San Jose California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions play a crucial role in determining the banking partner and account signatories for corporations based in San Jose, California. These resolutions are important for establishing financial relationships and managing banking operations for corporations operating in the city. Here is a detailed description of what the San Jose California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions entails, along with possible variations: 1. Purpose: The San Jose California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions serves the purpose of authorizing the corporation's board of directors to select a bank as the official financial institution and determine the authorized individuals who are authorized to sign on the corporation's bank accounts. 2. Bank Selection: This resolution outlines the process by which the corporation's board of directors evaluates and selects a bank for the corporation. It may involve factors such as reputation, services offered, proximity to the corporation's location, financial stability, fees, and access to technology-driven banking solutions. 3. Account Signatories: The resolution identifies the authorized signatories for the corporation's bank accounts. The board of directors determines the individuals who are authorized to sign on behalf of the corporation and conduct financial transactions, including depositing or withdrawing funds, issuing checks, initiating wire transfers, and accessing online banking platforms. 4. Variation 1: Type of Corporation: Depending on the type of corporation established in San Jose, California, such as a sole proprietorship, partnership, limited liability company (LLC), or a publicly traded company, the resolutions may differ in terms of the decision-making process and the level of authorization and scrutiny required. 5. Variation 2: Corporate Bylaws: The resolutions may also be influenced by the corporation's specific bylaws, which are internal operating rules and regulations. The bylaws may determine the protocol for selecting a bank and the procedure for designating account signatories, adding a layer of customization and complexity to the resolutions. 6. Voting and Approval Process: The resolution should outline the voting and approval process within the corporation's board of directors. It indicates the minimum number of directors required to approve or reject the selection of the bank and the appointment of account signatories. Additionally, it may specify whether the resolution needs to be approved by a majority or a super majority of directors. 7. Documentation and Execution: Upon approval, the resolution should be properly documented, signed, and notarized by the authorized representatives of the corporation. This ensures the validity and enforceability of the resolution and facilitates future interactions with the chosen bank. In conclusion, the San Jose California Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions are essential for corporations in San Jose to establish banking relationships and designate authorized individuals for financial transactions. Variations may exist depending on the type of corporation and its bylaws, and the resolution should be properly documented for future reference and compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Resolución de Selección de Banco para Sociedades Anónimas y Signatarios de Cuentas - Resoluciones Corporativas - Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out San Jose California Resolución De Selección De Banco Para Sociedades Anónimas Y Signatarios De Cuentas - Resoluciones Corporativas?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create San Jose Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid San Jose Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Jose Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions:

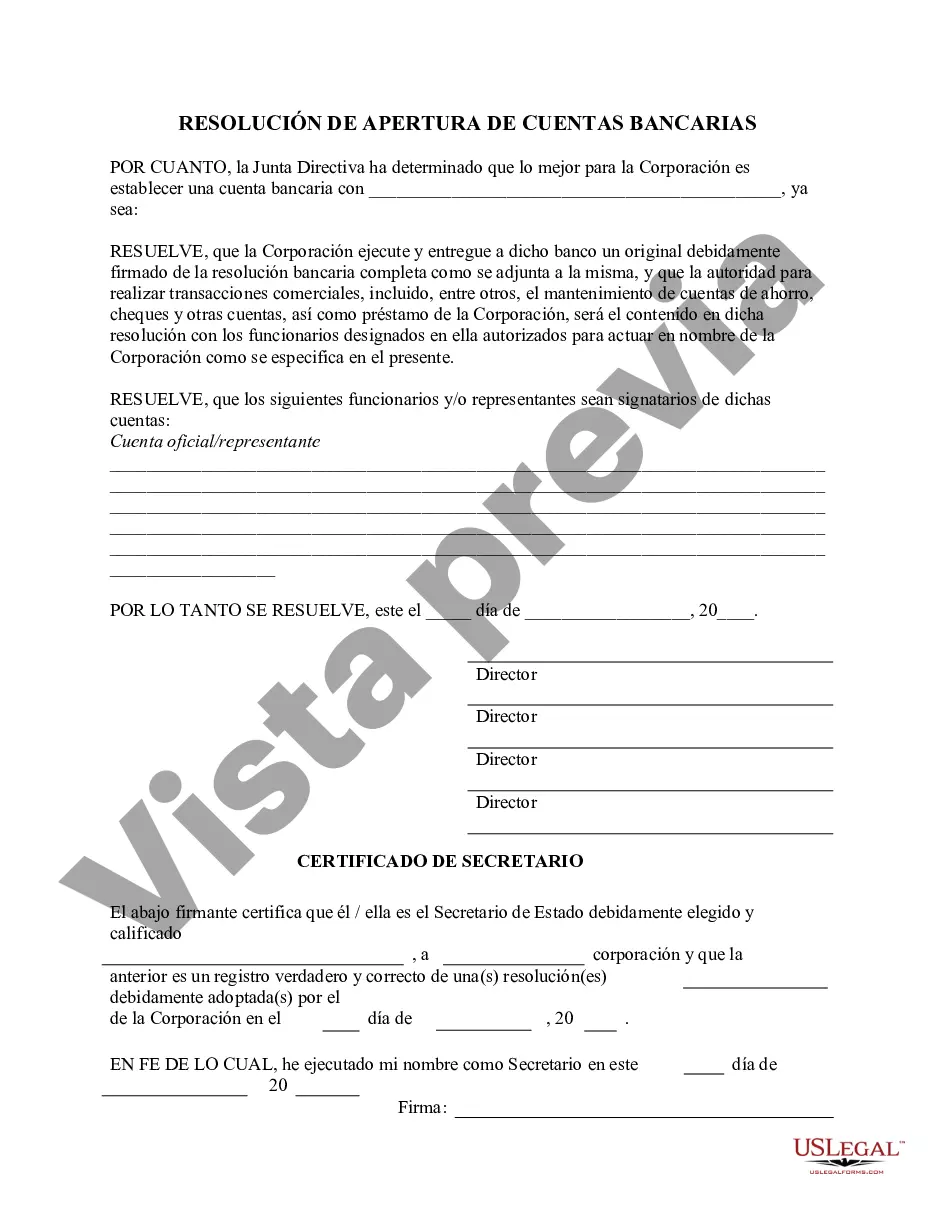

- Look through the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!