Harris Texas Lease to Own for Commercial Property is a unique opportunity for aspiring business owners to secure a commercial property without having to make an upfront purchase. This innovative leasing arrangement allows tenants to rent a commercial space with an option to buy it at a later agreed-upon date. Lease to Own agreements offer several benefits for entrepreneurs looking to establish their businesses in Harris County, Texas. One of the primary advantages is the ability to build equity in the property over time while operating the business. Instead of pouring funds into rent payments that yield no ownership benefits, tenants can apply a portion of their monthly dues towards the future purchase of the property. Furthermore, Harris Texas Lease to Own agreements provide tenants with an excellent chance to test the viability of their business before fully committing to property ownership. This option is particularly appealing for startups and businesses entering new markets, as it minimizes financial risks and allows for flexibility during the early stages. There are various types of Harris Texas Lease to Own for Commercial Property, tailored to meet different business needs: 1. Traditional Commercial Lease to Own: This type of agreement works similarly to a standard commercial lease. Tenants are given the option to buy the property at a predetermined price at the end of the lease term. 2. Lease Purchase Agreement: This agreement involves a contractual obligation to purchase the property at the end of the agreed-upon lease period. It differs from the traditional lease to own structure, as tenants have a stronger commitment to buying the property. 3. Lease Option Agreement: In this type of Lease to Own agreement, tenants have the option but not the obligation to buy the property. The purchase price is typically set upfront, ensuring tenants know the exact cost if they decide to exercise the option. When considering Harris Texas Lease to Own for Commercial Property, tenants should carefully review the terms and conditions of each potential agreement. It is advisable to consult with experienced real estate professionals and attorneys to ensure a thorough understanding of the legal and financial aspects involved. Overall, Harris Texas Lease to Own for Commercial Property presents an attractive alternative to traditional buying or renting. It empowers entrepreneurs to establish and grow their businesses while gradually building equity in the property, ultimately leading to ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Arrendamiento con opción a compra para propiedad comercial - Lease to Own for Commercial Property

Description

How to fill out Harris Texas Arrendamiento Con Opción A Compra Para Propiedad Comercial?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Harris Lease to Own for Commercial Property, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any activities associated with document execution straightforward.

Here's how you can locate and download Harris Lease to Own for Commercial Property.

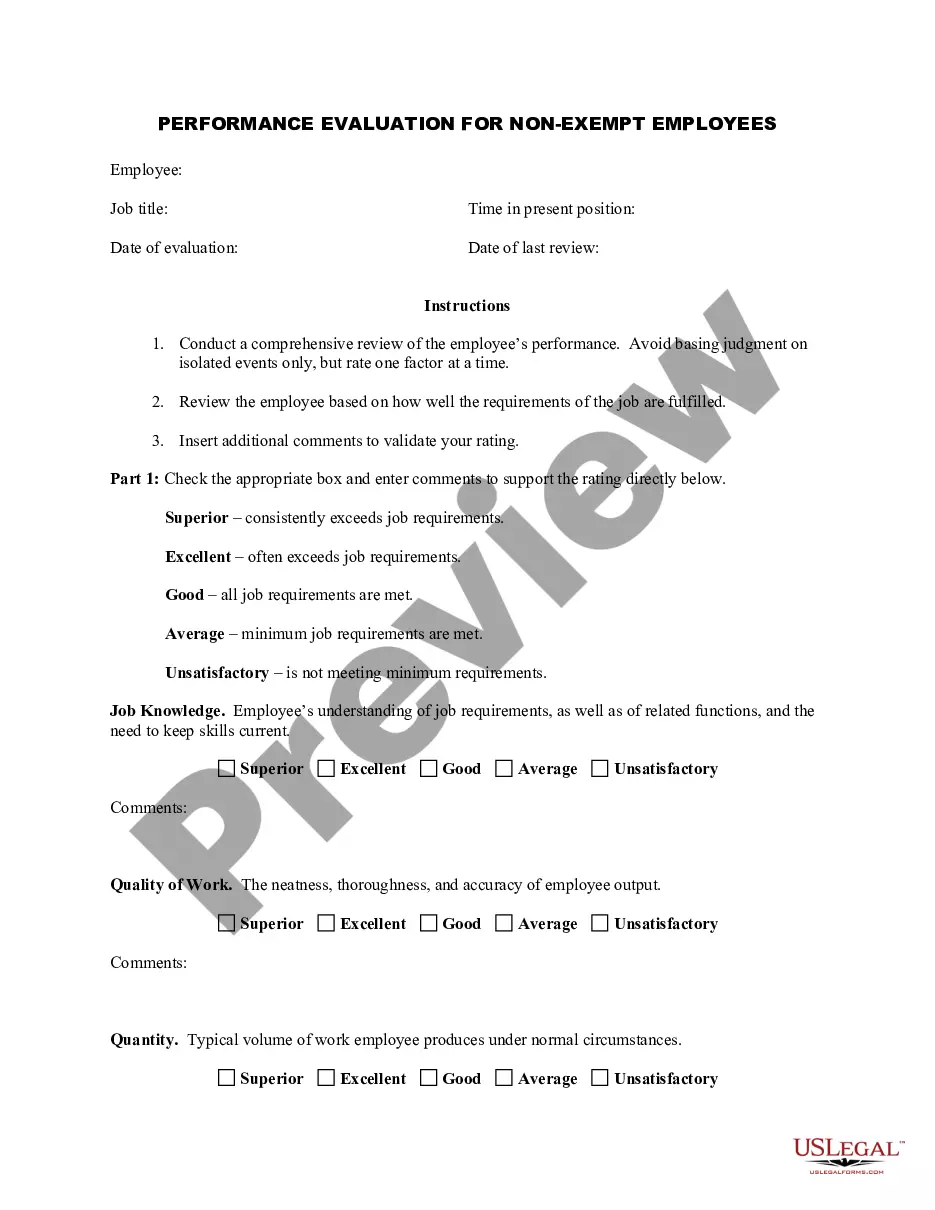

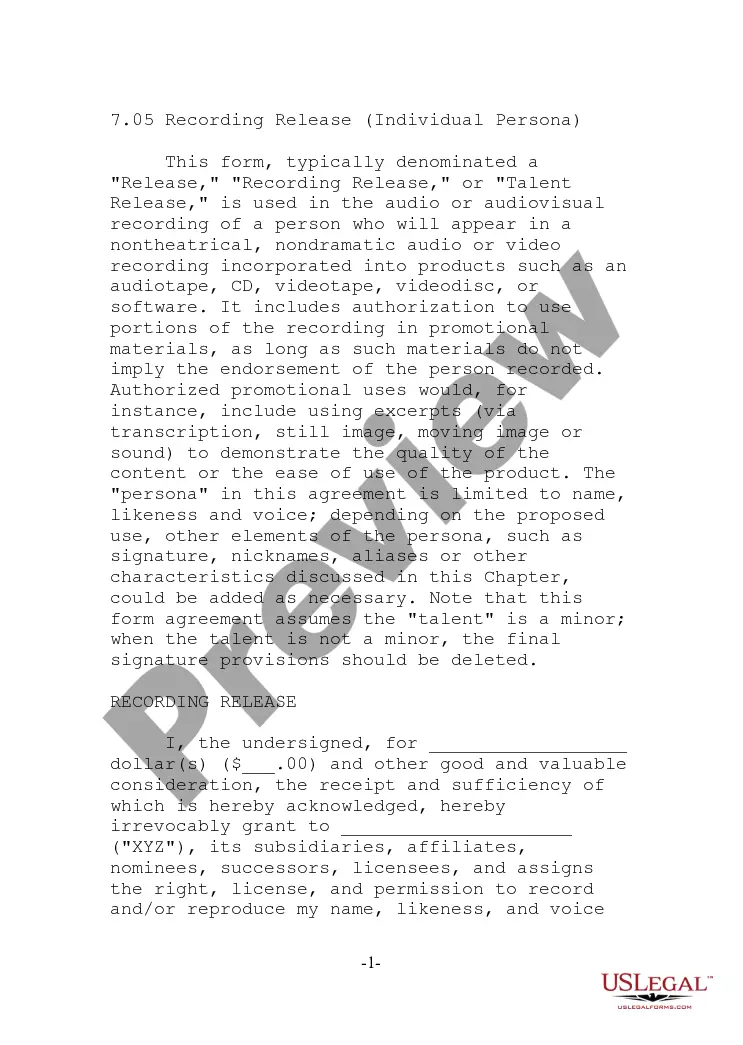

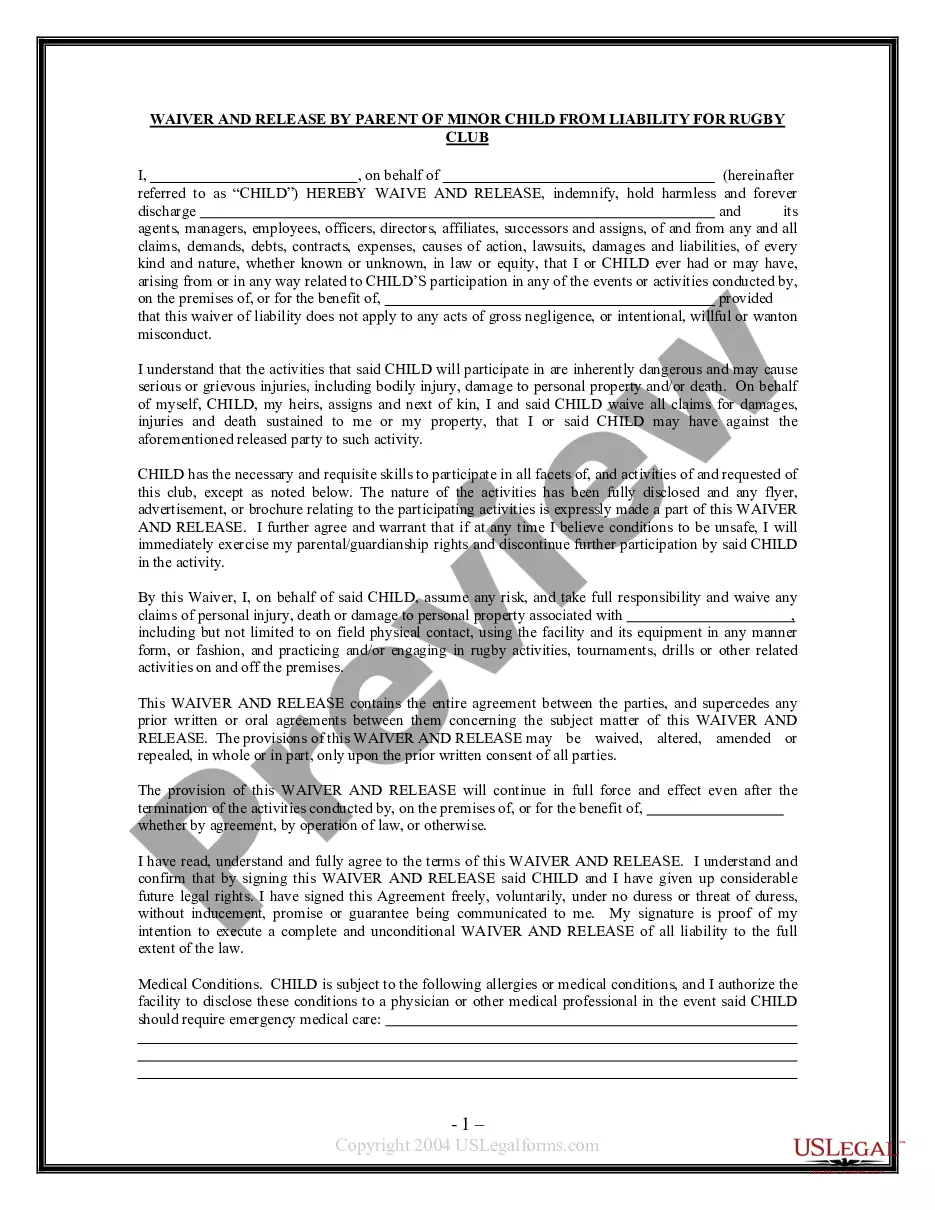

- Take a look at the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can affect the validity of some documents.

- Examine the related document templates or start the search over to find the correct file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and buy Harris Lease to Own for Commercial Property.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Harris Lease to Own for Commercial Property, log in to your account, and download it. Of course, our website can’t replace a lawyer entirely. If you have to cope with an exceptionally complicated situation, we advise getting an attorney to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!