The King Washington Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legally binding agreement between a sole proprietor and a buyer for the transfer of a retail store, as well as its goods and fixtures, at a specified cost plus a percentage mark-up. This agreement outlines the terms and conditions of the sale, ensuring a smooth transition of ownership and protecting the rights and responsibilities of both parties involved. Keywords: King Washington Agreement, Sale of Retail Store, Sole Proprietorship, Goods and Fixtures, Invoice Cost, Percentage, Transfer of Ownership, Terms and Conditions, Rights and Responsibilities. Different types of King Washington Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage might include: 1. Standard Agreement: This refers to the typical agreement used for the sale of a retail store, where the sole proprietor transfers the ownership, goods, and fixtures to the buyer at the agreed-upon invoice cost plus a percentage mark-up. 2. Customized Agreement: In some cases, the buyer and the sole proprietor may negotiate specific terms and conditions that deviate from the standard agreement. This type of agreement allows for personalized adjustments to accommodate unique circumstances or preferences. 3. Asset-Specific Agreement: If the retail store being sold has particular assets that are of significant value or require special terms, an asset-specific agreement may be drafted. This agreement would outline the details and conditions of transferring these specific assets, such as high-value equipment or specialized fixtures. 4. Installment Agreement: This type of agreement involves a payment plan where the buyer agrees to pay the total invoice cost plus percentage mark-up in installments over an agreed-upon period. This arrangement allows for flexibility in the payment process, benefiting both parties. 5. Leaseback Agreement: In certain situations, the sole proprietor may choose to lease back the retail store from the buyer after the sale. In this case, a leaseback agreement would be included within the King Washington Agreement, outlining the terms and conditions of the lease arrangement, including rent, duration, and any additional agreements. Remember, it is essential to consult with legal professionals or experts while drafting or finalizing any agreement to ensure compliance with local laws and to protect the interests of both the sole proprietor and the buyer involved in the sale.

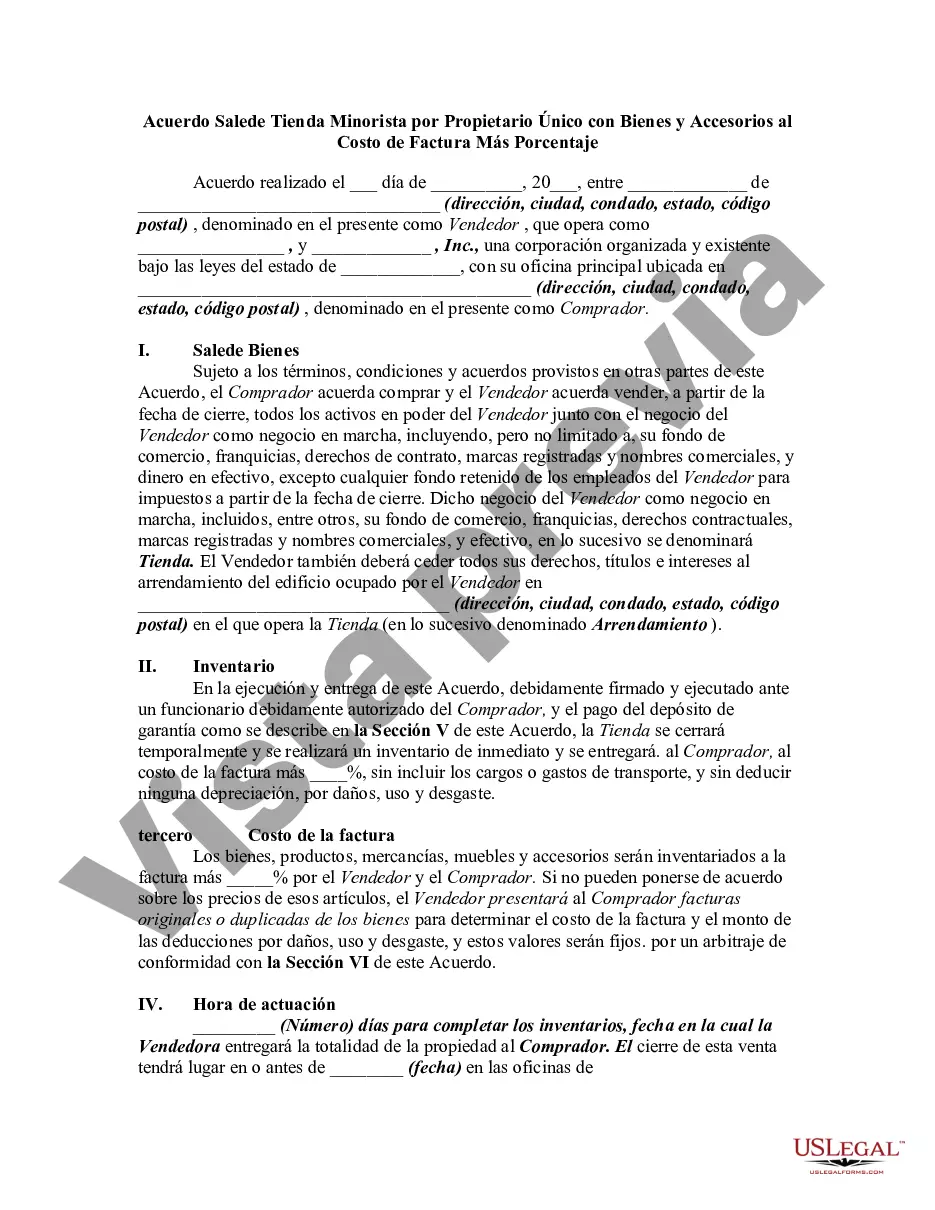

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out King Washington Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare formal documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the King Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the King Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the King Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage:

- Make sure you have opened the proper page with your localised form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the King Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

Interesting Questions

More info

Establish sales & marketing plan. 4. Research customer preferences. 5. Research market location. 6. Plan for a location. 7. Develop an operational plan. 8. Close a location. 9. Close an operation. 10. Acquire a property. 11. Acquire a franchise. 1. Research vehicles and features. 2. Get preapproved for a loan. 3. Establish sales & marketing plan. 4. Research customer preferences. 5. Research market location. 6. Plan for a location. 7. Develop an operational plan. 8. Close a location. 9. Close an operation. 10. Acquire a property. 11. Acquire a franchise. 1. Research vehicles and features. 2. Get preapproved for a loan. 3. Establish sales & marketing plan. 4. Research customer preferences. 5. Research market location. 6. Plan for a location. 7. Develop an operational plan. 8. Close a location. 9. Close an operation. 10. Acquire a property. 11. Acquire a franchise. 1. The largest businesses in Pennsylvania were the following as of the end of calendar-year 2011: 1. ExxonMobil. 2.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.