The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a the person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation. This form is a sample of a rejection of such a tender.

Title: Cook Illinois Letter Rejecting Tender of Check — Detailed Description Introduction: Welcome to this comprehensive description of the Cook Illinois Letter Rejecting Tender of Check. This document is designed to provide a detailed explanation of what this letter entails, its purpose, and any potential variations or types. Keywords: — CooIllinoisoi— - Letter - Rejecting - Tender of Check Description: The Cook Illinois Letter Rejecting Tender of Check serves as an official written communication informing the party who issued the check that it has been declined or refused. This rejection may occur due to several reasons, including insufficient funds, errors in the check details, or non-compliance with specific requirements outlined by Cook Illinois or the recipient. The primary objective of this letter is to formally notify the check issuer of the rejection and explain the reasons for it. This notification allows parties involved to rectify the issues, resolve any discrepancies, and eventually request a new valid payment method. Types of Cook Illinois Letter Rejecting Tender of Check: 1. Insufficient Funds Rejection Letter: This type of rejection letter is sent when the issuer's bank account does not have enough funds to cover the check amount. Cook Illinois notifies the issuer about the insufficient funds and requests an alternative payment method. 2. Check Detail Errors Rejection Letter: In case of incorrect or incomplete check details such as incorrect amount, missing signature, invalid payee name, or improper format, Cook Illinois issues this rejection letter. It points out the specific errors, instructs the issuer on corrections, and advises on re-submitting the revised check. 3. Non-compliance with Cook Illinois Requirements Rejection Letter: Cook Illinois may reject a check if the payment does not adhere to their specific requirements or terms. This could involve checks not authorized by Cook Illinois, non-compliance with contractual obligations, or failure to follow the specified payment instructions. This rejection letter aims to outline the specific non-compliance issues, providing necessary guidance and requesting immediate rectification. In all types of rejection letters mentioned above, Cook Illinois may include important contact information, such as the appropriate department or individual to contact for further clarification or assistance. Resolving the issues or providing a valid payment method promptly is essential for uninterrupted service or fulfillment of obligations. Conclusion: The Cook Illinois Letter Rejecting Tender of Check is an official communication notifying the issuer that their check has been declined. It explains the reasons for rejection and provides instructions for resolution. By comprehending these rejection letters, issuers can rectify the discrepancies and ensure a smooth payment process, benefiting both Cook Illinois and the party issuing the check.Title: Cook Illinois Letter Rejecting Tender of Check — Detailed Description Introduction: Welcome to this comprehensive description of the Cook Illinois Letter Rejecting Tender of Check. This document is designed to provide a detailed explanation of what this letter entails, its purpose, and any potential variations or types. Keywords: — CooIllinoisoi— - Letter - Rejecting - Tender of Check Description: The Cook Illinois Letter Rejecting Tender of Check serves as an official written communication informing the party who issued the check that it has been declined or refused. This rejection may occur due to several reasons, including insufficient funds, errors in the check details, or non-compliance with specific requirements outlined by Cook Illinois or the recipient. The primary objective of this letter is to formally notify the check issuer of the rejection and explain the reasons for it. This notification allows parties involved to rectify the issues, resolve any discrepancies, and eventually request a new valid payment method. Types of Cook Illinois Letter Rejecting Tender of Check: 1. Insufficient Funds Rejection Letter: This type of rejection letter is sent when the issuer's bank account does not have enough funds to cover the check amount. Cook Illinois notifies the issuer about the insufficient funds and requests an alternative payment method. 2. Check Detail Errors Rejection Letter: In case of incorrect or incomplete check details such as incorrect amount, missing signature, invalid payee name, or improper format, Cook Illinois issues this rejection letter. It points out the specific errors, instructs the issuer on corrections, and advises on re-submitting the revised check. 3. Non-compliance with Cook Illinois Requirements Rejection Letter: Cook Illinois may reject a check if the payment does not adhere to their specific requirements or terms. This could involve checks not authorized by Cook Illinois, non-compliance with contractual obligations, or failure to follow the specified payment instructions. This rejection letter aims to outline the specific non-compliance issues, providing necessary guidance and requesting immediate rectification. In all types of rejection letters mentioned above, Cook Illinois may include important contact information, such as the appropriate department or individual to contact for further clarification or assistance. Resolving the issues or providing a valid payment method promptly is essential for uninterrupted service or fulfillment of obligations. Conclusion: The Cook Illinois Letter Rejecting Tender of Check is an official communication notifying the issuer that their check has been declined. It explains the reasons for rejection and provides instructions for resolution. By comprehending these rejection letters, issuers can rectify the discrepancies and ensure a smooth payment process, benefiting both Cook Illinois and the party issuing the check.

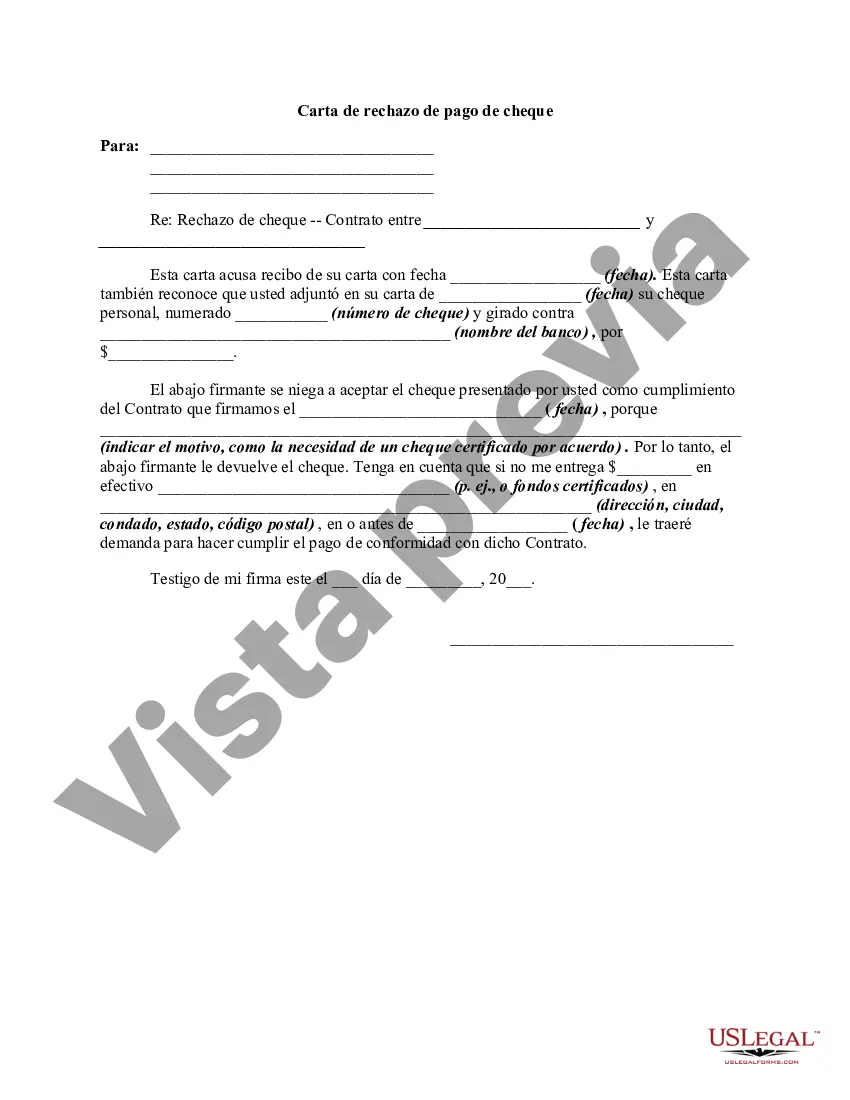

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.