San Antonio, Texas is a vibrant city known for its rich history, diverse culture, and thriving business community. In this bustling city, the Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that facilitates the transfer of ownership of a retail store from a sole proprietor to a potential buyer. The agreement outlines the terms and conditions under which the sale will take place. It includes detailed information about the retail store, its fixtures, and the goods that will be included in the sale. The purchase price is calculated based on the invoice cost of the goods, along with an additional percentage agreed upon by both parties. There are several types of San Antonio, Texas Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage, including: 1. General Retail Store Agreement: This type of agreement is applicable to a wide range of retail stores, such as clothing boutiques, electronics shops, and gift stores. It covers the sale of goods, fixtures, and all necessary assets for the operation of the store. 2. Food and Beverage Retail Store Agreement: Specifically designed for restaurants, cafés, and other food-related businesses, this agreement addresses the sale of kitchen equipment, furniture, and inventory pertaining to food and beverages. 3. Specialty Retail Store Agreement: Unique retail stores, such as antique shops, art galleries, or specialty stores, require tailored agreements. This type of agreement addresses any specific characteristics or requirements of the particular retail store. 4. Clothing Retail Store Agreement: Fashion boutiques, apparel stores, and clothing chains may have specific clauses within their agreement to cover specialized fixtures, like clothing racks, mannequins, and display units. 5. Electronics Retail Store Agreement: For businesses specializing in electronics, such as computer stores or consumer electronics retailers, this agreement may include provisions for the sale of various electronics, including computers, televisions, and audio systems. It is important to remember that the specifics of the Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage may vary depending on the nature of the retail store and the negotiations between the buyer and seller. It is recommended to consult with a legal professional familiar with local laws and regulations to ensure the agreement aligns with San Antonio, Texas legal requirements.

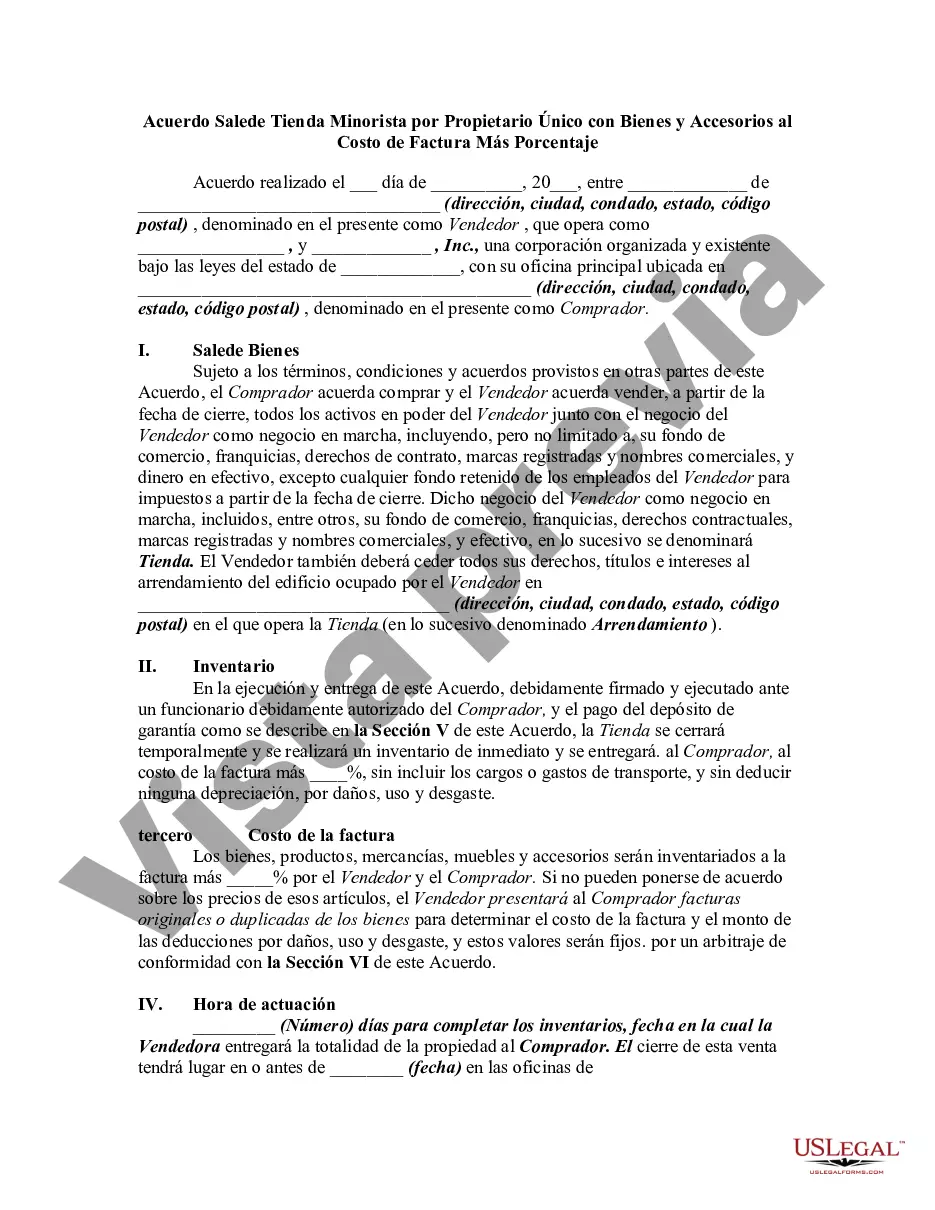

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo para la Venta de Tienda Minorista por Propietario Único con Bienes y Accesorios al Costo de Factura Más Porcentaje - Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out San Antonio Texas Acuerdo Para La Venta De Tienda Minorista Por Propietario Único Con Bienes Y Accesorios Al Costo De Factura Más Porcentaje?

Do you need to quickly create a legally-binding San Antonio Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage or probably any other document to take control of your own or corporate affairs? You can select one of the two options: contact a professional to write a legal document for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including San Antonio Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- First and foremost, carefully verify if the San Antonio Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is adapted to your state's or county's laws.

- If the document comes with a desciption, make sure to verify what it's intended for.

- Start the search again if the document isn’t what you were hoping to find by using the search box in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the San Antonio Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. In addition, the documents we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!