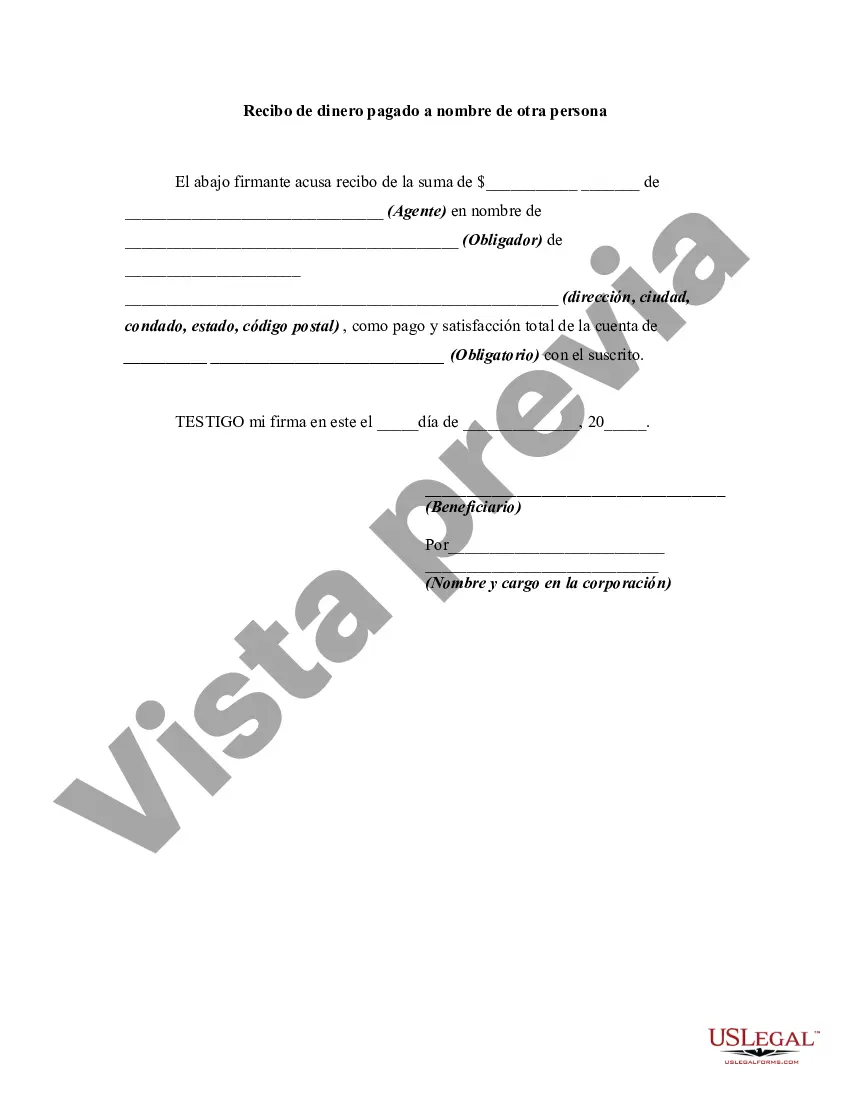

A Houston Texas Receipt for Money Paid on Behalf of Another Person is a legally binding document that serves as proof of a financial transaction where an individual or entity pays for goods, services, or debts on behalf of another person. This receipt ensures transparency, accountability, and provides a record of the amount paid, date, and purpose of the transaction. There are several types of Houston Texas Receipts for Money Paid on Behalf of Another Person, including: 1. Personal Receipt: This type of receipt is commonly used when one person pays for goods or services on behalf of another person in a personal capacity. This can include scenarios such as friends or family members paying for someone else's meal, utilities, or medical bills. 2. Business Receipt: In a business context, this type of receipt is issued when a company or organization makes a payment on behalf of an individual or another business. This can occur when a company foots the bill for travel expenses for an employee, settles outstanding invoices for a client, or reimburses an employee for work-related expenses. 3. Legal Receipt: Sometimes, individuals or entities may pay legal fees or fines on behalf of another person, such as in the case of legal guardianship or as a part of a legal settlement. These receipts are crucial in documenting the transaction and providing evidence if required in a court of law. 4. Financial Assistance Receipt: Non-profit organizations or social welfare agencies may issue receipts when they provide financial assistance or grants on behalf of someone in need. These receipts help keep track of the funds disbursed and ensure transparency between the organization and the recipient. Regardless of the type, a Houston Texas Receipt for Money Paid on Behalf of Another Person should include essential information such as: a. Date: The date when the payment was made. b. Amount: The total amount of money paid. c. Payer's Information: The name, address, and contact details of the person or entity who made the payment. d. Payee's Information: The name, address, and contact details of the person on whose behalf the payment was made. e. Purpose: A detailed description of the goods, services, or debts for which the payment was made. f. Signature: The signature of the person or entity issuing the receipt, along with their official title or designation. It is crucial to retain a copy of the Houston Texas Receipt for Money Paid on Behalf of Another Person for tax purposes, expense reimbursement, or as proof of payment in case of any disputes or audits.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Recibo de dinero pagado a nombre de otra persona - Receipt for Money Paid on Behalf of Another Person

Description

How to fill out Houston Texas Recibo De Dinero Pagado A Nombre De Otra Persona?

Drafting documents for the business or individual needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Houston Receipt for Money Paid on Behalf of Another Person without professional assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Houston Receipt for Money Paid on Behalf of Another Person on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Houston Receipt for Money Paid on Behalf of Another Person:

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!