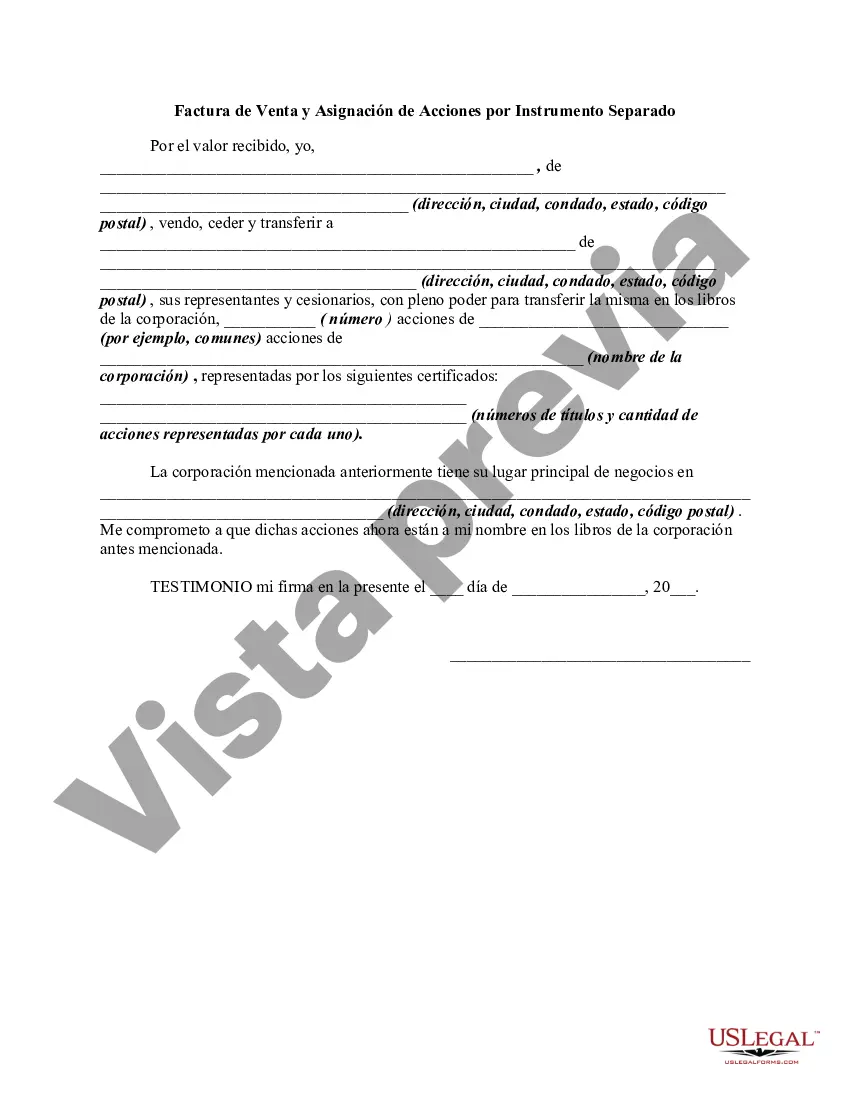

A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument is a legal document that outlines the transfer of ownership for stocks or assets in Collin County, Texas. This document ensures the smooth and lawful transfer of stocks and protects the rights of both parties involved in the transaction. The Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument serves as evidence of the transfer and provides a detailed record of the transaction. It includes information such as the names and addresses of the buyer and seller, the date of the transaction, the description of the stock being transferred, and the agreed-upon purchase price. This document is crucial in establishing the legal ownership of the stock and protecting the buyer's interests. By executing the Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument, the buyer gains the right to the stock and assumes all associated rights and responsibilities. Different types of Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument can vary depending on the specific nature of the transaction. Some common types include: 1. Collin Texas Bill of Sale and Assignment of Common Stock: This document pertains to the transfer of common stock ownership in a company. It includes details regarding the quantity of shares, the stock's par value, and any voting rights associated with the shares. 2. Collin Texas Bill of Sale and Assignment of Preferred Stock: This type of instrument focuses on the transfer of preferred stock ownership. Unlike common stock, preferred stock often carries additional benefits, such as priority in receiving dividends or in the event of liquidation. The document includes specific terms and conditions related to the preferred stock being transferred. 3. Collin Texas Bill of Sale and Assignment of Restricted Stock: This document applies to the transfer of restricted stock, which is subject to certain limitations or conditions set by the issuing company or regulatory authorities. The instrument outlines any restrictions or vesting requirements that must be met by the buyer. Overall, the Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument provides a legal framework for transferring ownership of stocks in Collin County, Texas. It ensures a transparent and legitimate exchange while protecting the rights and interests of both parties involved.Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument is a legal document that outlines the transfer of ownership for stocks or assets in Collin County, Texas. This document ensures the smooth and lawful transfer of stocks and protects the rights of both parties involved in the transaction. The Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument serves as evidence of the transfer and provides a detailed record of the transaction. It includes information such as the names and addresses of the buyer and seller, the date of the transaction, the description of the stock being transferred, and the agreed-upon purchase price. This document is crucial in establishing the legal ownership of the stock and protecting the buyer's interests. By executing the Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument, the buyer gains the right to the stock and assumes all associated rights and responsibilities. Different types of Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument can vary depending on the specific nature of the transaction. Some common types include: 1. Collin Texas Bill of Sale and Assignment of Common Stock: This document pertains to the transfer of common stock ownership in a company. It includes details regarding the quantity of shares, the stock's par value, and any voting rights associated with the shares. 2. Collin Texas Bill of Sale and Assignment of Preferred Stock: This type of instrument focuses on the transfer of preferred stock ownership. Unlike common stock, preferred stock often carries additional benefits, such as priority in receiving dividends or in the event of liquidation. The document includes specific terms and conditions related to the preferred stock being transferred. 3. Collin Texas Bill of Sale and Assignment of Restricted Stock: This document applies to the transfer of restricted stock, which is subject to certain limitations or conditions set by the issuing company or regulatory authorities. The instrument outlines any restrictions or vesting requirements that must be met by the buyer. Overall, the Collin Texas Bill of Sale and Assignment of Stock by Separate Instrument provides a legal framework for transferring ownership of stocks in Collin County, Texas. It ensures a transparent and legitimate exchange while protecting the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.