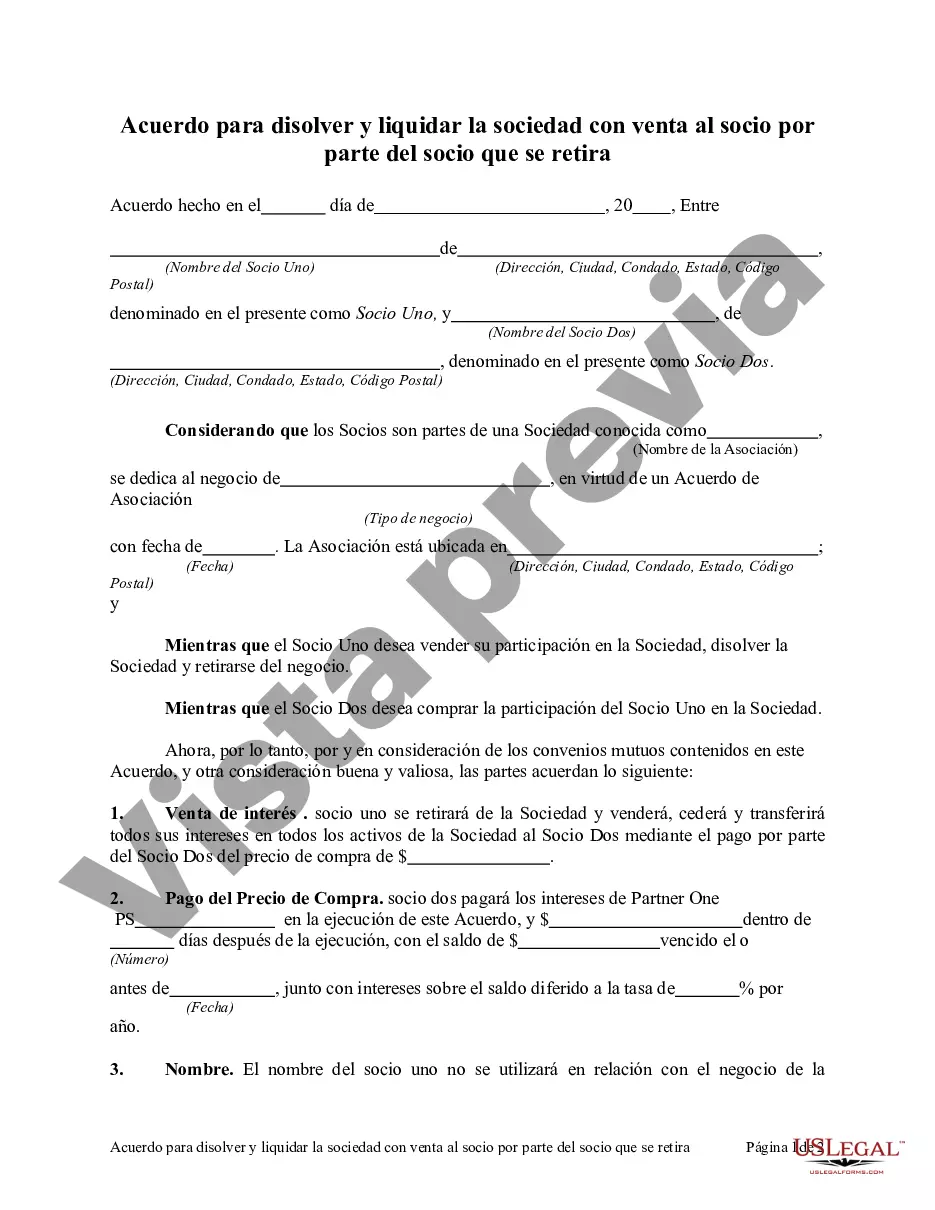

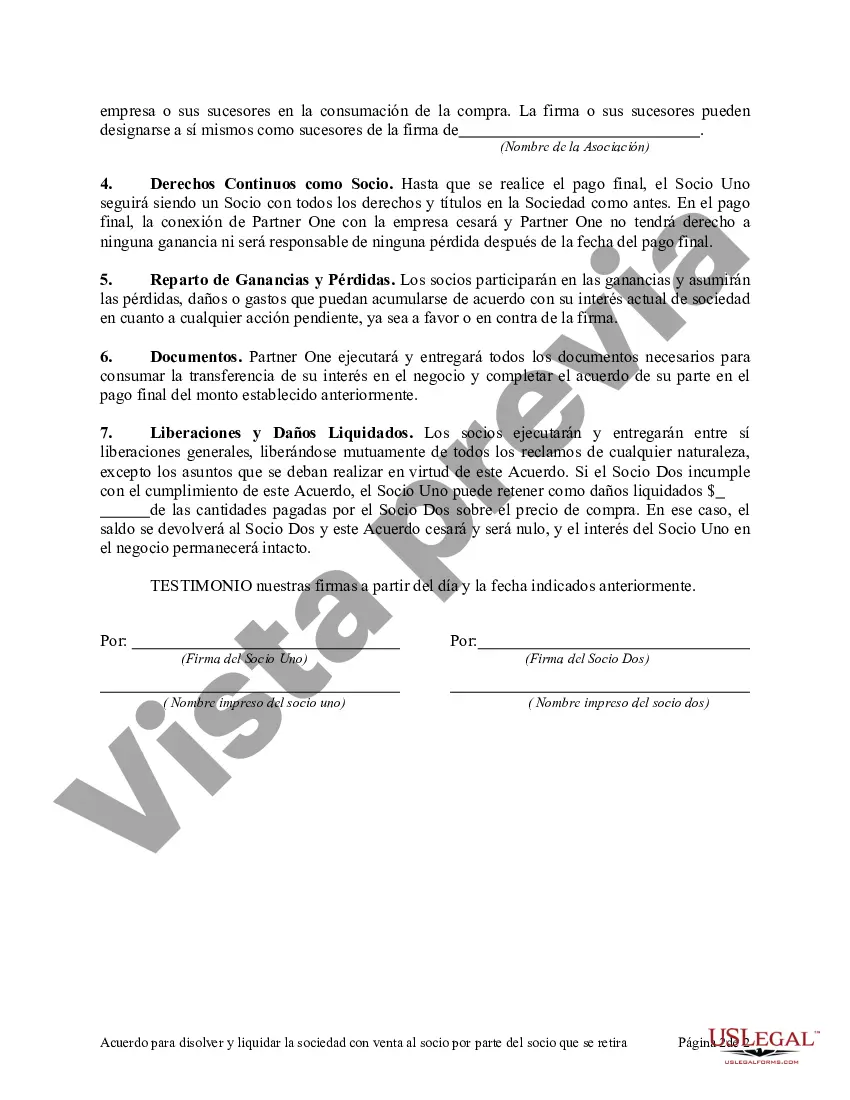

Palm Beach Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner: A Comprehensive Guide Introduction: The Palm Beach Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document that outlines the process by which a partnership can be dissolved and its assets distributed among the remaining partners, specifically with the retiring partner selling their stake to one of their existing partners. This agreement serves as a crucial tool to ensure a smooth transition and fair distribution of assets, while also addressing the financial obligations and liabilities of the partnership. Key Elements of the Agreement: 1. Partnership Dissolution: The agreement begins by clearly defining the intent of the partnership to dissolve and terminate its operations. It outlines the reasons behind the decision and ensures that all partner stakeholders are in agreement regarding the dissolution. 2. Partnership Liquidation: The agreement includes a detailed plan for the liquidation of the partnership's assets. This involves the identification, valuation, and distribution of all tangible and intangible assets, including but not limited to real estate, inventory, equipment, and any intellectual property rights. 3. Sale to Partner: In the case of a retiring partner, the agreement outlines the terms and conditions of the sale of their partnership interest to one or more remaining partners. This includes the purchase price, payment terms, and any other relevant considerations to ensure a fair and transparent transaction. 4. Distribution of Liabilities: The agreement specifies how the partnership's liabilities and debts will be addressed in the dissolution process. It outlines which partner(s) will assume responsibility for each liability and how any outstanding debts will be settled. 5. Tax Implications: The agreement acknowledges the potential tax implications that may arise from the dissolution and sale, and describes how the partnership will handle its tax obligations. It may also include provisions for allocating tax liabilities among the partners based on their respective ownership interests. Types of Palm Beach Florida Agreements to Dissolve and Wind Up Partnership with Sale to Partner by Retiring Partner: 1. General Partnership Dissolution Agreement: This type of agreement applies to general partnerships where partners have equal liability for the partnership's debts and obligations. 2. Limited Partnership Dissolution Agreement: Limited partnerships have both general partners, who have unlimited liability, and limited partners, who have limited liability. This type of dissolution agreement takes into account the different roles and responsibilities of each partner type. 3. Family Partnership Dissolution Agreement: When a partnership involves family members, such as siblings or spouses, this type of agreement addresses unique considerations that arise from the familial relationship and ensures a fair distribution of assets among family members. Conclusion: The Palm Beach Florida Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document designed to protect the interests of all partners involved in the dissolution process. By providing a clear and comprehensive framework, this agreement facilitates a smooth transition by addressing the sale of the retiring partner's share and the distribution of assets and liabilities. It is crucial to consult with legal professionals to customize the agreement based on specific partnership structures and circumstances to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo para disolver y liquidar la sociedad con venta al socio por parte del socio que se retira - Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Palm Beach Florida Acuerdo Para Disolver Y Liquidar La Sociedad Con Venta Al Socio Por Parte Del Socio Que Se Retira?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Palm Beach Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Palm Beach Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Palm Beach Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!