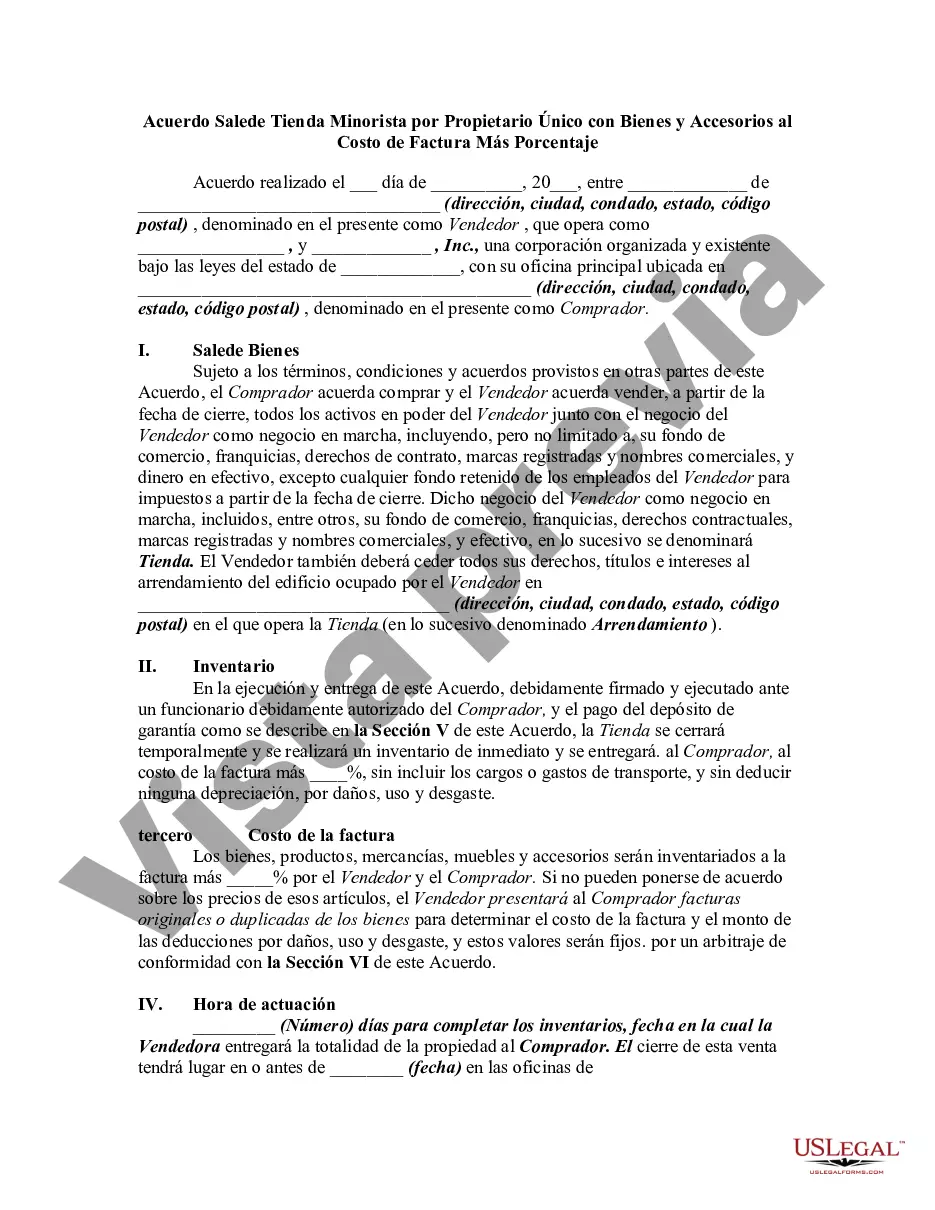

The Alameda, California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage refers to a legal document that outlines the terms and conditions of a retail store sale between a sole proprietor and a purchaser. This agreement specifically involves the transfer of both goods and fixtures from the sole proprietor's retail store to the buyer. In this contractual agreement, the sole proprietor agrees to sell their retail store and its contents, including goods (such as inventory, merchandise, and stock) and fixtures (such as furniture, displays, and equipment), to the purchaser. The purchase price for the store and its items is calculated based on the invoice cost plus a specified percentage agreed upon by both parties. Typically, the invoice cost refers to the original cost incurred by the sole proprietor to acquire the goods and fixtures from suppliers. The agreed-upon percentage added to the invoice cost represents a form of mark-up or profit margin applied to the items being sold. The Alameda, California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may have different variations or categories, depending on specific circumstances or additional features. Some potential types or variations of this agreement could include: 1. Alameda, California Agreement for Sale of Clothing Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: This type of agreement focuses on the sale of a retail store specializing in clothing and apparel. It includes the transfer of clothing inventory, clothing racks, changing rooms, and other related fixtures. 2. Alameda, California Agreement for Sale of Grocery Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: This variant of the agreement pertains to the sale of a grocery store. It involves the transfer of perishable and non-perishable goods, shelving units, coolers, freezers, cash registers, and other relevant fixtures. 3. Alameda, California Agreement for Sale of Electronics Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage: This type of agreement focuses on the sale of an electronics retail store, encompassing the transfer of electronic devices, computer systems, televisions, display units, and other fixtures specific to the electronics industry. It is important to customize the agreement according to the specific nature of the retail store being sold. Using relevant keywords, such as "retail store sale agreement," "sole proprietorship agreement," "invoice cost plus percentage agreement," and "fixtures and goods transfer agreement," will help ensure that the content is accurately aligned with the subject.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Alameda California Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Alameda Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Alameda Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage from the My Forms tab.

For new users, it's necessary to make some more steps to get the Alameda Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage:

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!