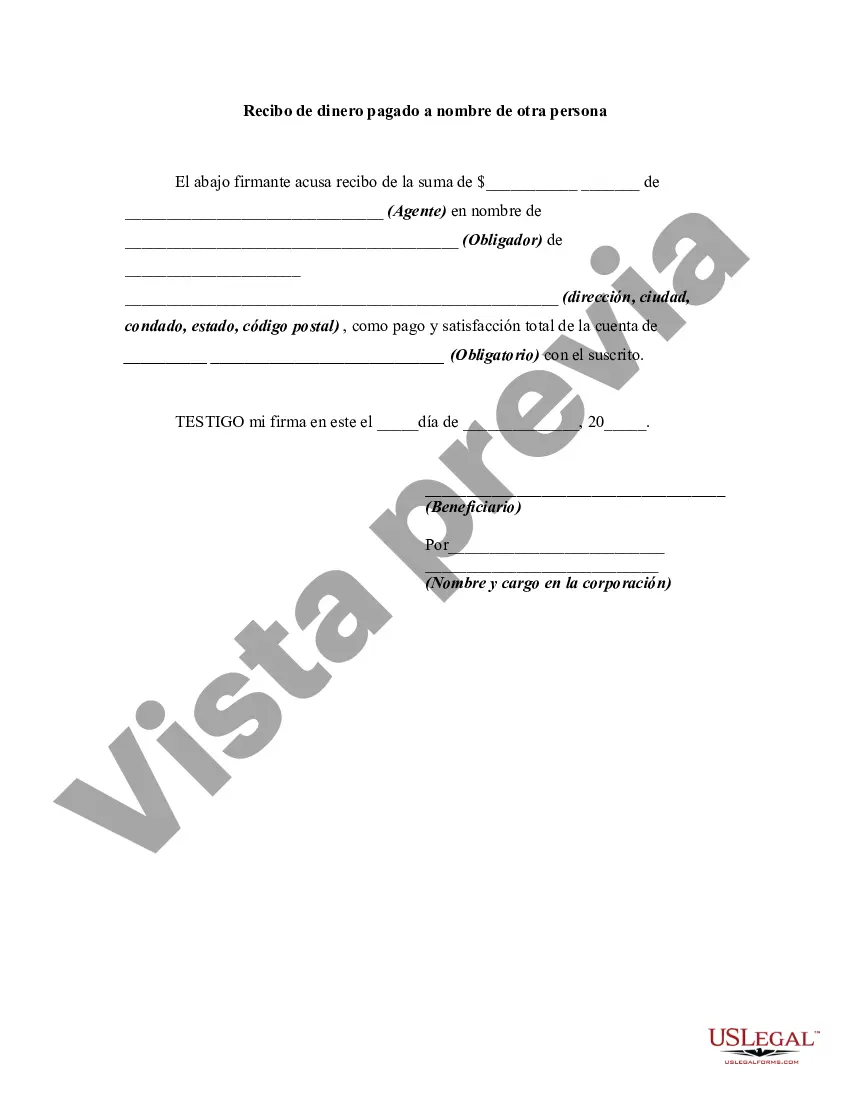

A Santa Clara California receipt for money paid on behalf of another person is a legal document that substantiates a transaction where an individual or entity has made a payment on behalf of another party. This receipt serves as evidence of the payment made and provides protection for both the payer and the recipient. The Santa Clara California receipt for money paid on behalf of another person typically includes essential details such as the date, the name and contact information of the payer and the recipient, and a description of the purpose of the payment. Additionally, it may mention the amount paid, the method of payment, and any applicable reference or invoice numbers. There are several types of Santa Clara California receipts for money paid on behalf of another person that can vary depending on the nature of the transaction. Some common categories include: 1. Personal Expense Receipt: This type of receipt accounts for payments made by an individual on behalf of another individual for personal expenses. It can include expenses like dining, travel, or entertainment costs. 2. Medical Expenses Receipt: A medical expenses receipt captures payments made by one person for the medical bills of another individual. This may include costs associated with doctor visits, prescriptions, surgeries, or medical treatments. 3. Tuition Fee Receipt: This receipt is issued when a person pays for someone else's educational fees, such as school or college tuition, on their behalf. It provides evidence of the payment made towards the educational institution. 4. Rent Receipt: In situations where one person pays rent on behalf of another, a rent receipt is generated to acknowledge the payment. It outlines details such as the property address, the amount paid, and the period covered by the payment. 5. Legal Fees Receipt: A legal fees receipt is used when someone pays the legal expenses of another person. It is commonly generated in situations where one party sponsors or supports legal representation for someone else. It is crucial for individuals engaging in such transactions in Santa Clara, California, to obtain and retain receipts for money paid on behalf of another person. These receipts not only serve as proof of payment for accounting and record-keeping purposes but also ensure transparency and avoid any potential misunderstandings or disputes in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Recibo de dinero pagado a nombre de otra persona - Receipt for Money Paid on Behalf of Another Person

Description

How to fill out Santa Clara California Recibo De Dinero Pagado A Nombre De Otra Persona?

Preparing documents for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to draft Santa Clara Receipt for Money Paid on Behalf of Another Person without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Santa Clara Receipt for Money Paid on Behalf of Another Person by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Santa Clara Receipt for Money Paid on Behalf of Another Person:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!