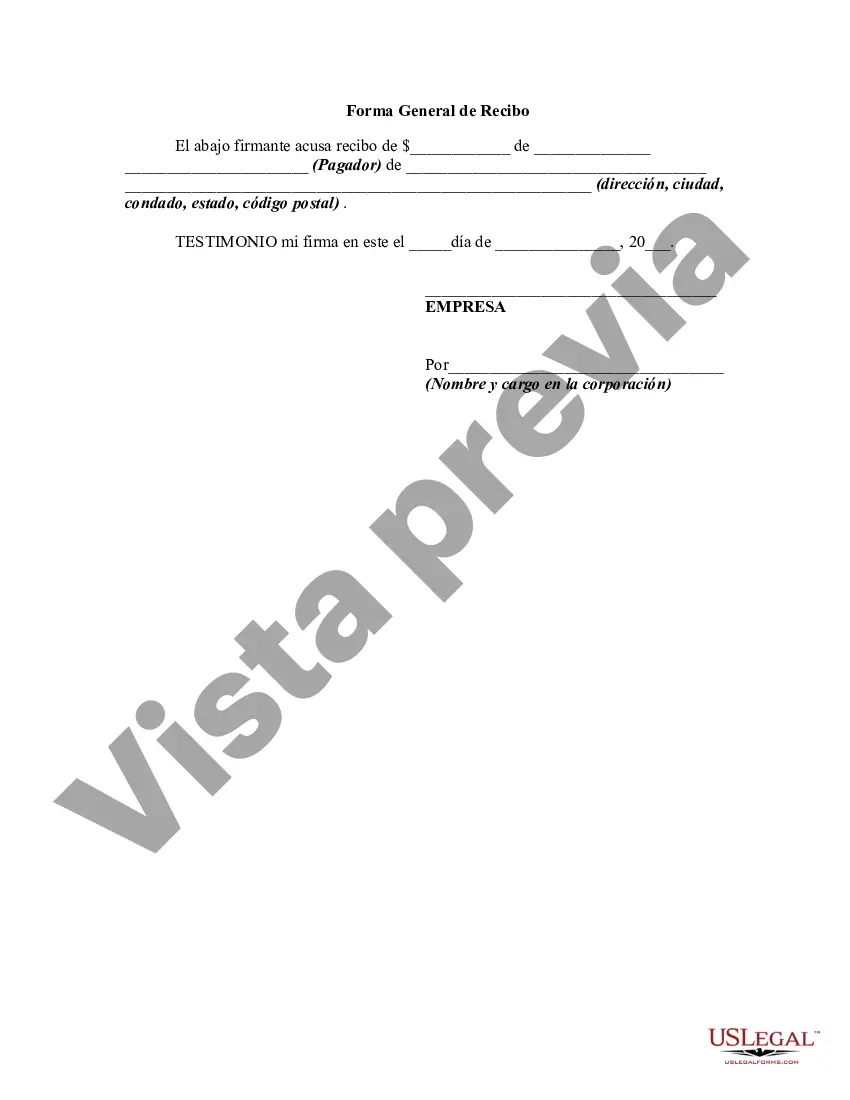

Travis Texas General Form of Receipt is a legal document used to acknowledge the acceptance of payment or goods/services rendered in the Travis County jurisdiction, located in the state of Texas, United States. It serves as proof of transaction and is important for record-keeping purposes for both parties involved. The Travis Texas General Form of Receipt includes the following key elements: 1. Heading: The receipt begins with a clear and concise heading stating "Travis Texas General Form of Receipt" to indicate its validity within the specified jurisdiction. 2. Date and Time: The receipt records the date and time of the transaction, ensuring accurate documentation. 3. Names and Contact Details: The receipt includes the complete name, address, contact number, and, if applicable, email address of both the recipient (the party providing goods/services) and the mayor (the party making the payment). 4. Description of Goods/Services: This section outlines a detailed description of the goods sold or services rendered. It includes quantity, quality, specifications, and any other relevant information necessary to accurately identify the transaction. 5. Payment Details: The receipt specifies the amount of payment made, the currency used, and the method of payment (cash, credit card, check, etc.). It may include any additional charges such as taxes, delivery fees, or discounts applied. 6. Signatures: Both parties involved in the transaction must sign and date the receipt to signify their agreement and confirmation of the transaction. Different types of Travis Texas General Form of Receipt may arise based on the nature of the transaction. These can include: 1. Sale Receipt: Used when goods are sold, it includes details such as the itemized list of sold products, quantities, prices, and the total amount paid. 2. Service Receipt: This type of receipt is issued when services are provided, highlighting the specific services rendered, duration, hourly rates, and the total service charge. 3. Rental Receipt: Issued when renting or leasing property or equipment, it lists the duration of the rental period, rental fees, additional charges, and any security deposit paid. 4. Donation Receipt: Used when receiving a charitable donation, it includes the donor's information, donated amount, and any applicable tax reducibility information. In conclusion, the Travis Texas General Form of Receipt is a comprehensive legal document used to acknowledge and record payment or exchange of goods/services in the Travis County jurisdiction. It ensures transparency, acts as evidence in case of disputes, and helps maintain accurate financial records for all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Forma General de Recibo - General Form of Receipt

Description

How to fill out Travis Texas Forma General De Recibo?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Travis General Form of Receipt, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various types varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and tutorials on the website to make any activities associated with document completion straightforward.

Here's how you can locate and download Travis General Form of Receipt.

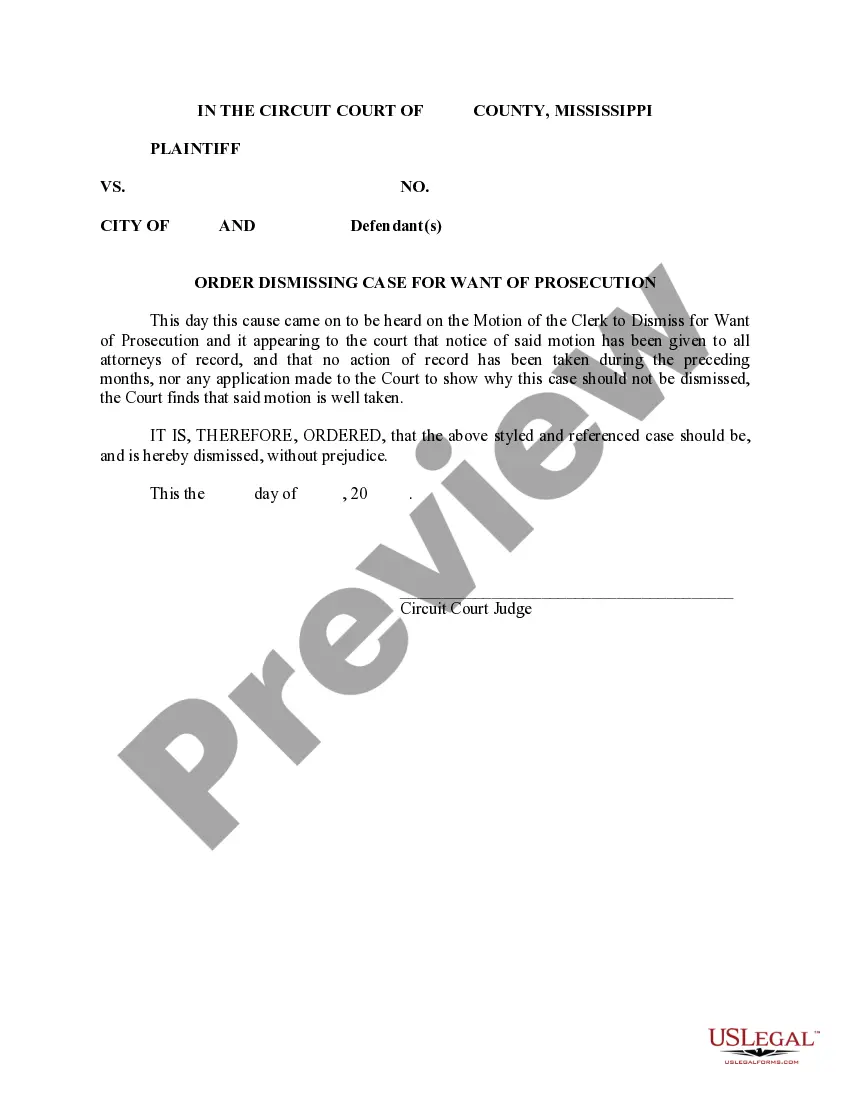

- Go over the document's preview and outline (if provided) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the similar forms or start the search over to find the correct document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Travis General Form of Receipt.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Travis General Form of Receipt, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional entirely. If you have to cope with an exceptionally complicated case, we recommend getting an attorney to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and get your state-specific documents with ease!