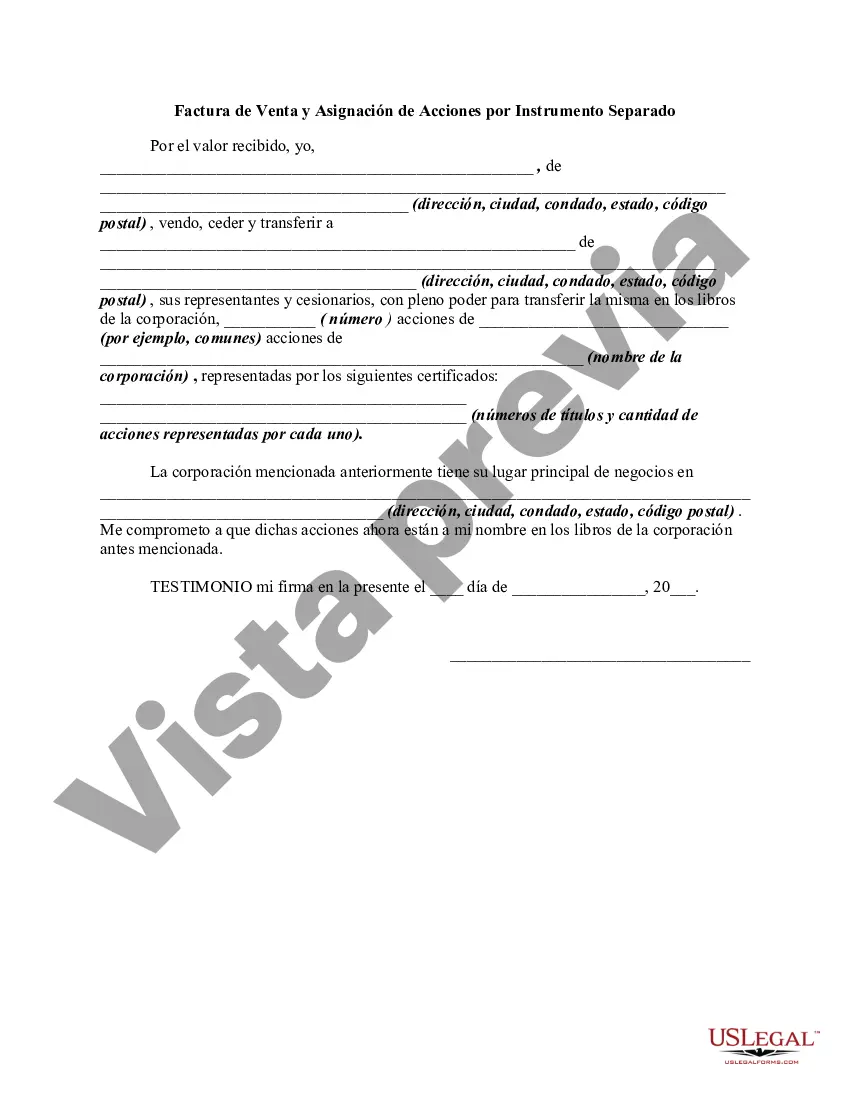

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

The Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument is a legal document used in Bexar County, Texas, to facilitate the transfer of ownership of stock from one party to another. It is a crucial document, ensuring the smooth and lawful transfer of stock ownership while protecting the rights and interests of both parties involved. Keywords: Bexar Texas, Bill of Sale, Assignment of Stock, Separate Instrument, transfer of ownership, stock ownership, legal document, Bexar County. Types of Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: 1. General Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale and assignment of stock applies to the transfer of stock in a general sense, encompassing various industries and sectors. 2. Corporate Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This particular type of bill of sale and assignment of stock is tailored specifically for transfers involving corporate entities. It adheres to the specific rules and regulations governing corporate stock ownership and transfers. 3. Limited Liability Company (LLC) Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale and assignment of stock caters to transfers involving limited liability companies (LCS). It takes into account the unique considerations and requirements related to LLC stock transfers. 4. Partnership Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: Designed for partnerships, this bill of sale and assignment of stock facilitates the transfer of ownership interest in a partnership. It ensures proper documentation and compliance with partnership laws in Bexar County, Texas. 5. Nonprofit Organization Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale and assignment of stock focuses on transfers involving nonprofit organizations. It takes into account the specific regulations and considerations applicable to the transfer of stock in nonprofit entities. These different types of Bexar Texas Bills of Sale and Assignment of Stock by Separate Instrument allow for customized and specific approaches to stock transfers, ensuring compliance with relevant laws and regulations based on the nature of the parties involved.The Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument is a legal document used in Bexar County, Texas, to facilitate the transfer of ownership of stock from one party to another. It is a crucial document, ensuring the smooth and lawful transfer of stock ownership while protecting the rights and interests of both parties involved. Keywords: Bexar Texas, Bill of Sale, Assignment of Stock, Separate Instrument, transfer of ownership, stock ownership, legal document, Bexar County. Types of Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: 1. General Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale and assignment of stock applies to the transfer of stock in a general sense, encompassing various industries and sectors. 2. Corporate Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This particular type of bill of sale and assignment of stock is tailored specifically for transfers involving corporate entities. It adheres to the specific rules and regulations governing corporate stock ownership and transfers. 3. Limited Liability Company (LLC) Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale and assignment of stock caters to transfers involving limited liability companies (LCS). It takes into account the unique considerations and requirements related to LLC stock transfers. 4. Partnership Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: Designed for partnerships, this bill of sale and assignment of stock facilitates the transfer of ownership interest in a partnership. It ensures proper documentation and compliance with partnership laws in Bexar County, Texas. 5. Nonprofit Organization Bexar Texas Bill of Sale and Assignment of Stock by Separate Instrument: This type of bill of sale and assignment of stock focuses on transfers involving nonprofit organizations. It takes into account the specific regulations and considerations applicable to the transfer of stock in nonprofit entities. These different types of Bexar Texas Bills of Sale and Assignment of Stock by Separate Instrument allow for customized and specific approaches to stock transfers, ensuring compliance with relevant laws and regulations based on the nature of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.