The Harris Texas Agreement for Purchase of Business Assets from a Corporation is a legally binding document used to facilitate the acquisition of business assets from a corporation located in Harris, Texas. This agreement outlines the terms and conditions agreed upon by both the buyer and the corporation to transfer ownership of the specified business assets. Keywords: Harris Texas Agreement, Purchase of Business Assets, Corporation, Harris County, Texas, Acquisition, Ownership Transfer, Terms and Conditions. Different Types of Harris Texas Agreement for Purchase of Business Assets from a Corporation: 1. Asset Purchase Agreement: This type of agreement is commonly used when a buyer only wishes to acquire specific assets of a corporation, such as equipment, inventory, or intellectual property. It ensures that these assets are transferred to the buyer, along with any associated contracts or liabilities. 2. Stock Purchase Agreement: In contrast to an asset purchase agreement, a stock purchase agreement involves the acquisition of the corporation's shares. By purchasing the majority or all of the corporation's stock, the buyer gains control of the entire business entity, including its assets, liabilities, and contracts. 3. Merger or Acquisition Agreement: This agreement outlines the consolidation of two corporations into a single entity. It involves a more comprehensive transfer of ownership, including all business assets, liabilities, contracts, and legal obligations. 4. Due Diligence Agreement: Before entering into a purchase agreement, a due diligence agreement may be signed to allow the buyer to investigate and evaluate the corporation's assets, financial records, contracts, and any potential legal issues. This agreement typically includes confidentiality provisions to protect sensitive information. 5. Non-Compete Agreement: In some cases, a non-compete agreement may be included as part of the purchase agreement. This clause prohibits the corporation or its shareholders from engaging in a similar business within a specified geographic area and for a specific duration after the sale, protecting the buyer's interests. These various types of agreements provide flexibility in structuring the purchase of business assets from a corporation located in Harris, Texas, ensuring a smooth and legally compliant transfer of ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo para la compra de activos comerciales de una corporación - Agreement for Purchase of Business Assets from a Corporation

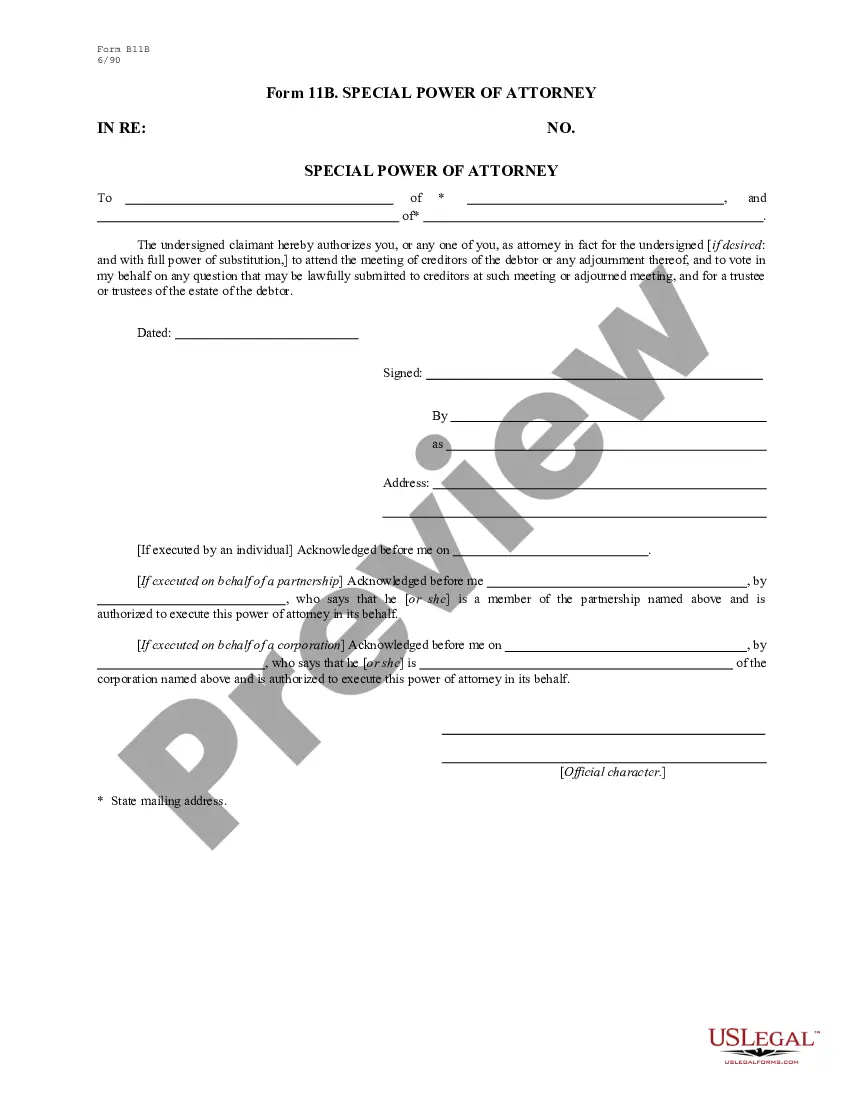

Description

How to fill out Harris Texas Acuerdo Para La Compra De Activos Comerciales De Una Corporación?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and get a document for any individual or business objective utilized in your region, including the Harris Agreement for Purchase of Business Assets from a Corporation.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Harris Agreement for Purchase of Business Assets from a Corporation will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Harris Agreement for Purchase of Business Assets from a Corporation:

- Make sure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Harris Agreement for Purchase of Business Assets from a Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!