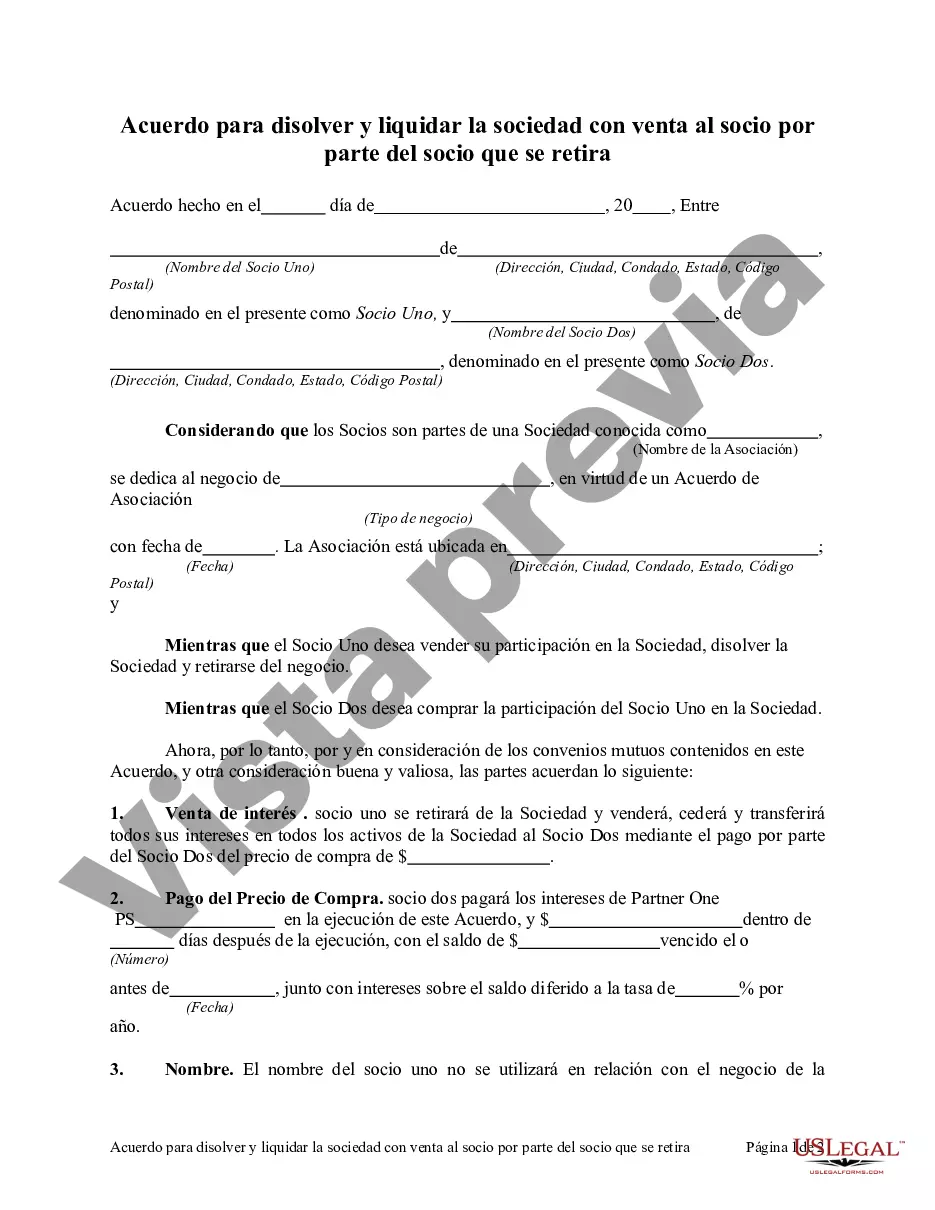

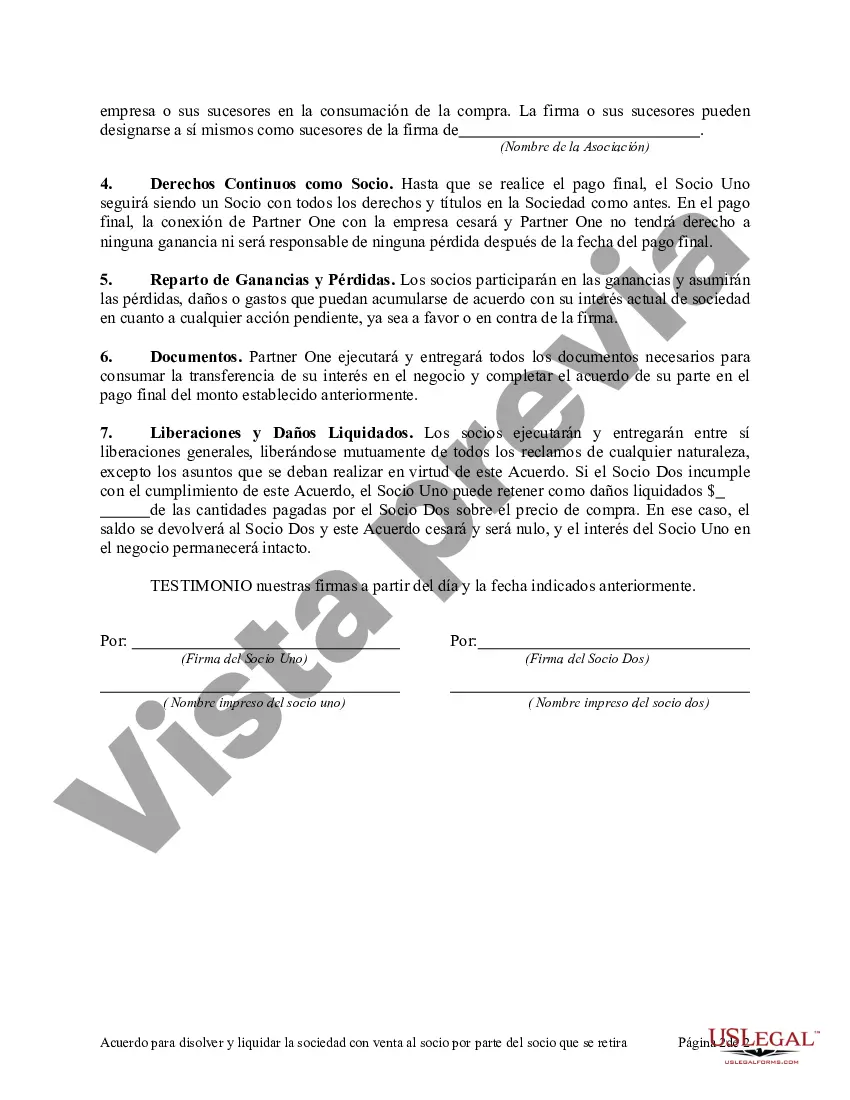

Montgomery Maryland Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document used in Montgomery County, Maryland, to terminate a partnership and facilitate the sale of a partner's interest to the remaining partner(s) upon retirement. This agreement encompasses the dissolution of a partnership and the subsequent distribution of assets, liabilities, and interests among the partners involved. The Montgomery Maryland Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner aims to outline the rights, obligations, and procedures that each partner must follow throughout the dissolution process. It helps ensure a smooth transition while protecting the interests of all parties involved. Key components of this agreement typically include: 1. Purpose: This section outlines the purpose of the agreement, which is to establish the terms and conditions for the dissolution and sale of a retiring partner's interest in the partnership. 2. Definitions: Here, relevant terms such as "retiring partner," "continuing partner(s)," "partnership assets," and "liabilities" are defined to avoid misunderstandings during the dissolution process. 3. Effective Date: The agreement specifies the effective date of the dissolution, which may be the date of signing or any other mutually agreed-upon date. 4. Dissolution Process: This section outlines the steps to be followed for the dissolution, including the timeline, notification to creditors, and the withdrawal of assets from the partnership. 5. Valuation of Interest: The agreement discusses the method to be used for valuing the retiring partner's interest in the partnership, such as appraisals, financial statements, or an agreed-upon formula. 6. Purchase Price and Terms: This part establishes the purchase price for the retiring partner's interest and the terms of payment, including any installment plans or financing arrangements. 7. Allocation of Assets and Liabilities: The agreement specifies how the partnership assets and liabilities will be allocated among the remaining partners and the retiring partner. 8. Release and Indemnification: Both parties release each other from any liability or claims arising from the dissolution and indemnify each other against any third-party claims related to the partnership. Different types or variations of the Montgomery Maryland Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may exist depending on the specific circumstances and agreements between the partners. For example, variations may arise when additional partners are involved or when the partnership has specific assets, such as real estate or intellectual property, which require a separate agreement for their disposition. It is important to consult with a legal professional specializing in partnership agreements and business law to ensure compliance with local laws and to properly execute the Montgomery Maryland Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Acuerdo para disolver y liquidar la sociedad con venta al socio por parte del socio que se retira - Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Montgomery Maryland Acuerdo Para Disolver Y Liquidar La Sociedad Con Venta Al Socio Por Parte Del Socio Que Se Retira?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Montgomery Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Montgomery Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Montgomery Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner:

- Examine the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!