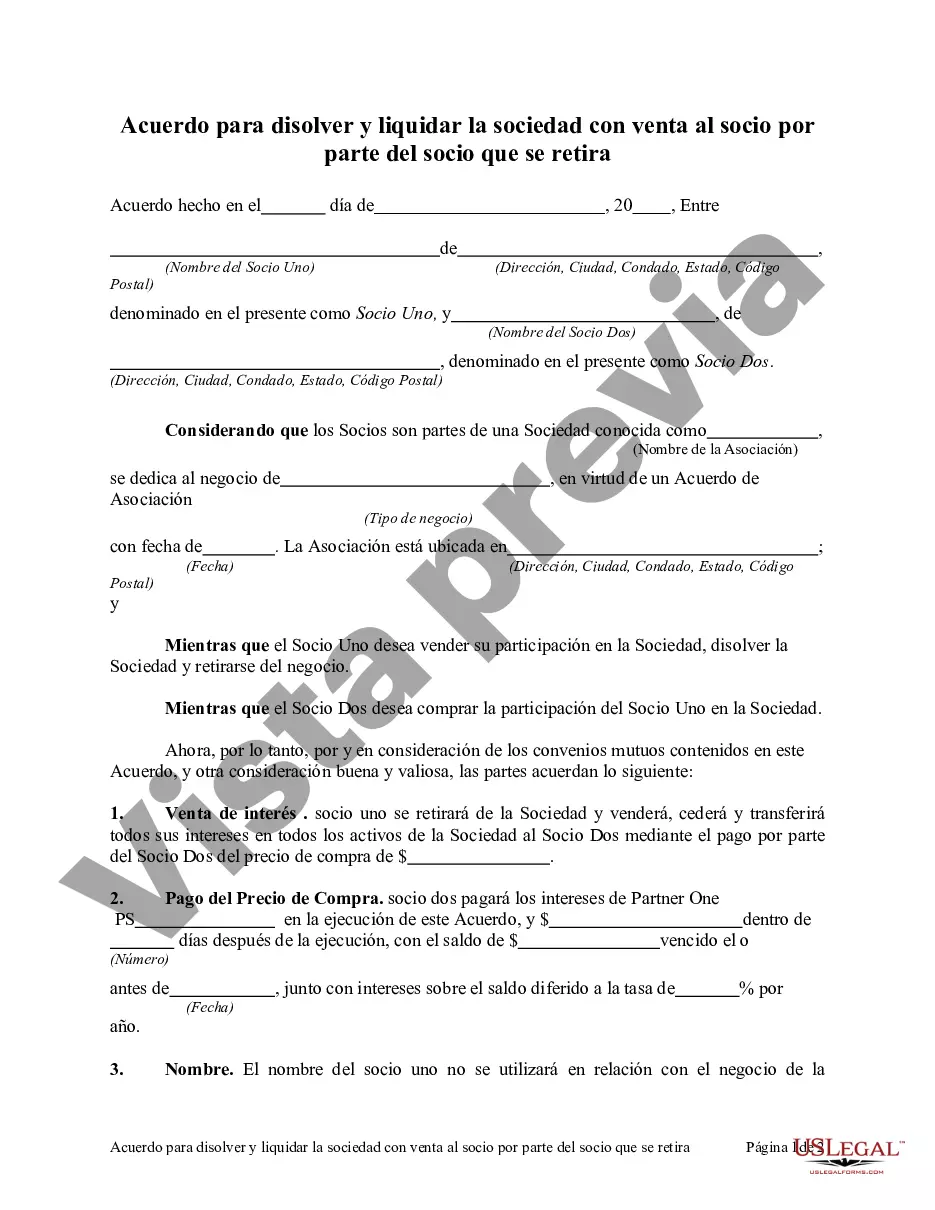

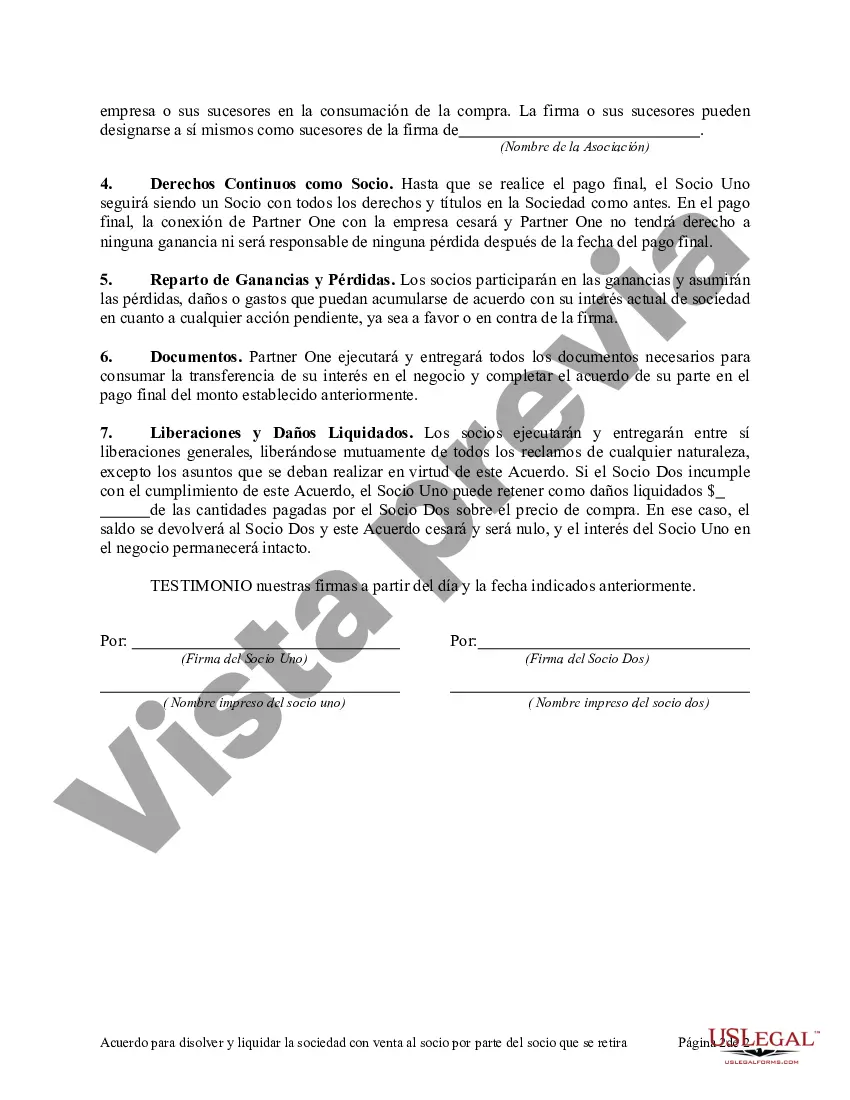

The Suffolk New York Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is a legal document that outlines the process of terminating a partnership and transferring the retiring partner's stake in the business to the remaining partner(s). This agreement is crucial when a partner decides to retire or withdraw from the partnership, ensuring a smooth transition and the fair distribution of assets. 1. Purpose: The purpose of the Suffolk New York Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner is to provide guidelines and terms for dissolving a partnership while allowing the retiring partner to sell their interest to the remaining partner(s). 2. Key elements: This agreement usually includes key elements such as the effective date of the partnership dissolution, the withdrawal notice period, the purchase price for the retiring partner's interest, the terms of payment, and the allocation of partnership assets among the remaining partners. 3. Sale to Partner option: The Suffolk New York Agreement allows the retiring partner to sell their share to the remaining partner(s). This option ensures continuity of the business while providing financial compensation to the retiring partner. 4. Valuation of partnership interest: The agreement may specify how the retiring partner's stake will be valued before the sale. Common methods include using the book value, the fair market value, or a pre-determined formula agreed upon by the partners. 5. Payment terms: The agreement outlines the terms of payment for the retiring partner's share, including whether it will be paid in a lump sum or installments within a specified timeline. It may also address any potential interest rates or collateral requirements if payments are made over time. 6. Asset distribution: The document determines how the partnership's assets and liabilities will be distributed among the remaining partners after the retiring partner's share has been bought out. This process ensures an equitable division of the partnership's resources. 7. Termination of partnership: The agreement provides clarity on the specific details and steps involved in terminating the partnership. This includes canceling any existing contracts, notifying clients and suppliers, settling outstanding debts, and fulfilling any legal obligations or regulatory requirements. 8. Legal implications: The Suffolk New York Agreement is a legally binding document that protects the rights and interests of all parties involved. It prevents potential disputes and sets forth the agreed-upon terms for the successful dissolution of the partnership. Different types of Suffolk New York Agreements to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner may include variations based on the partners' specific circumstances, such as the size and nature of the partnership, the duration of the notice period, and the valuation methods for the retiring partner's interest. However, it is essential to consult with a legal professional specializing in partnership law to ensure compliance with relevant statutes and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Acuerdo para disolver y liquidar la sociedad con venta al socio por parte del socio que se retira - Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

How to fill out Suffolk New York Acuerdo Para Disolver Y Liquidar La Sociedad Con Venta Al Socio Por Parte Del Socio Que Se Retira?

If you need to find a trustworthy legal form provider to obtain the Suffolk Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support make it easy to get and execute various paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply type to search or browse Suffolk Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Suffolk Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, create a real estate agreement, or complete the Suffolk Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner - all from the comfort of your sofa.

Sign up for US Legal Forms now!

Form popularity

FAQ

Articulo 29. - El ingreso o separacion de un socio no impedira que continue la misma razon social hasta entonces empleada; pero si el nombre del socio que se separe apareciere en la razon social, debera agregarse a esta la palabra sucesores.

La disolucion es el acto juridico a traves del cual la sociedad suspende el desarrollo de su actividad social y entra en el proceso para finiquitar su operacion y llegar a la liquidacion final.

- Cuando la razon social de una compania sea la que hubiere servido a otra cuyos derechos y obligaciones han sido transferidos a la nueva, se agregara a la razon social la palabra "sucesores".

¿Como realizar un cambio de una sociedad? Para modificar una sociedad se debera realizar una junta en la cual los socios acuerden modificar los estatutos sociales. En el caso de que todos esten de acuerdo, los socios deberan suscribir una escritura publica de modificacion.

Toda sociedad podra disolverse, entre otras, por las siguientes causales: Por vencimiento del termino de duracion de la sociedad.Por decision de los socios, antes de vencerse el termino de duracion.Disolucion en virtud de causal legal o estatutaria.

La razon social es el nombre o denominacion oficial de una empresa, es decir, es la forma de nombrar a la persona moral, y que permite identificarla de manera inequivoca.

Disolucion de una empresa societaria: Es un procedimiento especial que tiene etapas, primero es el acuerdo de la disolucion que, lo deben adoptar los socios, luego la liquidacion que estara a cargo del o los liquidadores y, finalmente la extincion, acto que se debe inscribir en Registros Publicos.

Cuando una sociedad se disuelve quiere decir que termina su existencia; significa que no va a seguir ejecutando la actividad a la que se dedicaba, pues lo efectos de la disolucion de una sociedad es que no puede volver a ejecutar ninguna clase de actos, excepto los actos necesarios para su inmediata liquidacion.

¿Como se realiza una disolucion? La decision de los socios o accionistas de disolver la sociedad debe ser aprobada en reunion de Junta de Socios o Asamblea de Accionistas, segun sea el caso, de la cual se levantara acta donde conste la modificacion estatutaria adoptada.

En definitiva, la disolucion no deja de ser el fenomeno previo a la liquidacion, pero no es el fin de la sociedad, porque cuando se disuelva, aun conserva su personalidad juridica. En cambio, la liquidacion es la fase final del estado de disolucion y una vez realizada deja de existir la sociedad.