Queens, New York, Sale and Leaseback Agreement for Commercial Building is a legal arrangement commonly used in the commercial real estate market. It involves the sale of a commercial building by the owner to an investor followed by a long-term leaseback of the property by the original owner. In this arrangement, the owner, who needs funds for business expansion or financial liquidity, sells the property while simultaneously entering into a lease agreement with the buyer. The leaseback terms typically extend over a long duration, ranging from 10 to 25 years, depending on the agreement. The Queens, New York, Sale and Leaseback Agreement offers various benefits to both parties involved. For the property owner, it provides an immediate influx of capital that can be reinvested in business operations, debt reduction, or other expansion plans. Meanwhile, allowing them to maintain operational control and continuity without the need for relocation. For the investor, the Sale and Leaseback Agreement provides a secure long-term income stream through lease rental payments. It offers transparency and stability, as the property is typically released to a reliable tenant with an established track record. This makes it an attractive investment option for those looking for a steady return on investment. There are different types of Sale and Leaseback Agreements for Commercial Buildings available in Queens, New York, catering to diverse needs and market conditions: 1. Full Payout Leaseback: This agreement involves the sale of the commercial building at its full market value, providing the highest level of capital injection to the property owner. 2. Net Leaseback: Under this agreement, the property owner not only transfers the ownership but also the responsibility for property taxes, insurance, and maintenance to the buyer. The owner becomes a tenant responsible for lease payments only. 3. Capital Leaseback: This type of agreement is structured like a loan and typically involves a higher lease payment. The property owner retains a buy-back option at the end of the lease term. 4. Synthetic Leaseback: This arrangement is a hybrid of traditional leasing and ownership. It offers tax benefits by treating the lease payments as tax-deductible expenses. Queens, New York, Sale and Leaseback Agreements for Commercial Buildings have gained popularity in recent years due to their flexibility and advantages for both buyers and sellers. However, it's crucial for parties to engage professional legal and financial advisors to ensure a fair and comprehensive agreement that aligns with their specific requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Contrato de Venta y Arrendamiento de Edificio Comercial - Sale and Leaseback Agreement for Commercial Building

Description

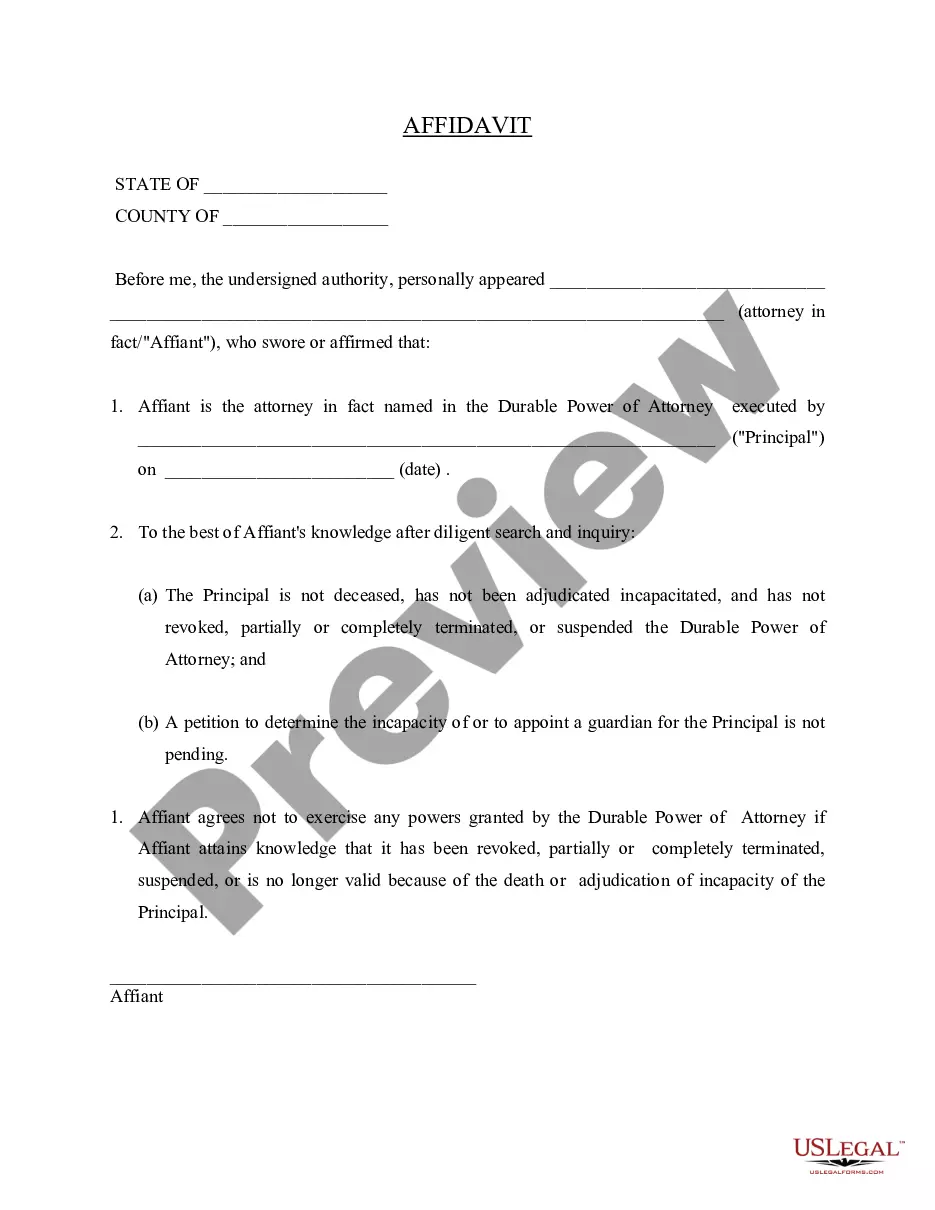

How to fill out Queens New York Contrato De Venta Y Arrendamiento De Edificio Comercial?

If you need to find a trustworthy legal document supplier to find the Queens Sale and Leaseback Agreement for Commercial Building, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, number of supporting resources, and dedicated support make it easy to locate and execute different documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Queens Sale and Leaseback Agreement for Commercial Building, either by a keyword or by the state/county the document is created for. After locating needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Queens Sale and Leaseback Agreement for Commercial Building template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or execute the Queens Sale and Leaseback Agreement for Commercial Building - all from the comfort of your sofa.

Join US Legal Forms now!