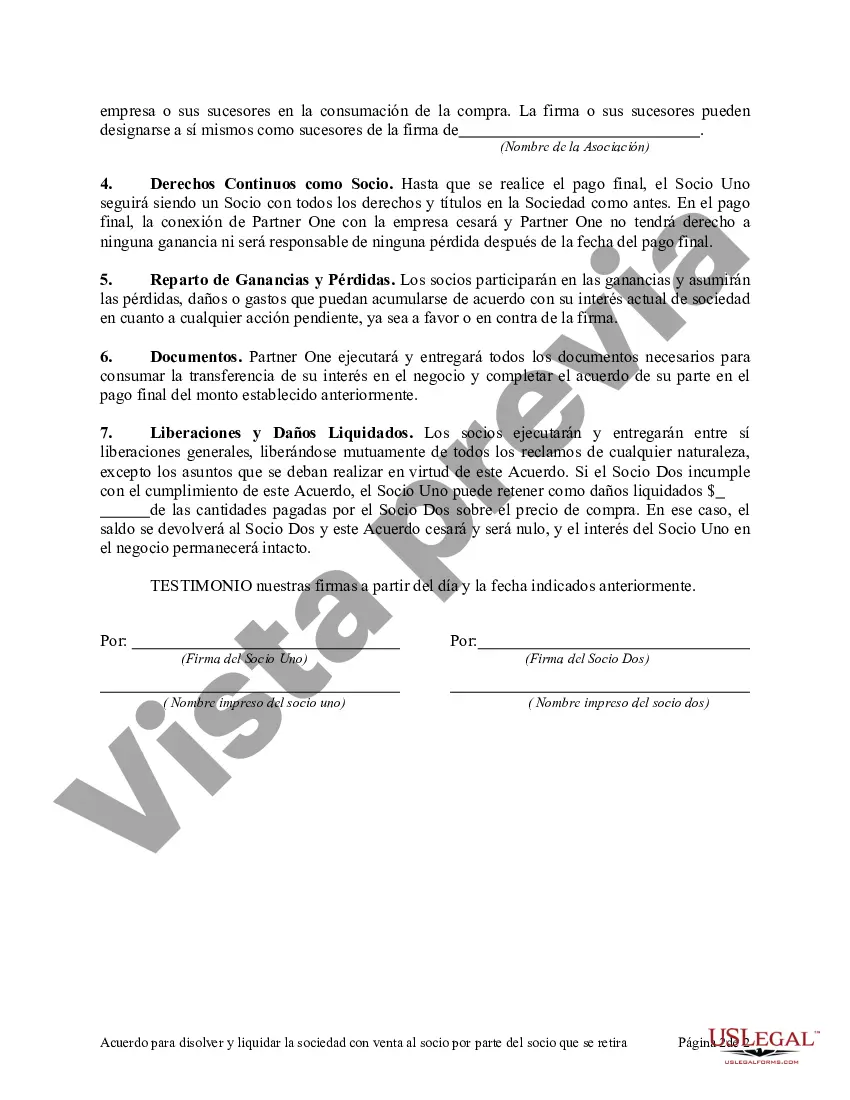

Chicago Illinois Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legally binding contract that sets out the terms and conditions for the dissolution and closure of a partnership, wherein one partner decides to retire and sell their share of the business to their fellow partner(s). This agreement is crucial for ensuring a smooth transition and an equitable division of assets, liabilities, and responsibilities among the remaining partners. The Chicago Illinois Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner typically includes the following key elements: 1. Introduction: The agreement begins with the identification of the parties involved, stating their names, addresses, and roles within the partnership. 2. Recitals: This section provides a brief background regarding the history of the partnership, highlighting its formation, purpose, and duration. 3. Termination Date: The agreement specifies the effective date on which the partnership will be dissolved and the retirement of the partner will be completed. This date is crucial as it marks the conclusion of the partnership's business operations. 4. Purchase Agreement: This section outlines the terms and conditions under which the retiring partner will sell their share of the partnership to the remaining partner(s). It includes details such as the purchase price, payment terms, and any additional considerations to be provided by the remaining partner(s) in exchange for the retiring partner's share. 5. Allocation of Assets and Liabilities: The agreement outlines the process for the fair distribution of the partnership's assets and liabilities among the remaining partners after the retiring partner's departure. It may include provisions for the sale or transfer of physical assets, settlement of outstanding debts, and the handling of ongoing contracts or leases. 6. Release and Indemnification: This clause highlights the mutual release of claims and liabilities between the retiring partner and the remaining partner(s), protecting each party from future disputes or legal actions related to the partnership's dissolution. 7. Confidentiality and Non-Competition: This section may impose restrictions on the retiring partner, preventing them from disclosing confidential information or directly competing with the partnership's business in the future. 8. Governing Law and Jurisdiction: The agreement specifies that Chicago Illinois laws govern the interpretation, validity, and enforcement of the contract. It also designates the jurisdiction or court where any disputes arising from the agreement will be resolved. Some variations of the Chicago Illinois Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may include: 1. Chicago Illinois Agreement to Dissolve and Wind up Partnership with Sale to Multiple Partners by Retiring Partner: This type of agreement caters to scenarios where the retiring partner wants to distribute their share among multiple remaining partners instead of selling it to a single individual. 2. Chicago Illinois Agreement to Dissolve and Wind up Partnership with Sale to Third-Party Buyer by Retiring Partner: In certain cases, the retiring partner may choose to sell their share of the partnership to a third-party buyer rather than the existing partner(s). This agreement outlines the terms and conditions for such a transaction. In conclusion, the Chicago Illinois Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a critical legal document that facilitates a smooth and fair dissolution of a partnership when one partner decides to retire and sell their share. It protects the rights and interests of all parties involved while ensuring a systematic closing of business operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo para disolver y liquidar la sociedad con venta al socio por parte del socio que se retira - Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Chicago Illinois Acuerdo Para Disolver Y Liquidar La Sociedad Con Venta Al Socio Por Parte Del Socio Que Se Retira?

Laws and regulations in every area vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Chicago Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Chicago Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Chicago Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!