Lima, Arizona General Form of Receipt is an official document commonly used for recording and acknowledging the receipt of goods or services in the town of Lima, located in Graham County, Arizona. This multipurpose receipt form is designed to encompass a wide range of transactions, including sales, rentals, payments, donations, and more. The Lima, Arizona General Form of Receipt typically includes several essential elements to ensure accuracy and transparency in documenting the transaction. These elements may consist of: 1. Heading: The header of the receipt may include the name of the business or organization issuing the receipt, along with its contact information such as address, phone number, and website if applicable. 2. Receipt Number: Each receipt is assigned a unique identifier, usually displayed prominently at the top or in a designated area. This number helps in tracking and referencing the receipt for future purposes. 3. Date and Time: The exact date and time of the transaction are recorded on the receipt, ensuring a chronological record. 4. Description of Goods/Services: This section outlines the details of the transaction. It includes a comprehensive description of the goods sold or services rendered, mentioning the quantity, unit price, any discounts or taxes applied, and the total amount due. 5. Payment Details: The payment segment captures the mode of payment utilized, whether it's cash, credit/debit card, check, or any other form. It may also include information related to partial payments, paid installments, or any outstanding balance. 6. Customer/Receiver Information: The receipt may incorporate fields to record the customer or receiver's personal details, including their name, address, email, and phone number. 7. Seller/Issuer Information: This section lists the name and contact details of the seller or issuer of the receipt. It may also include the company's logo or branding elements for added professionalism. 8. Terms and Conditions: In some cases, the receipt may specify certain terms and conditions that govern the transaction, such as return policies, warranties, or disclaimers. While the Lima, Arizona General Form of Receipt is comprehensive enough to cover various transactions, it can also be adapted or customized to cater to specific needs. Some examples of specific Lima, Arizona General Form of Receipt variations include: 1. Lima, Arizona Rental Receipt: This type of receipt is used specifically for rental transactions, such as properties, vehicles, equipment, or tools. 2. Lima, Arizona Sales Receipt: Designed explicitly for product sales, this receipt variation emphasizes the items purchased, their quantities, prices, and any applicable taxes or discounts. 3. Lima, Arizona Donation Receipt: Used extensively by charitable organizations, this receipt distinguishes itself by highlighting the tax-deductible nature of the donation and any specific requirements for claiming deductions. It is crucial to ensure that the Lima, Arizona General Form of Receipt adheres to any local or state regulations and includes all relevant details required for legal and financial purposes.

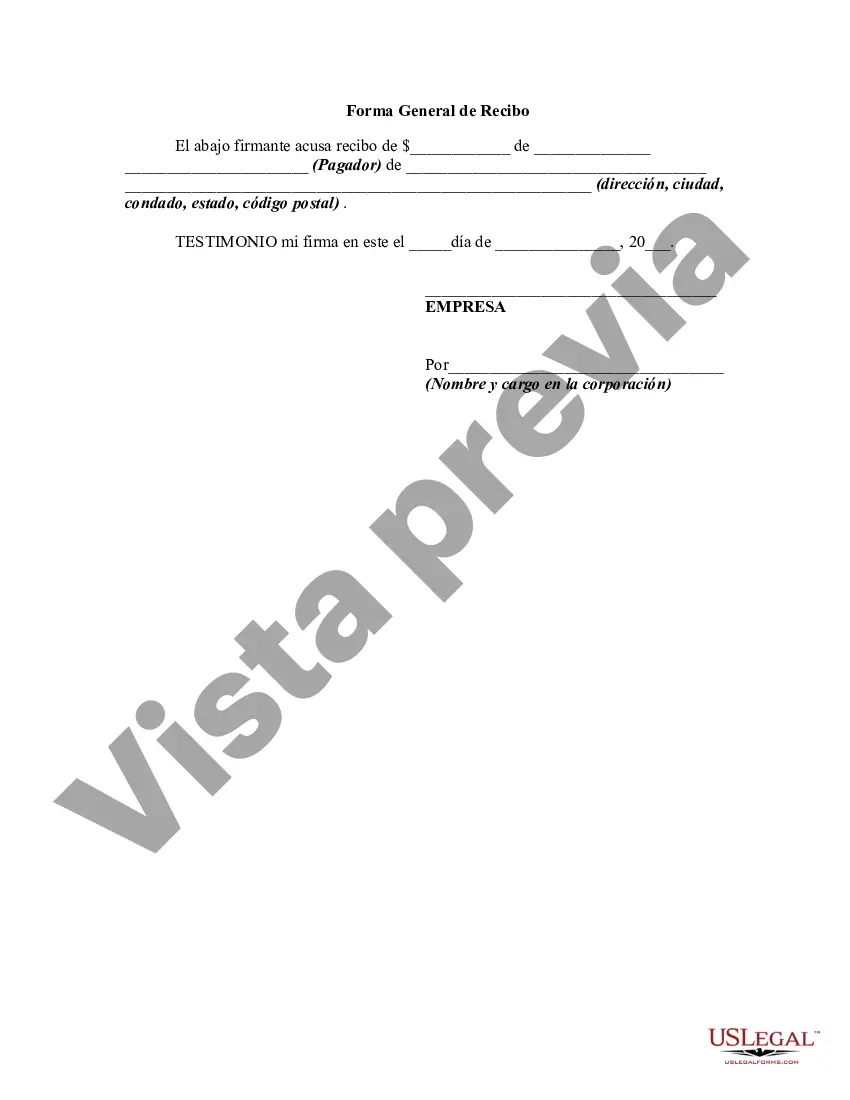

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Forma General de Recibo - General Form of Receipt

Description

How to fill out Pima Arizona Forma General De Recibo?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Pima General Form of Receipt, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed materials and guides on the website to make any activities related to document execution simple.

Here's how you can locate and download Pima General Form of Receipt.

- Go over the document's preview and description (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the similar document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Pima General Form of Receipt.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Pima General Form of Receipt, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer completely. If you have to deal with an extremely difficult situation, we recommend getting an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!