Description: The Montgomery Maryland Resolution Selecting Bank for Corporation and Account Signatories is a crucial corporate resolution that outlines the process of choosing a bank for a corporation's financial transactions and designating authorized signatories for the company's accounts. This resolution plays a vital role in ensuring smooth financial operations and ensuring compliance with banking regulations. There are different types of Montgomery Maryland Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions. These include: 1. General Resolution: This type of resolution is typically used when selecting a bank for routine banking needs, such as opening a corporate checking account or maintaining existing accounts. It specifies the bank's name and details the authorization process for the appointed signatories. 2. Loan Resolution: In some cases, corporations may need to secure loans or lines of credit from financial institutions. A Loan Resolution specifies the bank or lending institution selected for such purposes and assigns authorized signatories to manage the borrowing transactions. 3. Investment Resolution: This resolution is specific to corporations looking to invest surplus funds, make strategic investments, or establish investment accounts. It outlines the bank chosen for investment-related activities and defines the signatory authority for these transactions. 4. Real Estate Resolution: When a corporation intends to purchase or sell real estate properties, a Real Estate Resolution is necessary. It identifies the bank involved in mortgage financing, escrow services, or any other financial transactions related to real estate, along with the authorized signatories involved. Each type of Montgomery Maryland Resolution Selecting Bank for Corporation and Account Signatories ensures the corporation's financial interests are safeguarded by considering factors such as the bank's reputation, financial stability, service offerings, fees, and convenience. Additionally, these resolutions require the company's management to nominate individuals within the organization to act as authorized signatories on behalf of the corporation. These signatories are responsible for conducting financial transactions, signing checks, authorizing wire transfers, and accessing corporate accounts as per the designated banking relationship. In summary, the Montgomery Maryland Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions are critical documents that guide corporations in choosing the right banks and appointing authorized individuals to manage their financial affairs. These resolutions ensure effective financial operations, regulatory compliance, and protection of the corporation's financial interests.

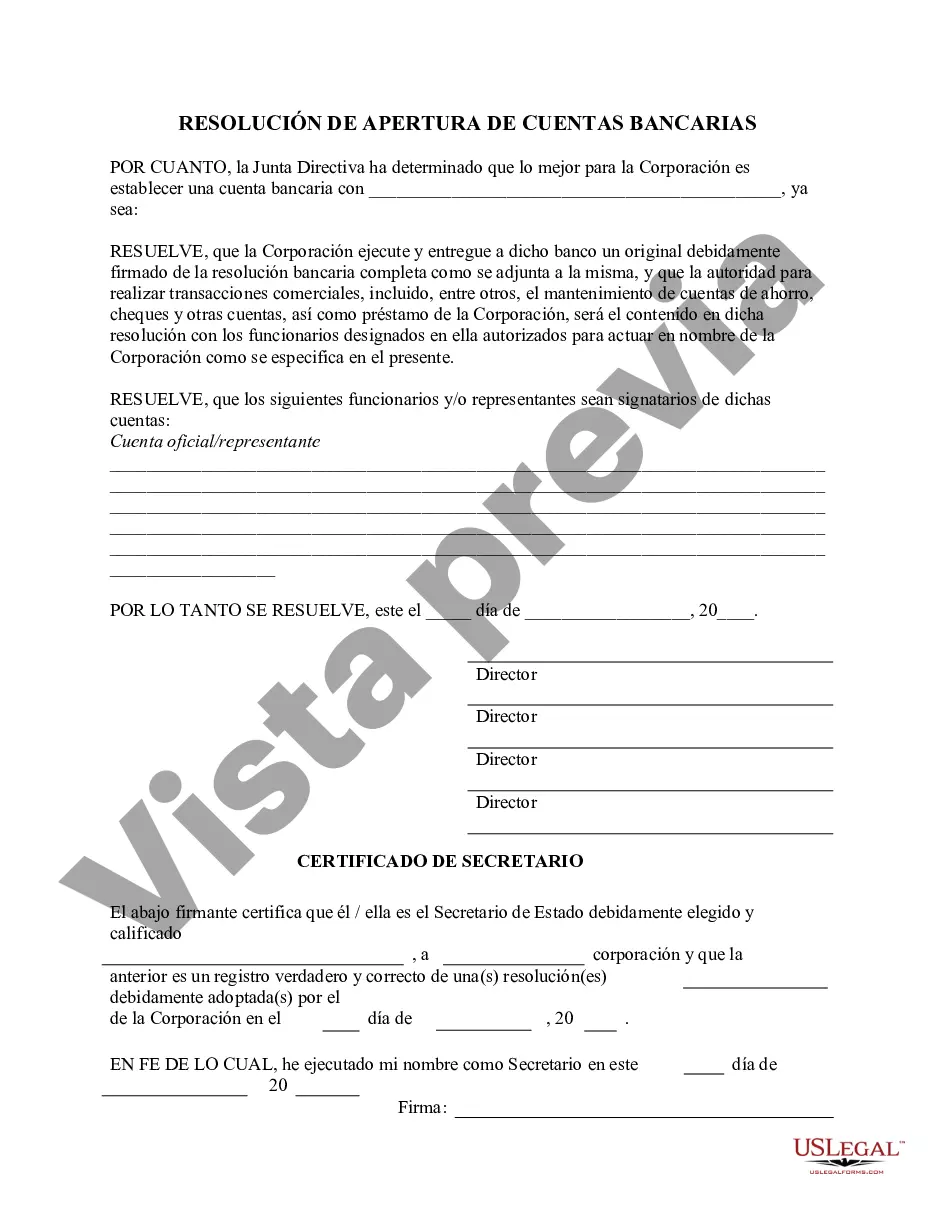

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Resolución de Selección de Banco para Sociedades Anónimas y Signatarios de Cuentas - Resoluciones Corporativas - Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out Montgomery Maryland Resolución De Selección De Banco Para Sociedades Anónimas Y Signatarios De Cuentas - Resoluciones Corporativas?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Montgomery Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Montgomery Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Montgomery Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions:

- Ensure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Montgomery Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!