The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a the person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation. This form is a sample of a rejection of such a tender.

Title: Houston Texas Letter Rejecting Tender of Check: Exploring Types and Detailed Descriptions Keywords: Houston Texas letter, reject tender of check, types, detailed descriptions Introduction: In Houston, Texas, a letter rejecting the tender of a check serves as an official communication when an individual, organization, or business decides to decline a check that has been submitted. This article explores the various types of Houston Texas letters rejecting the tender of checks and offers detailed descriptions of each type. 1. Personal Letter Rejecting Tender of Check: This type of letter is commonly used by individuals who wish to reject a check they have received. It can be sent in situations like reimbursement requests, payments for goods or services, or personal loans. The letter should clearly state the reasons for rejecting the check and provide alternative forms of payment if applicable. 2. Business Letter Rejecting Tender of Check: Businesses in Houston, Texas may encounter instances where they need to reject a check due to various reasons such as insufficient funds, incorrect payment details, or other discrepancies. This letter should maintain professionalism and clearly explain the reasons behind the rejection, while suggesting alternative payment options or requesting a new check. 3. Legal Letter Rejecting Tender of Check: In certain legal situations, individuals or organizations may need to issue a letter rejecting the tender of a check. This type of letter is typically drafted by attorneys or legal representatives and should follow specific protocols. It clarifies legal reasons for the rejection, highlights any associated legal consequences, and provides guidance on resolving the matter. 4. Commercial Letter Rejecting Tender of Check: Commercial establishments, such as shops, restaurants, or service providers, may occasionally need to reject payment by check. This letter should be concise and polite, stating reasons for rejecting the check, offering alternative payment methods, and aiming to maintain a positive customer relationship. 5. Insurance Letter Rejecting Tender of Check: Within the insurance industry, a letter rejecting the tender of a check may be issued when an insurer refuses to accept a premium payment due to policy cancellation, non-compliance with terms, or other related factors. The letter should outline the specific reasons for rejecting the check and provide information on how the insured can rectify the issue or seek alternative coverage. Conclusion: Houston, Texas letters rejecting the tender of checks serve as essential communication tools for individuals, businesses, legal entities, and insurance companies. Whether it's a personal, business, legal, commercial, or insurance-related matter, properly crafted rejection letters play an essential role in maintaining transparency, preventing misunderstandings, and providing alternative solutions.Title: Houston Texas Letter Rejecting Tender of Check: Exploring Types and Detailed Descriptions Keywords: Houston Texas letter, reject tender of check, types, detailed descriptions Introduction: In Houston, Texas, a letter rejecting the tender of a check serves as an official communication when an individual, organization, or business decides to decline a check that has been submitted. This article explores the various types of Houston Texas letters rejecting the tender of checks and offers detailed descriptions of each type. 1. Personal Letter Rejecting Tender of Check: This type of letter is commonly used by individuals who wish to reject a check they have received. It can be sent in situations like reimbursement requests, payments for goods or services, or personal loans. The letter should clearly state the reasons for rejecting the check and provide alternative forms of payment if applicable. 2. Business Letter Rejecting Tender of Check: Businesses in Houston, Texas may encounter instances where they need to reject a check due to various reasons such as insufficient funds, incorrect payment details, or other discrepancies. This letter should maintain professionalism and clearly explain the reasons behind the rejection, while suggesting alternative payment options or requesting a new check. 3. Legal Letter Rejecting Tender of Check: In certain legal situations, individuals or organizations may need to issue a letter rejecting the tender of a check. This type of letter is typically drafted by attorneys or legal representatives and should follow specific protocols. It clarifies legal reasons for the rejection, highlights any associated legal consequences, and provides guidance on resolving the matter. 4. Commercial Letter Rejecting Tender of Check: Commercial establishments, such as shops, restaurants, or service providers, may occasionally need to reject payment by check. This letter should be concise and polite, stating reasons for rejecting the check, offering alternative payment methods, and aiming to maintain a positive customer relationship. 5. Insurance Letter Rejecting Tender of Check: Within the insurance industry, a letter rejecting the tender of a check may be issued when an insurer refuses to accept a premium payment due to policy cancellation, non-compliance with terms, or other related factors. The letter should outline the specific reasons for rejecting the check and provide information on how the insured can rectify the issue or seek alternative coverage. Conclusion: Houston, Texas letters rejecting the tender of checks serve as essential communication tools for individuals, businesses, legal entities, and insurance companies. Whether it's a personal, business, legal, commercial, or insurance-related matter, properly crafted rejection letters play an essential role in maintaining transparency, preventing misunderstandings, and providing alternative solutions.

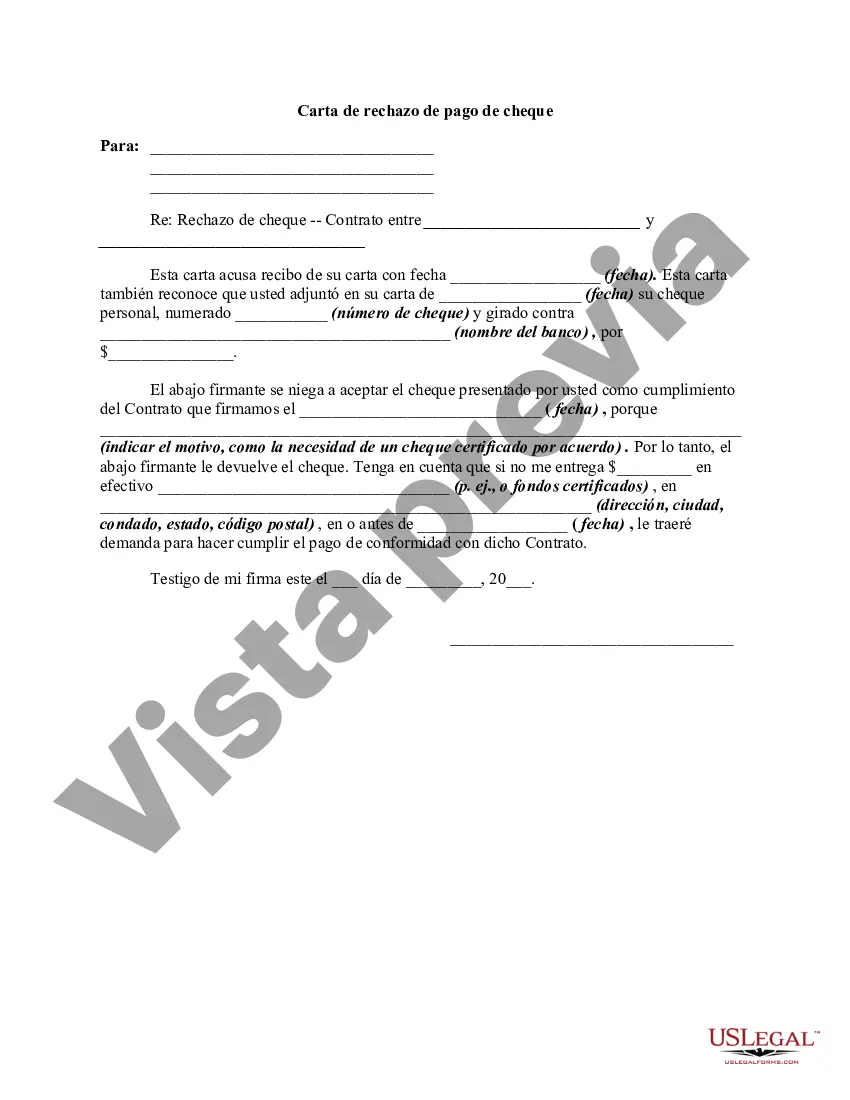

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.