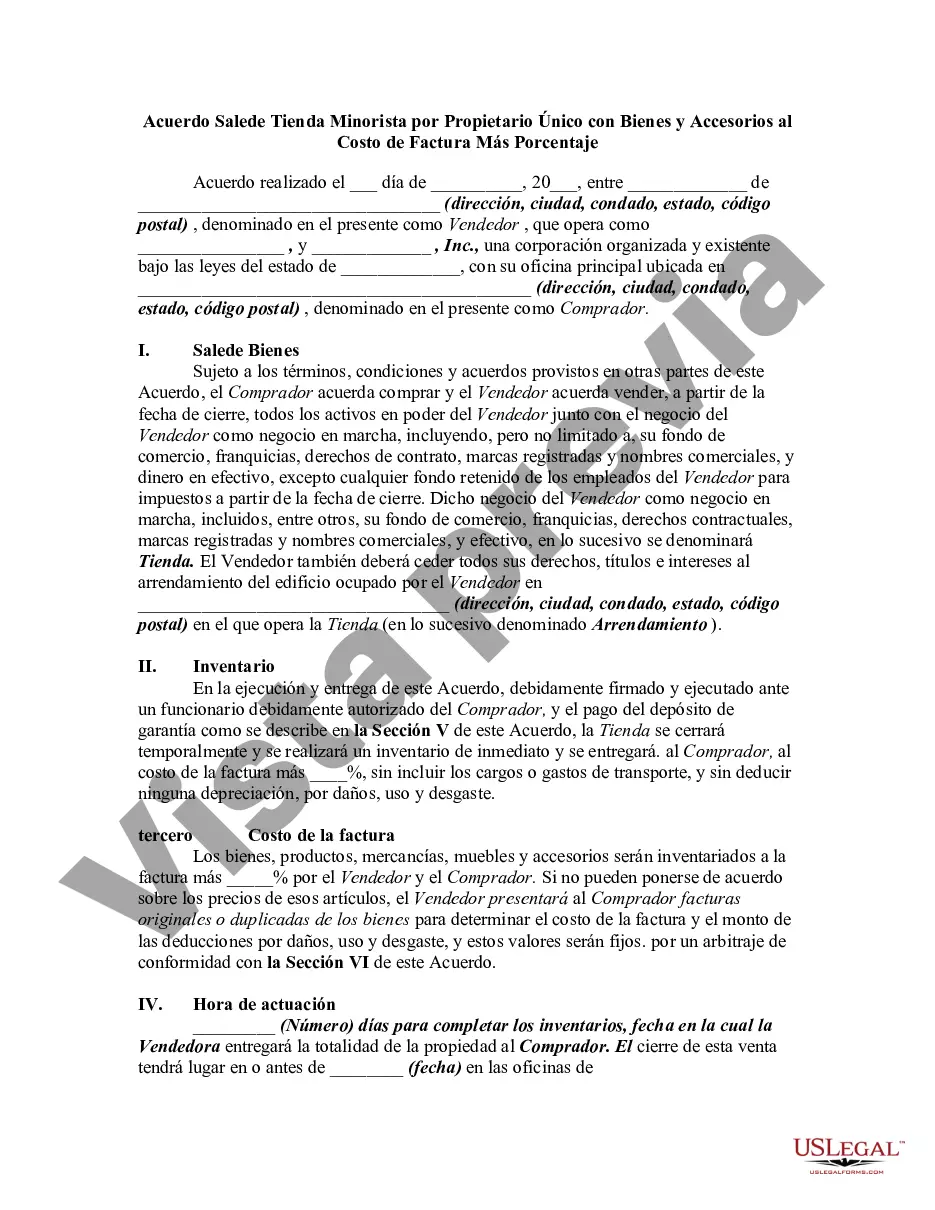

Los Angeles California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that outlines the terms and conditions for the sale of a retail store by a sole proprietorship in Los Angeles, California. This comprehensive agreement ensures that all parties involved are protected and have a clear understanding of their rights and obligations. The Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage contains various sections, each addressing crucial aspects of the transaction. It includes details about the parties involved, the purchase price and payment terms, the transfer of ownership, and any warranties or guarantees provided. This agreement also outlines the inventory and fixtures included in the sale, specifying that they will be sold at the invoice cost plus a percentage. The buyer is responsible for verifying the accuracy of the inventory and fixtures, and the agreement may include provisions allowing for adjustments if discrepancies are discovered. Some additional types of Los Angeles California Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may include: 1. Asset Purchase Agreement: This type of agreement focuses on the sale of specific assets of the retail store, such as inventory, equipment, and fixtures. The agreement may exclude the transfer of liabilities and contracts associated with the business. 2. Stock Purchase Agreement: Instead of selling individual assets, this agreement facilitates the purchase of the sole proprietorship as a whole, including all assets, liabilities, and contracts. The buyer becomes the new owner of the business, including all its obligations and potential liabilities. 3. Installment Sale Agreement: In some cases, the buyer may not be able to provide the full purchase price upfront. This agreement allows for a structured payment plan, where the buyer makes regular installments over a specified period. 4. Lease Purchase Agreement: This type of agreement combines the sale of the retail store with a lease arrangement. The buyer purchases the assets of the business while simultaneously signing a lease agreement with the seller to lease the premises where the retail store operates. It is important to note that these additional types of agreements may require specific clauses or provisions depending on the nature of the transaction. To ensure legal compliance and maximum protection for all parties involved, seeking the advice of legal professionals experienced in business transactions is highly recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Los Angeles California Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life scenario, finding a Los Angeles Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. Apart from the Los Angeles Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Los Angeles Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Los Angeles Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!