Phoenix Arizona Acuerdo para la compra de activos comerciales de una corporación - Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Acuerdo Para La Compra De Activos Comerciales De Una Corporación?

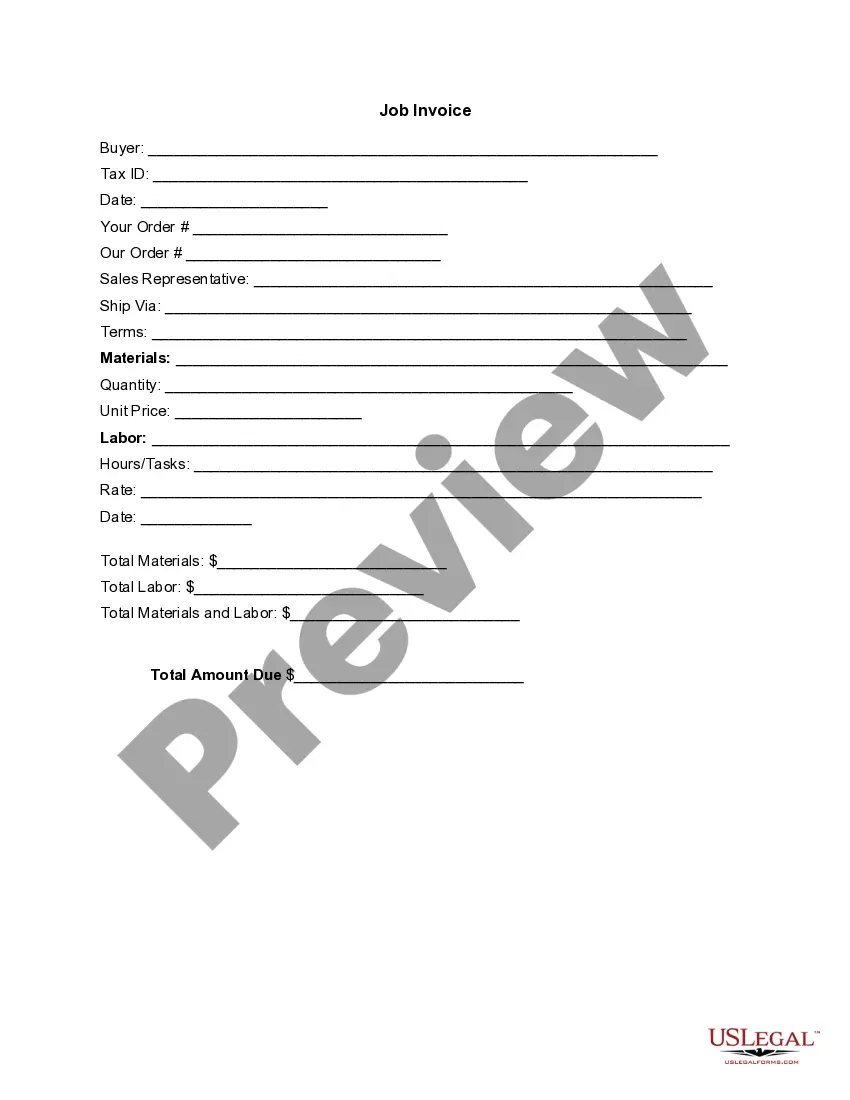

Preparing documentation, such as the Phoenix Agreement for Acquisition of Business Assets from a Corporation, to manage your legal issues is a demanding and time-intensive endeavor. Numerous situations necessitate an attorney’s involvement, which also renders this process costly. However, you can take command of your legal concerns and handle them independently. US Legal Forms is here to assist you. Our platform features over 85,000 legal documents tailored for various situations and life events. We ensure that each document complies with the laws of each state, alleviating your worries about possible legal compliance issues.

If you are accustomed to our offerings and possess a subscription with US, you know how simple it is to obtain the Phoenix Agreement for Acquisition of Business Assets from a Corporation template. Just Log In to your account, download the template, and modify it according to your needs. Have you misplaced your document? No need to fret. You can recover it in the My documents section of your account—accessible on desktop or mobile devices.

The registration process for new users is equally uncomplicated! Here’s what you must do prior to downloading the Phoenix Agreement for Acquisition of Business Assets from a Corporation.

Your document is ready. You can attempt to download it. It’s simple to find and purchase the necessary document with US Legal Forms. Thousands of businesses and individuals are already leveraging our extensive collection. Sign up now if you wish to explore what further advantages you can gain with US Legal Forms!

- Verify that your document corresponds to your state/county since the laws for drafting legal documents may vary from one state to another.

- Obtain additional information about the form by previewing it or reviewing a brief introduction. If the Phoenix Agreement for Acquisition of Business Assets from a Corporation isn’t what you were looking for, utilize the header to search for another option.

- Sign in or create an account to start using our service and download the document.

- Everything appears satisfactory on your side? Press the Buy now button and select a subscription plan.

- Choose the payment processor and input your payment details.

Form popularity

FAQ

Ayuda financiera para pequenos negocios por COVID-19 El Programa de proteccion de pago de salarios (PPP) El Programa de proteccion de pago (PPP, sigla en ingles) termino el 31 de mayo de 2021.Prestamo de desastre por danos economicos (EIDL)Alivio de deuda de la SBA.Subvencion para operadores de lugares cerrados.

En el caso de los prestamos por desastre de la SBA para viviendas y empresas aprobados en 2020, los prestatarios deberan reanudar los pagos regulares de capital e intereses 12 meses despues de la fecha de vencimiento del siguiente pago, de conformidad con los terminos de la autorizacion del prestamo.

La SBA otorga subvenciones a organizaciones comunitarias para ayudar a promover el espiritu empresarial, incluyendo las que apoyan a pequenas empresas propiedad de veteranos y propiedad de veteranos con discapacidad, asi como los Centros de desarrollo de pequenas empresas.

Las 52 ideas de negocio que importar de USA Presentacion de clientes.Day Trading.Hacer encuestas.Negocio de blogs.Vender productos caseros a traves de Internet.Redactar contenidos.Venta de servicios en Internet.Vender productos en un marketplace.

¿Como solicito el financiamiento? Recibe la llamada de la Secretaria de Bienestar o llama a la linea del Bienestar al numero telefonico 800 639 42 64. Llena y firma la Solicitud de Incorporacion a Programas de Desarrollo. Registra tu informacion personal y de tu negocio en la Cedula de Informacion.

Como iniciar una LLC en Arizona Paso 1: Decida un nombre para su LLC de Arizona. Paso 2: Asignar un agente registrado en Arizona. Paso 3: Presentar articulos de organizacion en Arizona. Paso 4: Cumpla con los requisitos de publicacion de Arizona LLC. Paso 5: Cree su acuerdo operativo de LLC de Arizona.

El costo promedio inicial es de $14,000: la mitad de propietarios reporta iniciar su negocio con menos de $5,000. Ademas de contratar a un abogado para que te ayude a registrar el nombre de tu empresa dentro de tu estado, deberas pagar por las licencias y los costos de publicidad (entre $4,000 y $6,000).

La Agencia Federal de Pequenos Negocios de Estados Unidos (SBA, por sus siglas en ingles) se creo en 1953; sigue ayudando a empresarios y duenos de pequenas empresas a perseguir el sueno americano.

Como iniciar una LLC en Arizona Paso 1: Decida un nombre para su LLC de Arizona. Paso 2: Asignar un agente registrado en Arizona. Paso 3: Presentar articulos de organizacion en Arizona. Paso 4: Cumpla con los requisitos de publicacion de Arizona LLC. Paso 5: Cree su acuerdo operativo de LLC de Arizona.

Opciones de pago Vaya a Pay.gov. Busque el formulario de la SBA 1201 Borrower Payment. Envie el pago junto con el formulario 1201, por medio de uno de los siguientes metodos de pago en linea aceptados: cuenta bancaria (ACH, por sus siglas en ingles), cuenta de PayPal, tarjeta de debito.