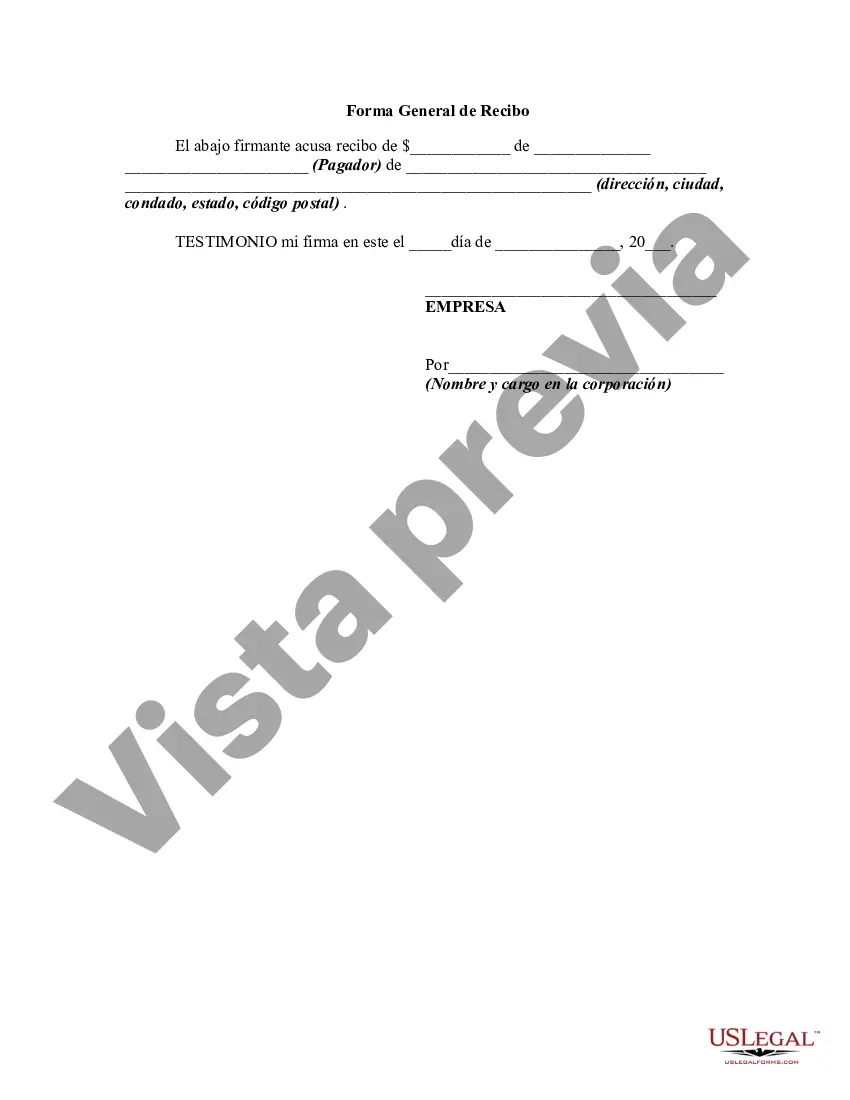

San Jose, California General Form of Receipt is a legal document used in the city of San Jose to acknowledge the receipt of payments or any other type of transaction. It serves as proof of payment and outlines essential details related to the transaction. Here is a detailed description of what the San Jose, California General Form of Receipt entails: 1. Header: The receipt starts with a header, including the official name of the business or organization issuing the receipt, their contact information such as address, phone number, and email address, and the receipt number for reference. 2. Date: The date of the transaction is mentioned prominently to indicate when the receipt was issued. 3. Payment Details: This section provides a breakdown of the payment received. It includes the amount paid, payment method (cash, credit card, check, etc.), and the purpose of payment (e.g., product purchase, service rendered). 4. Description: A detailed description of the goods or services received is mentioned to ensure clarity for both parties involved. It may include the quantity, item name, unit price, applicable taxes, or any other relevant information. 5. Taxes and Discounts: If applicable, taxes (state, local, sales tax, etc.) are mentioned separately in this section. Any discounts or promotional offers applied are also indicated, along with the corresponding deduction from the total payment. 6. Total Amount: The grand total paid by the customer is displayed clearly, including any taxes or discounts applied. 7. Customer Information: This part collects essential customer information, such as their name, address, phone number, and email address. If the receipt is part of a business transaction, the buyer's company name and address may also be included. 8. Authorized Signatures and Stamps: The receipt should include sections for both the customer's and the issuer's signatures. Additionally, an official stamp or seal may be present, confirming the authenticity of the receipt. Different types of San Jose, California General Form of Receipt may exist, depending on the specific industry or purpose. For example: 1. Retail Receipt: Used by businesses selling products to customers, including details of purchased items, prices, and any applicable taxes. 2. Service Receipt: Issued by service-based businesses, it outlines the services provided, time spent, hourly rates, and any additional charges or fees. 3. Rental Receipt: Used in scenarios where a property or equipment is rented out, it includes duration, rental fees, security deposit information, and any penalties or damages incurred. 4. Donation Receipt: For nonprofit organizations, this type of receipt is given to donors, detailing their contribution towards a cause, with necessary tax-exempt information. In conclusion, the San Jose, California General Form of Receipt is a comprehensive document capturing payment details and transaction specifics. Various industries may utilize different types of receipts tailored to their specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Forma General de Recibo - General Form of Receipt

Description

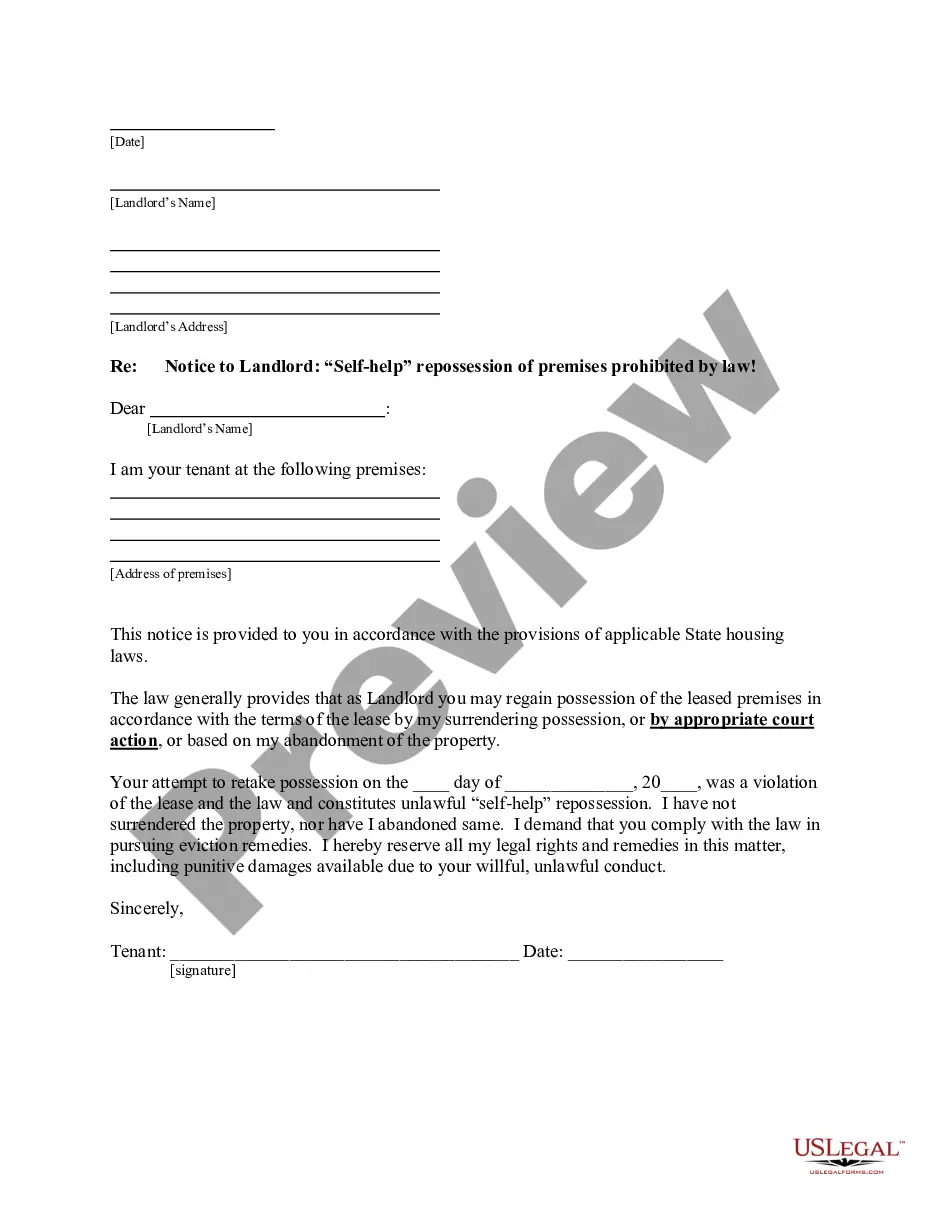

How to fill out San Jose California Forma General De Recibo?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Jose General Form of Receipt, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the current version of the San Jose General Form of Receipt, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the San Jose General Form of Receipt:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your San Jose General Form of Receipt and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!