Title: Phoenix Arizona Resolution: Selecting Bank for Corporation and Account Signatories — Corporate Resolutions Keywords: Phoenix Arizona, resolution, selecting bank, corporation, account signatories, corporate resolutions. Introduction: In Phoenix, Arizona, businesses often need to select banks and appoint account signatories through resolutions. These corporate resolutions are crucial for streamlining financial operations and ensuring effective banking practices. In this article, we will discuss the importance of Phoenix Arizona Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions, along with different types of resolutions that may be required. 1. Significance of Phoenix Arizona Resolution Selecting Bank for Corporation and Account Signatories: When starting or operating a corporation in Phoenix, Arizona, it is essential to pass a resolution selecting a bank and appointing account signatories. This resolution serves as an official record and authorization for the corporation's financial transactions. It outlines the processes and individuals responsible for managing corporate finances, maintaining proper accountability and compliance. 2. Types of Phoenix Arizona Resolution Selecting Bank for Corporation and Account Signatories: Common types of resolutions related to selecting banks and account signatories include: a. Bank Selection Resolution: This resolution is passed by the corporation's board of directors or shareholders, selecting a bank or financial institution where the corporation's accounts will be opened. It considers factors such as banking services, fees, accessibility, and reputation, ensuring a suitable banking partner for the corporation. b. Account Signatory Appointment Resolution: Once the bank has been selected, this resolution appoints individuals as authorized signatories for the corporation's accounts. It outlines their roles, responsibilities, and limitations in managing the corporation's financial transactions. It is crucial to specify the number of required signatures for various types of transactions and clarify any threshold amounts requiring additional approvals. c. Account Signatory Update Resolution: This resolution is necessary when there is a need to add or remove account signatories due to changes in personnel or organizational structure. It ensures that the corporation's banking relationships remain up-to-date, reflecting accurate authorization of individuals responsible for financial decision-making. d. Bank Relationship Review Resolution: Periodically, corporations may pass resolutions to review their banking relationships and assess whether a change in banks or account signatories is necessary. This resolution facilitates the evaluation of existing banking services, fees, or changes in the corporation's needs, ensuring optimal banking arrangements. Conclusion: Selecting a bank for a corporation and determining account signatories through proper resolutions is vital for effective financial management, transparency, and accountability. Phoenix Arizona Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions serve as legal documents authorizing financial actions and protecting corporate interests. By understanding the various types of resolutions involved, corporations can ensure they have sound banking relationships and reliable individuals managing their financial affairs in Phoenix, Arizona.

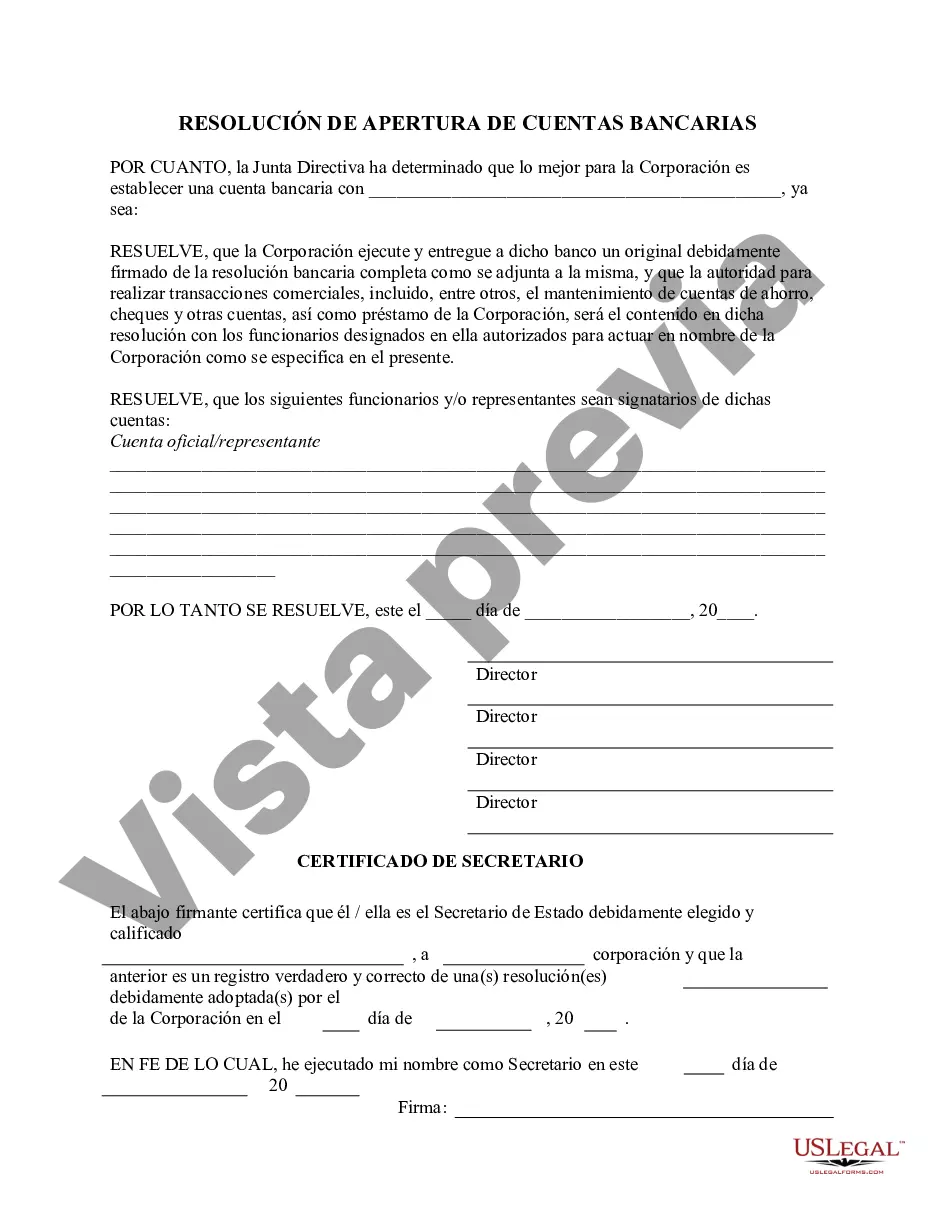

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Resolución de Selección de Banco para Sociedades Anónimas y Signatarios de Cuentas - Resoluciones Corporativas - Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out Phoenix Arizona Resolución De Selección De Banco Para Sociedades Anónimas Y Signatarios De Cuentas - Resoluciones Corporativas?

If you need to get a trustworthy legal form provider to get the Phoenix Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can select from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting resources, and dedicated support make it simple to locate and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Phoenix Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions, either by a keyword or by the state/county the form is intended for. After finding the needed form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Phoenix Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Phoenix Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions - all from the comfort of your home.

Sign up for US Legal Forms now!